With a key position in the financial sector serving "Agriculture and Rural Development", the Vietnam Bank for Agriculture and Rural Development (Agribank) has been affirming its important role.

Ms. Phung Thi Binh, Deputy General Director of Agribank, emphasized that Agribank is not only a financial intermediary providing capital, but also a reliable "companion" of millions of Vietnamese farmers, helping them gradually improve their production capacity and financial management.

As of September 30, 2024, Agribank's total outstanding loans had reached more than VND 1.6 million billion, of which more than VND 1 million billion was dedicated to agriculture, farmers and rural areas, with 2.8 million customers. This figure not only represents remarkable growth but is also double that of the time when Agribank began implementing Decree 55/2015/ND-CP of the Government on credit policies for agricultural and rural development.

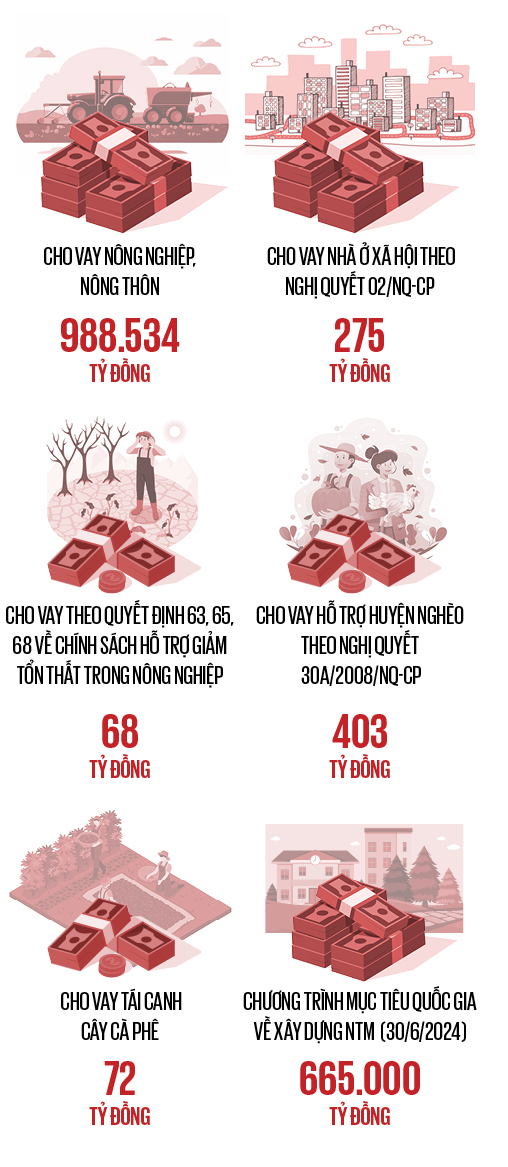

Not stopping at implementing Decree 55, Agribank also proactively and actively implemented effectively 07 policy credit programs and 02 national target programs on new rural construction and sustainable poverty reduction.

Every year, the bank also spends thousands of billions of VND to support businesses and farmers with preferential interest rate loan packages, helping them expand production, create more jobs and improve their lives.

In particular, in 2023, facing difficulties in the forestry and fishery sectors, Agribank pioneered in participating in a preferential credit program worth VND 5,000 billion, with interest rates at least 1% - 2% lower per year than the average.

By 2024, this program will be expanded to VND 8,000 billion, and lead the system in disbursement with VND 7,183 billion to more than 5,000 customers (as of September 2024).

Agribank continues to demonstrate its strong commitment to "accompanying and sharing" by increasing the program scale to VND13,000 billion, to help customers quickly stabilize production after storm No. 3 and prepare for year-end capital needs.

This month, Agribank also set aside VND5,000 billion for preferential loans for customers affected by storm No. 3 and floods, with interest rates starting at only 3.6% per year. Previously, the bank had reduced interest rates by 0.5% to 2% on existing loans, waived overdue interest, and implemented many other support measures such as debt extension, debt repayment restructuring, etc. - urgent solutions to help customers recover after the "blow" of natural disasters.

