| European business confidence index in Vietnam rises European businesses have strong confidence in Vietnam's economy |

Slight increase above 50 points

On October 8, 2024, the European Chamber of Commerce in Vietnam (EuroCham) released the Business Confidence Index (BCI) report for the third quarter of 2024.

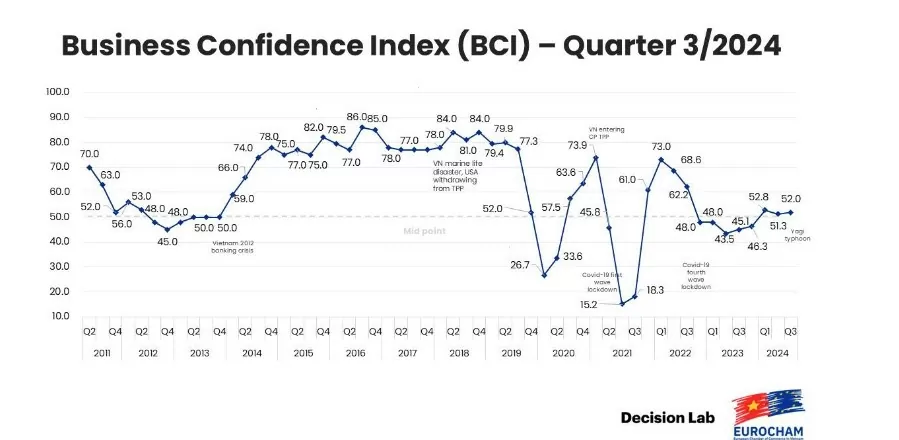

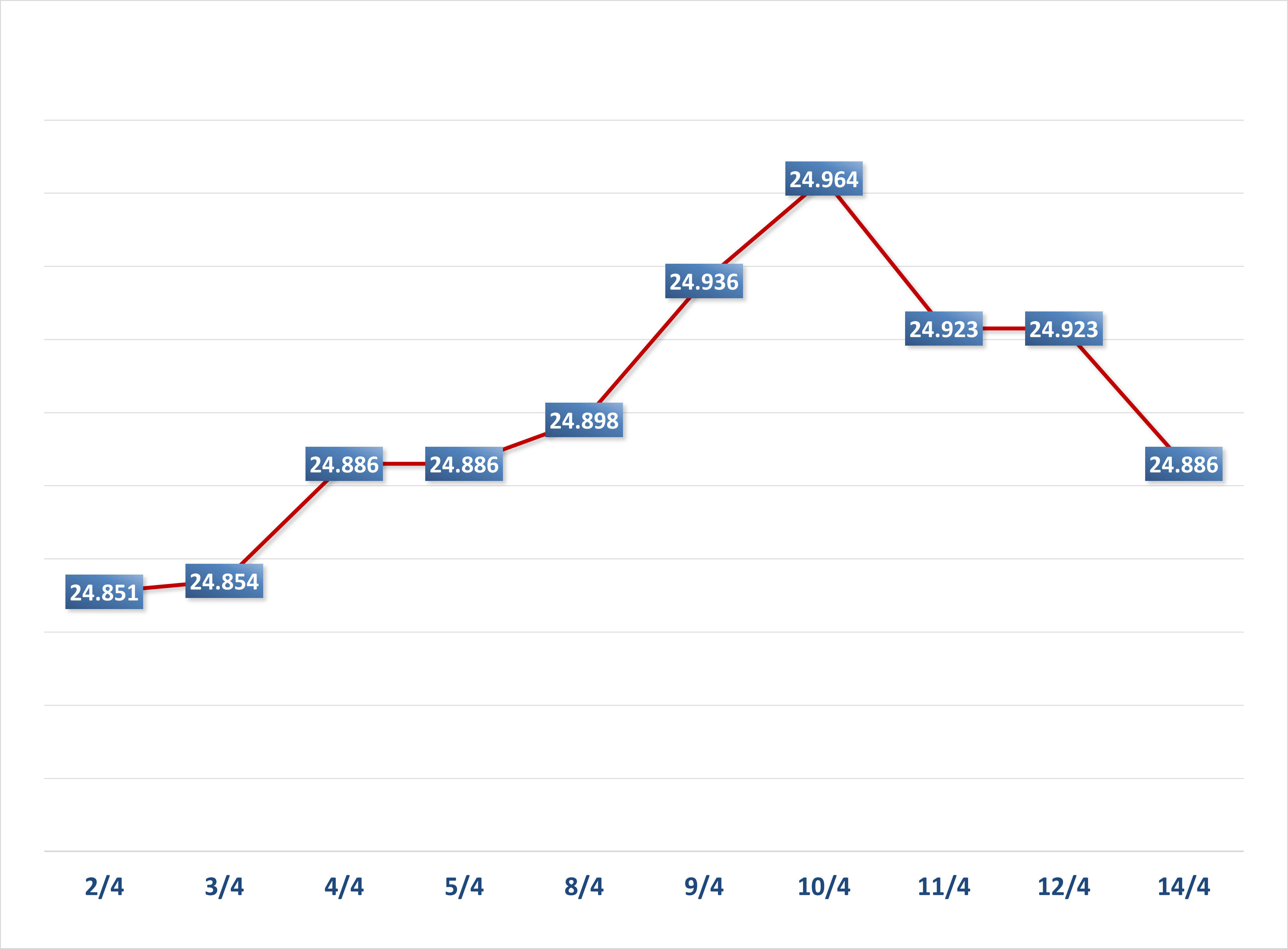

The report reflects positive signs in business sentiment despite the economic challenges caused by Typhoon Yagi and the barriers to business operations. The BCI increased significantly, from 45.1 in Q3 2023 to 52.0 in Q3 2024, marking a strong recovery in a year of turbulence due to external factors.

