The market performed positively in the session of October 31 when big names such as VCB, CTG, VIC… increased well and pulled the VN-Index above the reference level.

Masan shares have a huge deal, banking stocks bring back green to VN-Index

The market performed positively in the session of October 31 when big names such as VCB, CTG, VIC… increased well and pulled the VN-Index above the reference level.

VN-Index closed the session on October 30 at 1,258.63 points, down 0.25% from the previous session, trading volume also decreased by 3.18% and equal to 75% of the average. Short-term cash flow only increased when prices fell sharply and did not increase further when they recovered. The current total market capitalization is around 292 billion USD and equal to 63% of GDP in 2024.

After yesterday's decline, the trading session on October 31 started with similar developments to previous sessions, opening in green but with some pressure in the late morning. However, positive developments appeared in the afternoon session when demand increased in some stocks, especially the VN30 group, helping the indices recover well.

The focus of today's session was on Masan (MSN) shares. The market saw a "huge" negotiated transaction with nearly 76.4 million MSN shares changing hands, equivalent to a total transaction value of up to VND5,614 billion. The negotiated transactions mainly took place between foreign investors. Foreign investors bought 61.2 million MSN shares today while selling 78.6 million shares, equivalent to a net selling volume of 17.4 million shares, equivalent to a value of more than VND1,333 billion. This is also the stock that foreign investors sold the most on the stock exchange.

The sharp decline of MSN significantly affected the VN-Index, taking away 0.55 points from the index. In addition, stocks such as HDB, VRE, TCB, etc. were also in the red and negatively impacted the general market.

On the other hand, stocks of big banks brought back green to the market. VCB closed up more than 2% to VND93,600/share and had the most positive impact on the VN-Index when contributing 2.57 points to the increase. VCB increased sharply right after some rumors about the bank preparing a dividend payment plan to get approval in November. Besides VCB, stocks such as CTG, VIC, ACB, STB... also increased well and firmly consolidated the green color of the VN-Index. CTG increased by 2.7%, VIC increased by 1.34%, ACB increased by 1.2%. According to the newly released financial report, Vingroup Corporation brought in record revenue of VND 62,850 billion in the third quarter of 2024, an increase of 31% over the same period last year and after-tax profit of VND 2,015 billion, 3 times higher than the same period and also the highest quarterly profit in the past 5 years.

Aviation stocks also had a positive session. HVN increased by more than 4%, SCS increased by 1.2%, VJC increased by 1%... Similarly, the shipping group also recorded many stocks increasing in price. PVT increased by 2.2%, VTO increased by 1.7%, HAH increased by 0.34%.

While the green color was maintained on the two listed floors, the UPCoM-Index decreased due to strong pressure from codes such as VGI, FOX, BSR... Of which, VGI decreased by 0.7%, FOX decreased by 2.1% and BSR decreased by 1.4%. According to the financial report for the third quarter of 2024, Binh Son Refining and Petrochemical recorded revenue of VND 31,945 billion. However, the cost of goods sold of up to VND 33,415 billion caused the company's gross profit to be negative VND 1,470 billion. Although financial revenue reached VND 554 billion, it was still not enough to cover expenses, leading to a loss after tax of VND 1,209 billion, while in the same period last year, BSR made a profit of VND 3,620 billion.

At the end of the trading session, VN-Index increased by 5.85 points (0.46%) to 1,264.48 points. The entire floor had 199 stocks increasing, 169 stocks decreasing and 67 stocks remaining unchanged. HNX-Index increased by 0.48 points (0.21%) to 226.36 points. The entire floor had 69 stocks increasing, 86 stocks decreasing and 59 stocks remaining unchanged. UPCoM-Index decreased by 0.08 points (-0.09%) to 92.38 points. The total trading volume on HoSE reached 614 billion VND, equivalent to a trading value of 18,054 billion VND, up 42% compared to the previous session, however, negotiated transactions accounted for 7,082 billion VND. Thus, the order matching transactions in today's session only reached nearly 11,000 billion VND, down 2%. Trading values on HNX and UPCoM were VND616 billion and VND442 billion, respectively.

