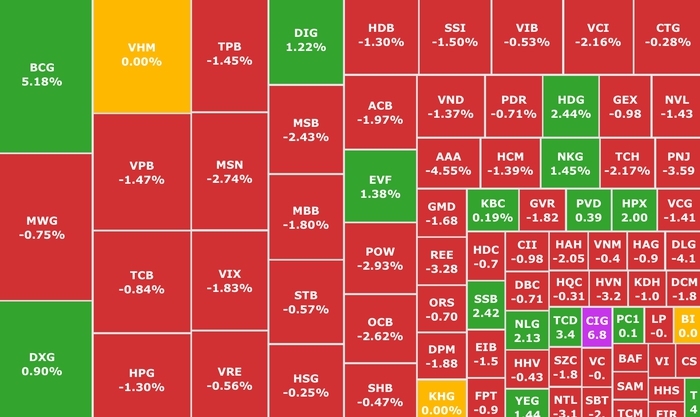

Foreign investors sold strongly, VN-Index fluctuated around 1,250, many real estate businesses reported strong profits, the steel industry was "unsatisfactory", dividend payment schedule...

VN-Index fluctuates, foreign investors net sell nearly 8,000 billion VND

The market recorded signs of accumulation and recovery at the 1,250 point area. Selling pressure tended to cool down, the "bottom fishing" force increased, helping VN-Index gradually regain its balance. VN-Index ended the week up 2.17 points (+0.17%) compared to the previous week, reaching 1,254.89 points.

Liquidity during the week remained at an average level, around 15,000 billion VND, with no signs of a breakthrough, showing that investors are still relatively cautious.

Foreign investors became the focus last week, with capital flows unexpectedly selling off with a sudden spike in negotiated transactions at VIB (VIB, HOSE). In total, in 5 trading sessions, the net selling value of foreign investors reached VND 7,890 billion across the market.

Of which, HOSE floor alone was 7,819 billion VND, HNX floor reached 123 billion VND, UPCoM net bought 69 billion VND.

Selling pressure was mainly on VIB shares with a value of VND 5,625 billion; VIB negotiated sale transaction with a value of more than VND 5,500 billion in the session on October 29.

The market "struggles" at the 1,250 point area (Photo: SSI iBoard)

MSN shares (Masan, HOSE) were also "sold" heavily with a value exceeding 2,000 billion after 5 sessions. Two codes VHM (Vinhomes, HOSE) and HPG (Hoa Phat Steel, HOSE) were net sold 526 billion and 223 billion respectively. In addition, codes SSI (SSI Securities, HOSE), BID (BIDV, HOSE), VCB (Vietcombank, HOSE), KBC (Kinh Bac, HOSE)... were also under significant selling pressure.

In contrast, VPB bank stocks (VPBank, HOSE) continued to attract foreign capital inflows. Following them were TCB (Techcombank, HOSE), GMD (Gamedept, HOSE), CTG (VietinBank, HOSE), EIB (Eximbank, HOSE), BMP (Binh Minh Plastics, HOSE), FPT (FPT, HOSE)... stocks last week.

Expecting to benefit from "anti-dumping" policy, steel industry "dismal" in Q3

After a period of positive recovery, the business situation of the listed steel industry group has turned more gloomy. The total profit of the steel industry in the third quarter only reached about 2,600 billion VND.

It is worth mentioning that many large enterprises reported losses, such as the case of Hoa Sen Group - Hoa Sen Steel (HSG, HOSE) with after-tax profit of negative 186 billion VND even though in the previous second quarter, after-tax profit was still 273 billion VND.

Steel group "less bright" in the third quarter of 2024 (Illustration photo: Internet)

Another case comes from VNSteel (TVN, HOSE) with a loss of 124 billion VND. In addition, there are a number of other names, Tisco (TIS, UPCoM), Tien Len Steel (TLH, HOSE)...

In the whole industry, no enterprise recorded a profit of over 100 billion, except for Hoa Phat Steel (HPG, HOSE) which maintained its performance with a profit after tax of 3,022 billion VND in the third quarter. This figure increased by 1.5 times compared to the same period in 2023, but was 9% lower than the previous second quarter.

Apart from Hoa Phat, no steel company on the stock exchange had a net profit of over 100 billion in the last quarter.

The third quarter saw little change in inventory among steel companies listed on the stock exchange. The total inventory of the entire industry is estimated at around VND75,000 billion, equivalent to the end of the previous second quarter. This figure is much lower than the boom period of the steel industry from 2021 to early 2022.