|

EuroCham’s BCI survey is conducted by Decision Lab and collects and analyses information from the Association’s 1,400 member network. This quarterly report serves as a barometer for European companies operating in Vietnam, providing timely information on the business landscape in one of Southeast Asia’s most dynamic markets. The BCI provides a multi-dimensional view of current conditions and future expectations for the economy, helping businesses make strategic decisions and advocate for policy.

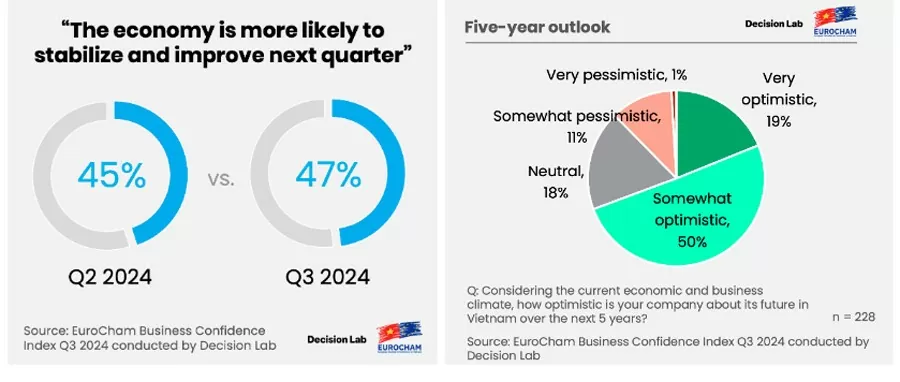

Typhoon Yagi has severely affected infrastructure and agriculture in northern Vietnam. The government is forecasting a 0.15% decline in GDP this year, with total losses estimated at US$1.63 billion. However, in EuroCham’s most recent business survey, conducted from 12 to 25 September, after the storm, nearly half (47.4%) believed that the macroeconomic situation would improve in the next quarter. Furthermore, long-term prospects remain high, with 69.3% expecting a favourable business environment over the next five years.

|

This positive view is further reinforced with 67% of European businesses recommending Vietnam as an attractive investment destination despite certain challenges.

“Despite the recent economic stress caused by Typhoon Yagi, the resilience and adaptability of both the Vietnamese economy and the European businesses operating here are clearly demonstrated in the survey. The results are more than just numbers; they paint a picture that highlights Vietnam’s development as a strategic business hub,” said Bruno Jaspaert, Chairman of EuroCham.

Identify obstacles

Similar to previous quarters, the survey found that the three biggest obstacles to European businesses' operations were administrative burden, unclear regulations and difficulties in obtaining permits.

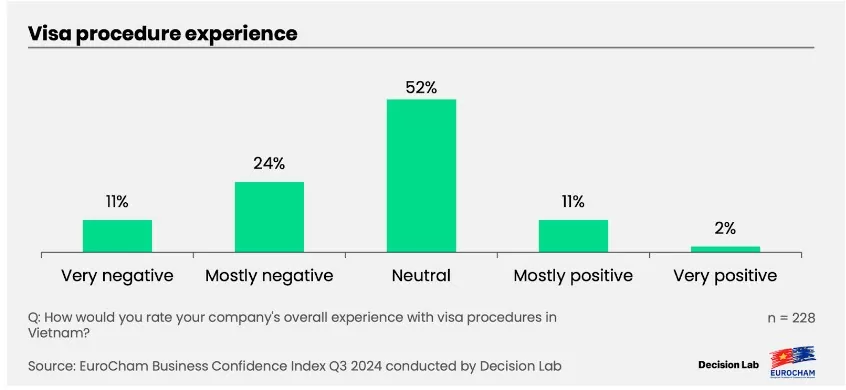

According to the survey, 66% of businesses currently employ between 1% and 9% of their employees as foreigners, while 6% of businesses have over 20% of their employees as foreigners. Although businesses show a desire to exploit the full potential of domestic and international labor resources, they still face many barriers in recruiting Vietnamese workers, including: Lack of necessary skills and experience, high turnover rates, and limited training resources. For foreign experts, the main challenges come from complicated visa and work permit application processes, strict labor regulations and high associated costs, along with difficulties in obtaining the necessary documents and approvals.

|

In particular, this problem becomes even more serious when up to 1/3 of businesses participating in the survey said they had negative experiences with the visa system in Vietnam, causing many international experts to be concerned about entering the Vietnamese labor market.

