In January 2025, the US manufacturing sector achieved positive growth for the first time in two years. However, President Donald Trump's tariff policies with three major partners are threatening this achievement.

|

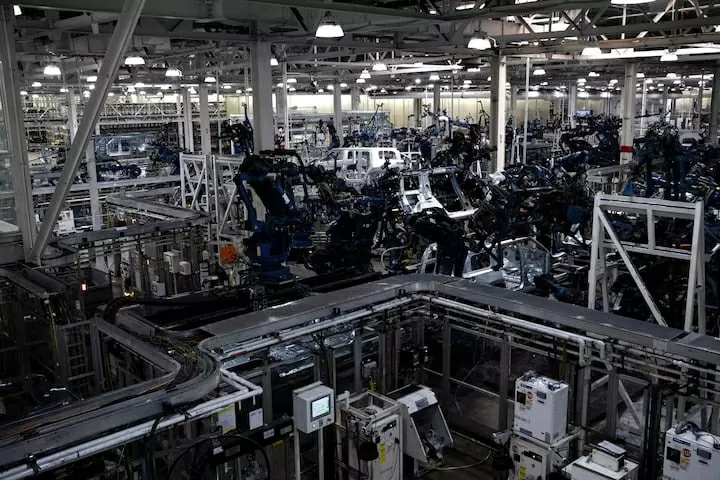

| Prolonged tariffs will push the US dollar up, making US-made goods less competitive and limiting the country's manufacturing activities. (Source: Reuters) |

On February 3, US President Donald Trump announced a one-month delay in the 25% tariff on goods from Mexico and Canada. However, Washington will continue to apply a 10% tariff on Chinese goods.

Economists stress that the threat of tariffs will limit production. Higher tariffs will boost the dollar, making it harder for American goods to compete.

“Tariffs are a supply shock, hurting production and raising prices,” said Kathy Bostjancic, chief economist at Nationwide, adding that further rounds of US tariffs would have a negative impact on inflation and GDP growth.

According to a survey released on February 3 by the Institute for Supply Management (ISM), in January 2025, raw material inventories tended to decrease, while product prices increased for the fourth consecutive month.

According to the survey, the US manufacturing PMI in January 2025 reached 50.9 points, the highest since September 2022, exceeding the 50-point threshold indicating growth. Previously, in December 2024, this index was 49.2 points.

The US manufacturing sector has underperformed since the Federal Reserve (Fed) implemented interest rate hikes with a total value of up to 5.25% from 2022-2023 to curb inflation.

In September 2024, the Fed began an easing policy to stimulate the economy. However, at its January 2025 meeting, the agency paused interest rate cuts due to concerns about the uncertain economic impact of President Donald Trump's new policies.

According to the central bank's data, US manufacturing output will fall 0.4% from the fourth quarter of 2023 to the fourth quarter of 2024.

“The threat of prolonged tariffs strengthens the dollar, adding further pressure to the manufacturing sector, as nearly half of US manufacturing is exported,” said Veronica Clark, an economist at financial services firm Citigroup.

In January 2025, eight manufacturing industries saw positive growth, including textiles, basic metals, machinery and transport equipment. On the contrary, eight industries recorded negative growth, including diversified goods manufacturing, wood processing, computers and electronic products.

The new orders index rose to 55.1 in January 2025 from 52.1 in December 2024. Manufacturing costs rose the most in eight months, rising to 54.9 from 52.5 in December 2024, beating economists' forecasts of 53.5.

Supplier delivery performance, however, has been on a downward trend, with the survey reading rising to 50.9 from 50.1 in December 2024 (a reading above 50 typically indicates slower deliveries).

The director of the ISM's manufacturing business survey committee explained that companies participating in the survey may not have received the raw materials needed for production.

According to the survey, industry inventories decreased, while imports in the industry tended to increase because manufacturers imported raw materials before the implementation of the tariff policy.

Manufacturing hiring increased for the first time since May 2024. However, manufacturing job growth did not match payrolls.

Thus, it can be seen that US manufacturing industry figures generally tend to increase compared to the previous period, however, these numbers are threatened by new tariffs.

Source: https://baoquocte.vn/chinh-sach-thue-quan-cua-tong-thong-trump-de-doa-nganh-san-xuat-my-303192.html

Comment (0)