Profits of securities and oil and gas groups grew negatively.

As of now, according to the latest update from FiinTrade, 1,060 listed enterprises, equivalent to 98.5% of the total market capitalization, have announced their business results for the third quarter of 2024.

Accordingly, the total profit after tax of the whole market in the third quarter increased by 21.6% compared to the same period, maintaining a stable rate compared to the previous two quarters. Growth was mainly contributed by the non-financial group increasing by 29%, the financial group recorded a lower increase of 15.7%, due to the "poor" results in the securities group (down 9.7%) and insurance (down 32.5%).

By industry, high profit growth comes from consumer goods (retail, food, livestock), exports (seafood, garment), raw materials (rubber, fertilizer), electricity, and industrial real estate.

On the contrary, the insurance, securities, milk, personal goods, oil and gas, chemicals, pharmaceuticals, and telecommunications groups recorded a decrease in profits. The groups with slower growth include: banking, steel, information technology, etc.

Pre-funding officially takes effect, foreign investors do not need to deposit 100% when buying securities

Circular 68/2024/TT-BTC officially takes effect from November 2, 2024. The Circular amends and supplements a number of articles of the Circulars regulating securities transactions on the securities trading system; clearing and settlement of securities transactions; operations of securities companies and information disclosure on the securities market.

Accordingly, the most notable content is the regulation that foreign institutional investors can purchase shares without requiring sufficient funds (Non Pre-funding solution - NPS). Investors must have sufficient funds when placing an order to purchase securities, except for 02 cases: (1) investors trading on margin as prescribed in Article 9 of this Circular; (2) Organizations established under foreign law participating in investment in the Vietnamese securities market (hereinafter referred to as foreign institutional investors) purchasing shares do not require sufficient funds when placing an order as prescribed in Article 9a of this Circular.

Circular 68/2024/TT-BTC has added Article 9a on "Stock purchase transactions do not require sufficient funds when placing orders by foreign institutional investors".

In addition, the roadmap for information disclosure in English is also fully regulated.

Maybank Investment Bank gave a positive assessment of the amendments to regulations related to pre-funding requirements, handling of unsuccessful transactions and capital adequacy ratios of securities companies. From there, it is expected that FTSE will officially upgrade the Vietnamese market to emerging status in the review period of March 2025 (positive scenario) or September 2025 (neutral scenario). In 2025-2026, integrate Vietnamese stocks into FTSE's emerging market (EM) indices.

Sharing the same view, ACBS Securities expects FTSE to add Vietnam to the Secondary Emerging Market list as early as the March 2025 review. Upgrading to Emerging Market will be a significant milestone for Vietnam's securities to be recognized as a market with investment accessibility for foreign investors.

On the other hand, the removal of important bottlenecks in the upgrading process is expected to become a catalyst to reverse foreign capital flows in the Vietnamese stock market. In the first 10 months of 2024, foreign investors continuously sold net with a total value of up to VND 76,000 billion (more than USD 3 billion) on HOSE alone.

Novaland unexpectedly reported a profit of thousands of billions thanks to financial revenue

At the end of the third quarter of 2024, No Va - Novaland Real Estate Investment Group Corporation (NVL, HOSE) saw its net revenue increase by 87% year-on-year to VND2,012.3 billion. Excluding cost of goods sold, gross profit reached VND545.4 billion, up 59.5% year-on-year.

Notably, financial revenue during the period increased 2.4 times, reaching nearly VND 3,898 billion.

Including the first half of 2024 financial revenue that the auditor adjusted down in the 2024 semi-annual audit report of VND 3,045.7 billion, the group has actually collected it in the third quarter of 2024.

After deducting other expenses, Novaland recorded VND2,950.3 billion in profit after tax, an increase of 2,057% over the same period last year.

Many real estate businesses report strong profits (Illustration photo: Internet)

In addition, many other real estate businesses also recorded sharp increases in profits in the third quarter of 2024.

Kinh Bac Urban Development Corporation (KBC, HOSE) achieved VND950 billion in net revenue in the third quarter of 2024, 3.8 times higher than the same period. As a result, Kinh Bac brought in VND201.5 billion in after-tax profit, up 986% over the same period. According to the company, the sharp increase in profit was mainly due to KBC recording revenue from industrial park business activities in this period, reaching more than VND580 billion.