Agribank is also a pioneer in applying digital technology, with more than 200 modern banking products and services, from loans, automatic debt collection to cashless payments. The digitalization of banking products is especially meaningful in remote areas where people have difficulty accessing traditional financial services, thereby, Agribank is contributing to the modernization of agriculture.

The digitalization of banking products and services has helped Agribank improve customer experience, especially in remote areas where people have limited access to traditional financial services. This also means that Agribank is gradually modernizing Vietnam’s agriculture, helping farmers easily access modern technology and improve their production capacity.

Agribank mobile transaction vehicle.

One of the important factors helping Agribank effectively implement agricultural credit programs is the close and continuous cooperation with the Vietnam Farmers' Union at all levels.

This connection has been clearly realized since 2016, when Agribank and the Farmers' Association officially signed the Inter-sectoral Agreement No. 01/TTLN-HND-AGRIBANK, aiming to promote the comprehensive implementation of Decree 55 of the Government. This agreement has opened the door for Farmers' Association members to easily access credit capital, ensuring transparency and efficiency in the process of capital use.

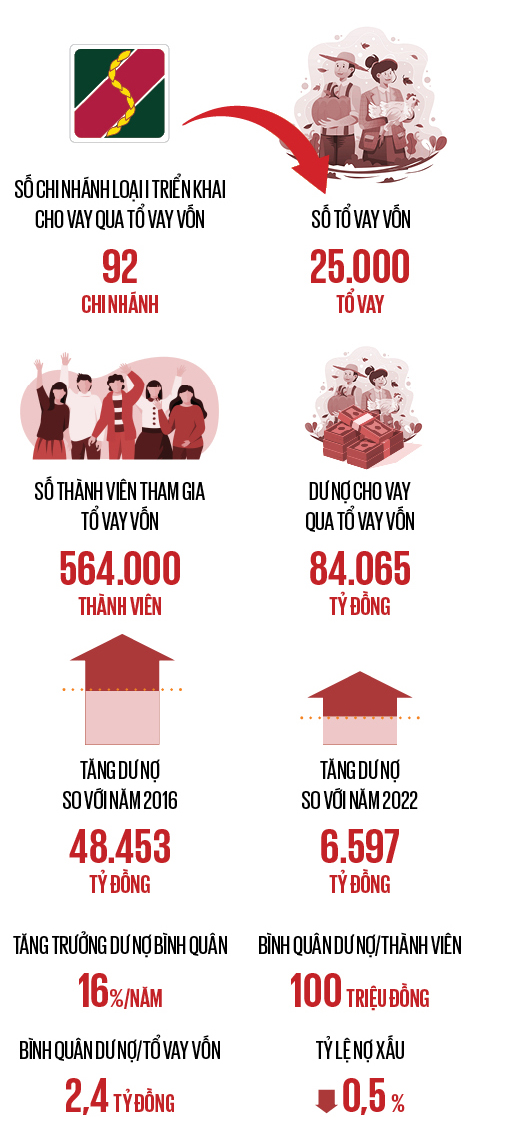

Up to now, the lending model through lending groups has been widely applied at 92 type I branches of Agribank, with the participation of more than 25,000 lending groups and 564,000 members. The total outstanding loans through lending groups have increased by more than VND 48,000 billion compared to 2016, reflecting the sustainable and effective development of this model. This not only helps rural people access capital more conveniently, but also contributes positively to Agribank's bad debt control, with the rate maintained at less than 0.5%.

The role of the loan group leaders is also noteworthy as they support borrowers from the stage of capital usage planning to loan monitoring and management. This smooth coordination has helped Agribank significantly reduce management costs, while creating conditions for the bank to lower loan interest rates, bringing practical benefits to farmers.

The Farmers' Association also plays a bridging role in guiding farmers to access and effectively use digital financial services, especially non-cash payment methods. The enthusiastic support from its members has helped change the financial habits of rural people, from the way they manage income and expenditure to the use of modern financial tools. Thereby, more and more "4.0 farmers" have emerged, not only proficient in agricultural production but also proficient in technology, ready to apply the utilities of the digital economy to improve production efficiency and manage finances in a more sustainable and professional way.