In addition, businesses also noted difficulties related to tax procedures and compliance with fire prevention and fighting regulations.

Green Transformation and Digital Transformation Take Center Stage

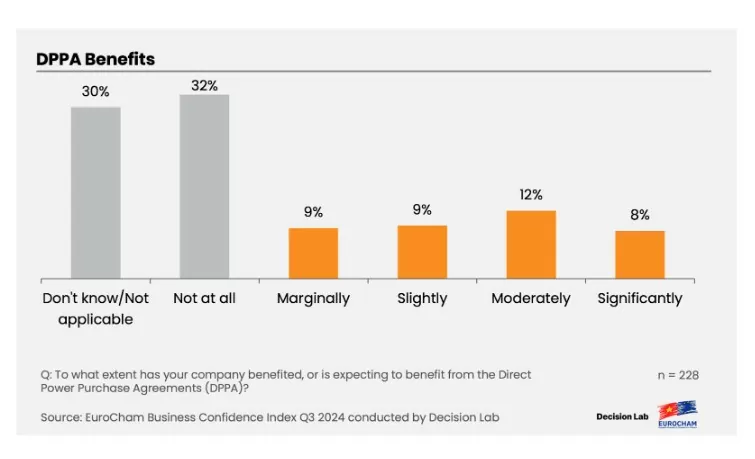

Following the issuance of the new Direct Power Purchase Agreement (DPPA) Decree in July this year, nearly 30% of businesses surveyed expect to benefit from renewable energy projects, reinforcing Vietnam’s commitment to the green transition. Notably, a quarter of service providers and companies with 100 or more employees expect to benefit moderately or significantly from the scheme. While nearly half (47.4%) of businesses are confident that they can fully transition to renewable energy by 2050, there are gaps in understanding and implementing relevant policies.

|

“GEFE 2024 will be a timely platform to address these gaps,” said Jaspaert. “At the conference, senior leaders and international experts will discuss topics such as energy transition and digital transformation, not only in terms of technical infrastructure but also in terms of promoting green leadership and building sustainable ecosystems for many industries.”

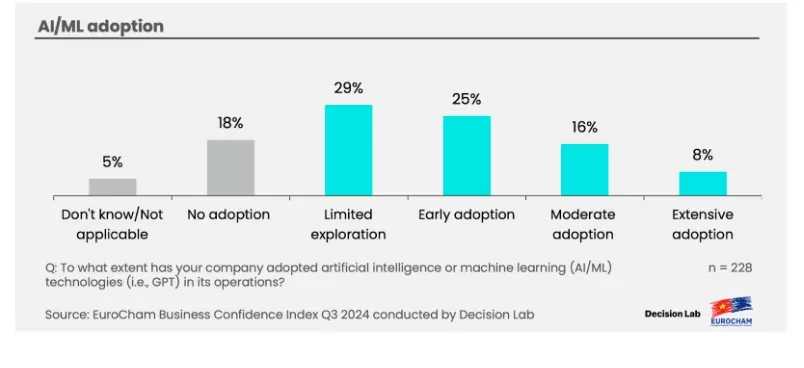

Digital transformation was also identified as an area for improvement, particularly in alleviating human resource constraints and streamlining administrative procedures. The BCI survey revealed a moderate adoption rate of AI/ML (artificial intelligence/machine learning), with 46.1% of businesses reporting that they have integrated the technology into their operations. However, most implementation projects are still in the early stages, indicating great potential for investment in digitalization projects.

|

While the survey shows overall improvement, the challenges identified – particularly in the area of digital transformation – highlight the need for concerted efforts to improve these areas ,” said Thue Quist Thomasen, CEO of Decision Lab. “Adopting technology will be key to helping businesses streamline processes and adapt to future sustainability standards.”

Trends in business planning and expansion

In addition to green and digital transformation, businesses are adapting their business travel strategies to cope with rising airfares. More than 40% of respondents said they have become more selective in planning business trips or using alternative modes of transportation due to high travel costs, while some businesses have reduced or even canceled business trips altogether.

Despite the challenges, business expansion plans remain promising, with nearly 80% of businesses reporting that they have one to three offices or manufacturing facilities in Vietnam. Of those businesses that shared their expansion plans, more than half intend to expand operations, with many planning to develop new manufacturing facilities in the North or open additional offices in key cities such as Hanoi, Ho Chi Minh City, Da Nang and Can Tho.

Source: https://congthuong.vn/index-of-business-trust-in-quy-3-tai-viet-nam-tang-nhe-350990.html

![[Photo] Opening of the 44th session of the National Assembly Standing Committee](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/03a1687d4f584352a4b7aa6aa0f73792)

![[Photo] Children's smiles - hope after the earthquake disaster in Myanmar](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/9fc59328310d43839c4d369d08421cf3)

![[Photo] General Secretary To Lam chairs the third meeting to review the implementation of Resolution No. 18-NQ/TW](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/10f646e55e8e4f3b8c9ae2e35705481d)

![[Photo] Touching images recreated at the program "Resources for Victory"](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/99863147ad274f01a9b208519ebc0dd2)

Comment (0)