Kinh Bac Urban Development Corporation (KBC, HOSE) recorded VND950 billion in net revenue, 3.8 times higher than the same period, and financial revenue was nearly double the same period, reaching VND116 billion thanks to increased interest on deposits.

Thanks to that, Kinh Bac brought in 201.5 billion VND in after-tax profit, up 986% over the same period. The company said that the sharp increase in profit was mainly due to KBC recording revenue from industrial park business activities in this period, reaching more than 580 billion VND.

Comments and recommendations

Mr. Pham Van Cuong, investment consultant, Mirae Asset Securities, commented that VN-Index has decreased by more than 50 points after many attempts to surpass the super resistance level at 1,300 points. Currently, the technical status shows that the threshold around 1,250 points helps the decline to temporarily stop but is not enough to stimulate cash flow from the demand side to actively participate, so the possibility of strong fluctuations or even the scenario of breaking through 1,250 points is quite likely to happen this week.

VN-Index at risk of "bottoming out" at 1,250 points

The banking group plays an important role as one of the important pillars of the index with CTG (VietinBank, HOSE) and VCB (Vietcombank, HOSE) but is not enough to create a large spread for the codes in the same industry, thus making the general sentiment more apprehensive. On the other hand, the Q3 Business Results Reporting season has entered the final stage, creating a "news void".

Especially when the US Presidential Election - one of the most important events in 2024 - enters the decisive stage, making large cash flows from both domestic and foreign investors cautious.

In the short term, VN-Index is moving sideways in the range of 1,250 - 1,270. The probability of "breaking the bottom" is quite clear, so investors need to be cautious with the early increases of the week (if any) and avoid chasing buying. Prioritize stock weight management (recommended)

With the scenario of breaking through 1,250, investors should wait for the equilibrium point around 1,200 points.

In the medium term (more than 6 months), VN-Index will accumulate in the large range of 1200 - 1300. Currently, there are no significant changes, VN-Index is likely to enter a new cycle this November. Detailed assessment will be decided by the first 2 weeks of the month.

Vietcap Securities assessed that VN-Index is unlikely to escape the downward momentum and will retest the MA200 line (1,250 points). The 1,265 - 1,270 point area is still the main resistance for the current correction period. If new buying power is found around MA200, the index will escape the medium-term downtrend, and this possibility only occurs when demand has a significant surge.

SSI Securities believes that VN-Index will remain within a narrow range of 1,250 - 1,268 points. Technical indicators remain neutral, and it is expected that the index will continue to fluctuate within the range of 1,250 - 1,258 points.

Dividend schedule this week

According to statistics, there are 13 enterprises that have fixed dividend rights from November 4-8, of which 10 enterprises pay in cash, 2 enterprises pay in shares and 1 enterprise gives bonus shares.

The highest rate is 100%, the lowest is 3%.

2 companies pay by stock:

Binh Thanh Production, Trading and Import-Export Joint Stock Company - Gilimex (GIL, HOSE), ex-right trading date is November 8, ratio is 45%.

PC1 Group Corporation (PC1, HOSE), ex-right trading date is November 7, rate is 15%.

1 company rewards shares:

Nam Viet Joint Stock Company - NAVICO (ANV, HOSE), ex-right trading date is November 7, ratio is 100%.

Cash dividend payment schedule

*Ex-right date: is the transaction date on which the buyer, upon establishing ownership of shares, will not enjoy related rights such as the right to receive dividends, the right to purchase additional issued shares, but will still enjoy the right to attend the shareholders' meeting.

| Code | Floor | GDKHQ Day | Date TH | Proportion |

|---|---|---|---|---|

| BCM | HOSE | 4/11 | 12/27 | 10% |

| HMS | UPCOM | 4/11 | 5/12 | 8% |

| PPC | HOSE | 5/11 | 6/12 | 6.3% |

| TV3 | HNX | 7/11 | 16/12 | 5% |

| HPT | UPCOM | 7/11 | 2/12 | 12% |

| CBS | UPCOM | 7/11 | 11/19 | 30% |

| DP1 | UPCOM | 8/11 | 12/20 | 8% |

| HAN | UPCOM | 8/11 | 11/29 | 3% |

| HNF | UPCOM | 8/11 | 11/27 | 10% |

| TNG | HNX | 8/11 | 11/22 | 4% |

Source: https://phunuvietnam.vn/chung-khoan-tuan-4-8-11-vn-index-giang-co-do-trong-thong-tin-tai-vung-1250-1270-20241104075545546.htm

Comment (0)