Novaland “rescues” VN-Index

The stock market on July 26 is predicted to be an important session when the VN-Index approaches the strong resistance level of 1,200 points. Selling pressure from large-cap stocks caused the VN30-Index to sink into the red at times.

Before the ATC session, the tug-of-war situation was still going on strongly. However, fortunately for VN-Index, by the end of the session, stronger buying power appeared, helping VN30-Index regain green, thereby helping VN-Index successfully conquer the 1,200-point mark.

Closing the stock market on July 26, VN-Index increased by 4.94 points, equivalent to 0.41% to 1,200.84 points; VN30-Index increased by 3.42 points, equivalent to 0.29% to 1,201.43 points. The whole floor recorded 213 stocks increasing in price, 64 stocks remaining unchanged and 246 stocks decreasing in price. It can be seen that the number of stocks decreasing in price is still greater, so the strength of VN-Index still depends heavily on blue-chips.

The July 26 stock market session saw the Asian market engulfed in a “sea of fire”. Meanwhile, the VN-Index could have “followed” Asia if it had not been for Novaland’s “rescue”. Illustrative photo

In the July 26 stock market session, Vietcombank's VCB stock still played a key supporting role. VCB increased by VND1,700/share, equivalent to 1.9% to VND93,400/share. However, besides VCB, a blue-chip also played a role in "rescuing" the VN-Index. That was Novaland's NVL stock.

In the July 24th stock session, NVL attracted attention when it hit the ceiling with a sudden increase in volume, up to 96 million units. Then, in the July 25th stock session, NVL temporarily rested when it closed the session at the reference price.

At the beginning of the July 26 stock market session, NVL was even trading at a red price. However, by the end of the session, NVL almost hit the ceiling when it increased by VND1,000/share, equivalent to 6.2% to VND17,200/share, just VND100/share lower than the purple price. With a very high trading volume of more than 73 million units, NVL contributed significantly to helping the VN-Index surpass the important milestone of 1,200 points.

Although VN-Index successfully conquered the 1,200-point mark, the stock market session on July 26 still had a less optimistic point, which was a significant decrease in liquidity. The entire Ho Chi Minh City Stock Exchange had 912 million shares, equivalent to 17,952 billion VND, successfully traded. The VN30 group had 267 million shares, equivalent to 6,818 billion VND, transferred.

In the stock market session on July 26, the Hanoi Stock Exchange was not as lucky as the Ho Chi Minh City Stock Exchange when the indices were submerged in red.

Closing the stock market session on July 26, HNX-Index decreased by 0.73 points, equivalent to 0.31% to 236.2 points; HNX30-Index decreased by 1.28 points, equivalent to 0.27% to 466.93 points.

Liquidity on the Hanoi Stock Exchange fell to a very low level in the July 26 session. Only 75.9 million shares, equivalent to VND1,282 billion, were successfully transferred.

Asian stocks engulfed in “sea of fire”

VN-Index is one of the few rare indices that successfully “weathered the storm” in the stock market on July 26. Most markets in Asia-Pacific were engulfed in “fire”.

Asia-Pacific markets were mostly lower as investors braced for the US Federal Reserve's interest rate decision on Wednesday.

The Fed is expected to approve its 11th rate hike since March 2022.

Markets are pricing in an absolute certainty that the Fed will approve a quarter-percentage-point hike, which would take its benchmark lending rate to a target range of 5.25% to 5.5%. That would push the upper bound of the federal funds rate to its highest level since January 2001.

In Australia, official S&P/ASX 200 data showed Australia's annual inflation rate rose 6% in the June quarter, slowing from the 7% seen in the first quarter.

South Korea's Kospi led losses in the region, falling as much as 2%, dragged down by technology and consumer services stocks.

The index ultimately ended the day 1.67% lower to close at 2,592.36, while the Kosdaq saw a larger loss of 4.18% to end at 900.63.

In Japan, the Nikkei 225 index edged down, extending losses from Tuesday to close at 32,668.34, while the Topix also fell 0.1% to end at 2,283.09.

Hong Kong's Hang Seng Index retreated from Tuesday's rally and fell slightly by 0.52%, while mainland Chinese markets also fell. The Shanghai Composite fell 0.4%, while the Shenzhen Component lost 0.5%.

Source

![[Photo] National Assembly Chairman Tran Thanh Man meets with General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/4e8fab54da744230b54598eff0070485)

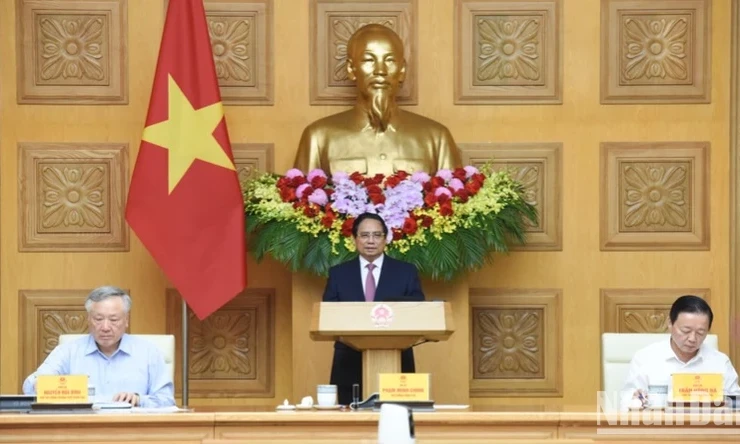

![[Photo] Prime Minister Pham Minh Chinh chairs conference to review the implementation of Resolution No. 18-NQ/TW](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/dcdb99e706e9448fb3fe81fec9cde410)

![[Photo] Ceremony to welcome General Secretary and President of China Xi Jinping on State visit to Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/5318f8c5aa8540d28a5a65b0a1f70959)

![[Photo] General Secretary To Lam holds talks with General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/b3d07714dc6b4831833b48e0385d75c1)

Comment (0)