Big stocks regain position

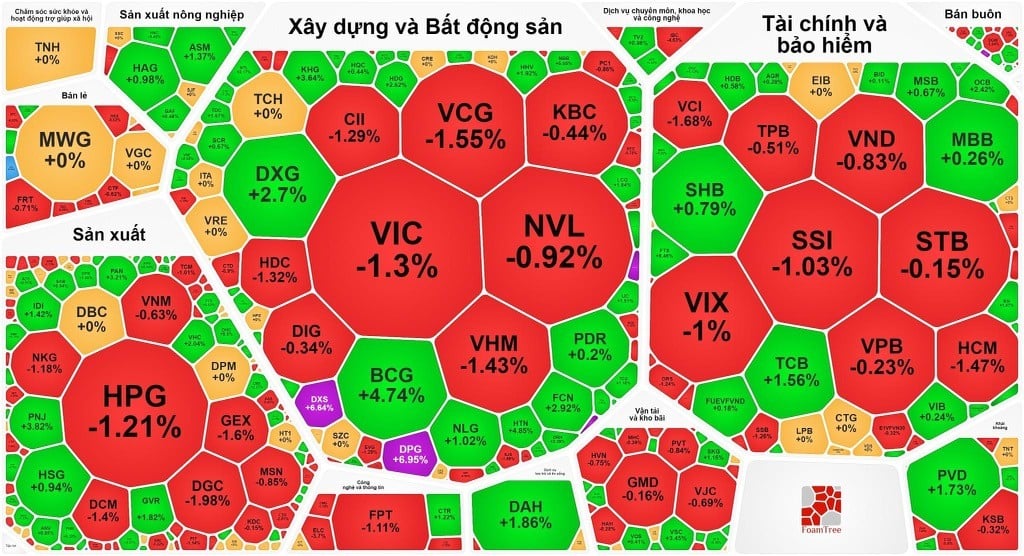

Continuing to maintain the recovery momentum, VN-Index increased points right from the opening of the stock trading session on July 5 and maintained good green color in the morning session. According to statistics, steel and retail stocks attracted the best demand with increases of 2% and 1.5%, respectively.

According to VCBS Securities Company, the positive sentiment was still recorded throughout the afternoon session through active buying liquidity accounting for nearly 72%. However, selling pressure continued to appear at the psychological point, making it impossible for VN-Index to overcome the old peak resistance.

Blue-chips contributed greatly to the green color of the July 5 stock market session. After many sessions of being “outdone” by penny and mid-cap stocks, today, big-cap stocks received a large cash flow from investors. Blue-chips led the VN-Index up.

In the July 5 stock session, big stocks regained their market-leading position by helping the VN-Index increase points. Illustrative photo

At the close of the stock market session on July 5, VN-Index increased by 2.62 points, equivalent to 0.23% to 1,134.62 points; VN30-Index increased by 1.76 points, equivalent to 0.16% to 1,129.76 points. The entire floor recorded 807 million shares, equivalent to 17,201 billion VND, successfully traded. Of which, the VN30 group witnessed improved liquidity, reaching 7,194 billion VND.

Some big stocks that played a leading role in the stock market on July 5 include VCB (up 2,000 VND/share, equivalent to 2% to 102,000 VND/share), HPG (up 700 VND/share, equivalent to 2.7% to 26,950 VND/share), VIB (up 250 VND/share, equivalent to 1.3% to 19,900 VND/share), VRE (up 300 VND/share, equivalent to 1.1% to 27,500 VND/share),...

One of the highlights of the July 5 stock market session was retail stocks. The cash flow into this industry group was quite strong but brought about uneven results. While MWG and MSN increased significantly, VNM stopped in the red.

Closing the stock market session on July 5, MWG increased by VND 100/share, equivalent to 0.2% to VND 43,350/share; MSN increased by VND 200/share, equivalent to 0.3% to VND 75,800/share; VNM decreased by VND 800/share, equivalent to 1.1% to VND 69,800/share.

On the Hanoi Stock Exchange, the trend continued to be less optimistic. At the close of the stock market session on July 5, the HNX-Index decreased by 0.92 points, equivalent to 0.4%, to 227.84 points; the HNX30-Index decreased by 1.26 points, equivalent to 0.29%, to 436.85 points.

Asian stocks in the red

The stock market session on July 5 saw green spread across the Ho Chi Minh City Stock Exchange. However, across Asia, all indices were in red, such as the HNX-Index.

Asia-Pacific markets were largely lower as investors digested a slew of private surveys on services activity.

Service activity in Japan and China continued to expand in the month while the pace of growth slowed.

In Japan, the Nikkei 225 fell 0.25% to 33,338.7 and the Topix edged down to 2,306.03. South Korea's Kospi also lost 0.55% to 2,579 while the Kosdaq rose 0.13% to 891.18.

Chinese markets fell, with the Shanghai Composite down 0.69% to close at 3,222.95 and the Shenzhen Component down 0.91% to 11,029.3. Hong Kong's Hang Seng Index fell 1.6% in the final hour while the Hang Seng Tech Index also traded 1.5% lower.

Australia's S&P/ASX 200 fell 0.35% to close at 7,253.6 after the Reserve Bank of Australia kept interest rates on hold at 4.1% on Tuesday.

U.S. markets are closed for the Independence Day holiday, but U.S. futures are lower ahead of Wednesday’s session. Traders will be closely watching the minutes from the Federal Reserve’s June meeting, after Chairman Jerome Powell said last month that they expect more rate hikes.

Dow Jones Industrial Average futures fell 0.11%, while S&P 500 and Nasdaq Composite futures fell 0.9% and 0.17%, respectively.

Source

![[Photo] National Assembly Chairman Tran Thanh Man meets with outstanding workers in the oil and gas industry](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/1d0de4026b75434ab34279624db7ee4a)

![[Photo] Closing of the 4th Summit of the Partnership for Green Growth and the Global Goals](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/c0a0df9852c84e58be0a8b939189c85a)

![[Photo] The beauty of Ho Chi Minh City - a modern "super city" after 50 years of liberation](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/18/81f27acd8889496990ec53efad1c5399)

![[Photo] Promoting friendship, solidarity and cooperation between the armies and people of the two countries](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/0c4d087864f14092aed77252590b6bae)

![[Photo] Nhan Dan Newspaper announces the project "Love Vietnam so much"](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/362f882012d3432783fc92fab1b3e980)

![[Photo] General Secretary To Lam receives French Ambassador to Vietnam Olivier Brochet](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/49224f0f12e84b66a73b17eb251f7278)

Comment (0)