|

| Top stocks with the strongest net buying/selling by foreign investors |

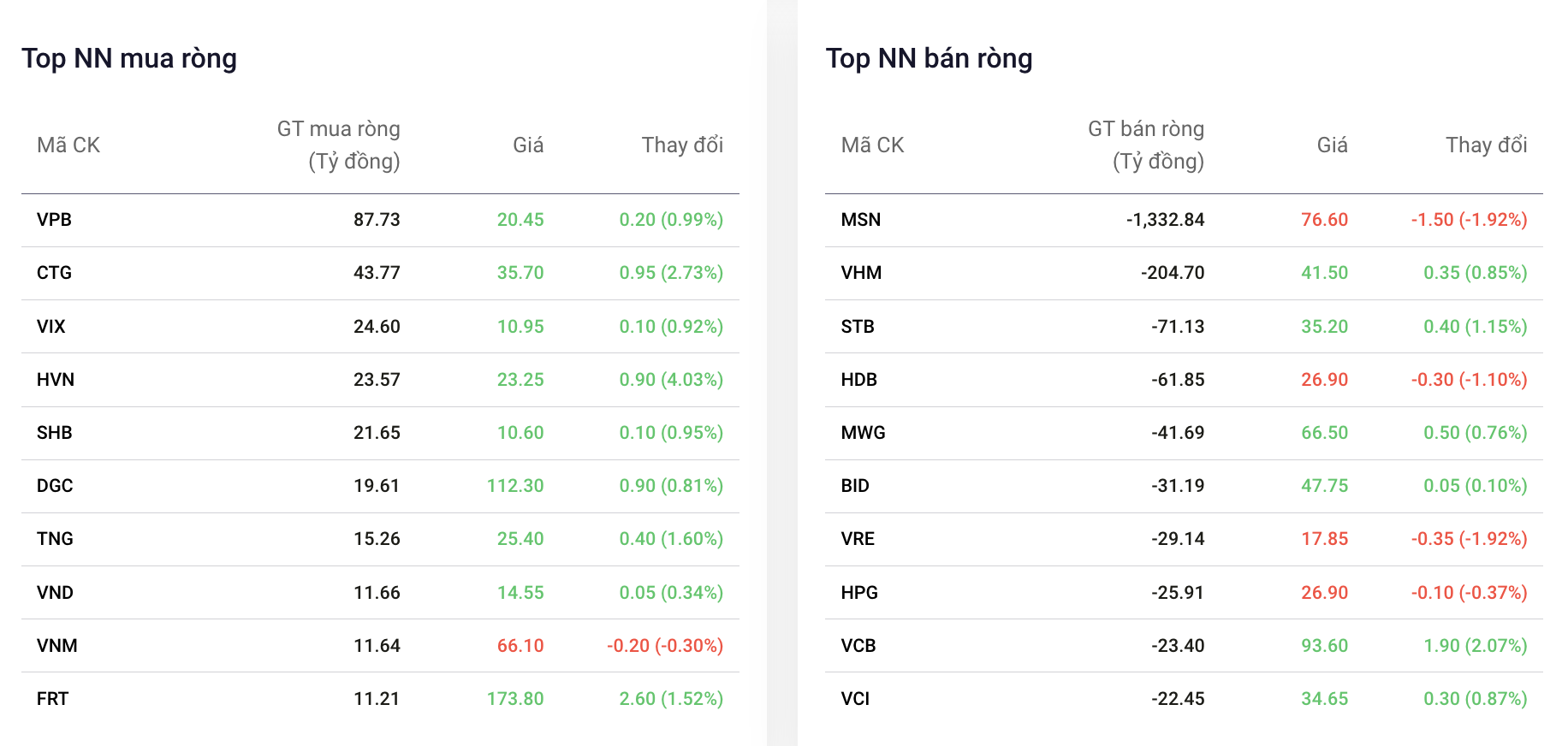

Foreign investors continued to net sell VND1,665 billion on HoSE, in which MSN was the most net sold with VND1,333 billion. VHM and STB were net sold with VND205 billion and VND71 billion respectively. In the opposite direction, VPB topped the list of net purchases by foreign investors with VND88 billion. CTG was net bought with VND44 billion.

Source: https://baodautu.vn/co-phieu-masan-thoa-thuan-khung-dong-ngan-hang-keo-lai-sac-xanh-cho-vn-index-d228894.html

![[Photo] Third meeting of the Organizing Subcommittee serving the 14th National Party Congress](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/2/3f342a185e714df58aad8c0fc08e4af2)

![[Photo] Close-up of Vietnam's sniffer dog team searching for earthquake victims in Myanmar](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/d4949a0510ba40af93a15359b5450df2)

![[Photo] Relatives of victims of the earthquake in Myanmar were moved and grateful to the rescue team of the Vietnamese Ministry of National Defense.](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/2/aa6a37e9b59543dfb0ddc7f44162a7a7)

Comment (0)