In May 2024, the Government issued Resolution No. 69/NQ-CP, approving the Action Program to implement Resolution No. 46-NQ/TW of the Politburo, with the goal of innovating and improving the quality of activities of the Vietnam Farmers' Union in the new period.

Notably, Agribank is mentioned in this resolution, affirming the bank's key position in supporting the agricultural, rural and farmer sectors. This is not only a recognition of Agribank's important role in the financial market, but also highlights the importance of the close cooperation between Agribank and the Farmers' Association in providing practical support to the people.

Together with the Farmers' Association, Agribank creates a bright future for Vietnamese agriculture. (Video: Nguyen Chuong)

In the spirit of Resolution 69, Ms. Phung Thi Binh, Deputy General Director of Agribank, shared that in the coming time, Agribank will continue to strengthen coordination with Farmers' Associations at all levels. The goal is to expand the scale of lending programs through farmer groups, along with implementing Agribank's preferential credit programs such as loans for developing OCOP products, the 1 million hectare rice program in the Mekong Delta.

At the same time, the bank will also promote green credit programs, focusing on important areas such as afforestation and lending according to the value chain of agricultural, aquatic and forestry production... These are all areas where Agribank always accompanies farmers, with the goal of sustainable development and increasing the value of Vietnamese agricultural products.

Ms. Binh emphasized: "One of our top priorities is to focus on lending along the agricultural value chain. Agribank will accompany us from production, purchasing to processing and exporting, helping to circulate cash transparently and effectively, ensuring that farmers and businesses can easily access capital and manage their finances better."

In this journey, the role of Farmers' Association members is indispensable. Together with Agribank staff, Farmers' Association members are the ones who directly put Agribank's credit policies into practice, helping people change their thinking in production and financial management. They not only support but also act as "propagandists" to help farmers and businesses realize that, in order for Vietnamese agricultural products to be competitive in the international market, changing the way of financial management and production is a must, especially in the context of ESG standards (Environment, Social and Governance) becoming an important measure in every agricultural value chain.

Ms. Phung Thi Binh, Deputy General Director of Agribank.

Agribank has pioneered in implementing green credit programs, typically the pilot sale of carbon credits in the Northern midlands, from Thanh Hoa to Quang Tri, to support forest planting enterprises. The close coordination between Agribank, the Farmers’ Association and enterprises in these fields has opened up a new direction for sustainable agriculture, bringing many positive results.

Looking to the future, Ms. Binh suggested that the Vietnam Farmers' Association coordinate closely with Agribank to recommend the Government and the Ministry of Agriculture and Rural Development to have policies to encourage producers and suppliers, consuming agricultural products in production areas, raw material areas to form linkage chains, policies on consuming domestic and foreign agricultural products, especially clean agricultural development programs, high-tech agriculture, One Commune One Product (OCOP) program, reducing greenhouse gas emissions... to create an investment environment for quality rural agricultural development, thereby creating conditions for Agribank to invest credit capital through the activities of loan groups and linkage groups more effectively.

The Vietnam Farmers' Association coordinates with Agribank to deploy the activities of loan groups associated with the digital banking model, implement measures to improve the operational efficiency of loan groups; strictly comply with regulations on loan group operations, limit credit risks; strengthen the bank's inspection and supervision of loan group operations.

The Deputy General Director of Agribank expressed his hope that the cooperative relationship between Agribank and the Farmers' Association will be increasingly strengthened and expanded, bringing practical benefits to farmers, while contributing to realizing the mission of sustainable agricultural development, opening up a bright future for Vietnamese agricultural products.

Source: https://danviet.vn/tu-hao-ndvn-2024-cung-hoi-nong-dan-agribank-kien-tao-tuong-lai-tuoi-sang-cho-nong-nghiep-viet-2024101400262341.htm

Comment (0)