The restructuring of shipping alliances around the world is expected to change the shipping market, affecting seaports around the world, including Vietnam.

Reshaping the shipping industry

At the end of 2024, Cai Mep - Thi Vai seaport (Ba Ria - Vung Tau province) is still bustling with large ships entering and leaving the port to load and unload goods. Among them, there are the world's leading shipping lines such as: MSC, CMA - CGM, Maersk, Cosco...

The formation of new shipping alliances is expected to bring opportunities to Cai Mep seaport as shipping lines restructure their shipping routes.

Shipping lines are distributed in the regional seaport system, diversifying cargo service routes, bringing many opportunities and choices to Vietnamese import and export shippers.

However, from 2025, the global shipping industry will witness changes in the structure of shipping line alliances.

Typically, the 2M alliance between MSC and Maersk will disband in January 2025. While MSC plans to operate independently on the East-West trade routes, Maersk "joins hands" with Hapag-Lloyd to form the Gemini Co-oporation alliance, expected to focus on important trade routes including the Asia-Europe, Trans-Pacific and Atlantic corridors.

Major shipping lines such as CMA-CGM, Cosco, OOCL and Evergreen also formed the Ocean Alliance, while THE Alliance is changing to Premier Alliance with members including Yang Ming, HMM and ONE.

According to Transport intelligence, a leading UK-based logistics research and analysis company, the end of 2M and THE Alliance (which together account for 34.4% of global container fleet capacity) will redefine global trade routes and capacity allocation.

The formation of new alliances and the dissolution of old ones will reshape the shipping industry in 2025, when shipping lines can restructure shipping routes to optimize capacity and reduce delays.

According to observers, this restructuring is expected to create fierce competition on major shipping routes. However, it also creates opportunities for small shipping lines to gain market share on underserved shipping routes.

Many opportunities, big challenges

The change in alliances is expected to affect the global supply chain, repositioning transit ports to accommodate new alliances. Therefore, it may have a certain impact on seaports, including Cai Mep - Thi Vai because currently, the world's leading shipping lines are operating here. Cai Mep - Thi Vai also has shipping routes to Europe and the US.

Mr. Pham Anh Tuan, General Director of Port Design and Marine Engineering Joint Stock Company (Portcoast) said that this could be an opportunity for Cai Mep seaport compared to other ports in Southeast Asia. Cai Mep has advantages in cargo handling quality, has been ranked in the top 6 most efficient container ports in the world, and has also welcomed the world's largest container ships of up to more than 232,000 DWT.

These bright spots are opportunities for Cai Mep to increase cargo throughput, promote transit cargo, and attract new shipping routes when shipping lines restructure their routes.

However, opportunities come with challenges as Cai Mep will increase competition with other regional transit ports such as Singapore and Malaysia. Investment in operational technology equipment to meet trends, increase capacity to receive large ships, and requirements for emission reduction will put pressure on port businesses.

No worries about fierce competition

According to Mr. Tran Khanh Hoang, Vice President of the Vietnam Port Association (VPA), the most important thing for seaports at the moment is to improve service quality, meet the needs and development trends of the world's maritime industry. In the context of the maritime industry focusing on reducing emissions, building ships running on green fuels such as methanol, ammonia, hydrogen, etc., the demand for greening seaports is increasingly high.

In addition, with the goal of reducing logistics costs, in the coming time, shipping alliances may change the size of ships for service routes. This requires improving the quality of public infrastructure and seaport infrastructure. Currently, the shipping route to the Far East often operates ships of 16,000 - 24,000 TEU, while the route to the US is about more than 15,000 TEU.

At that time, the ports downstream of Cai Mep - Thi Vai such as Gemalink, CMIT, SSIT... will have an advantage over the ports in the upstream area because they have drafts that meet the requirements. This can create a shift of goods in the seaport block when shipping lines form joint ventures with port operators.

In Hai Phong, after berths 3, 4, 5, 6 at Lach Huyen come into operation in phase 1, goods can be transferred from berths 1, 2 of TC-HICT to the remaining berths. The reason is that Maersk has a joint venture with Hateco Group to operate berths 5, 6, while MSC has a joint venture with Hai Phong Port to operate berths 3, 4.

However, port businesses do not need to worry too much about competing with each other because in reality, shipping lines still have independent policies on ports regardless of which alliance they are in.

Although there may be a shift of goods between ports, Mr. Hoang said that the total volume of goods passing through Vietnam's seaports will not be much affected by the new alliances. Vietnam's main goods are imports and exports, not many transit goods. Therefore, shipping lines, regardless of which alliance they are in, still have to enter Vietnam's ports.

A shipping alliance is a form of cooperation between shipping companies, shipping lines and related organizations in providing sea transport services on a global scale. Shipping alliances will allow members to share vessels, infrastructure and transport capacity, ensuring benefits for all parties.

The alliance was established to optimize resources and provide comprehensive services to shippers. Thereby, helping to reduce transportation costs and improve customer service capabilities.

Source: https://www.baogiaothong.vn/cang-bien-anh-huong-gi-khi-co-lien-minh-hang-tau-moi-192241226222826815.htm

![[Photo] National Assembly Chairman Tran Thanh Man meets with General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/4e8fab54da744230b54598eff0070485)

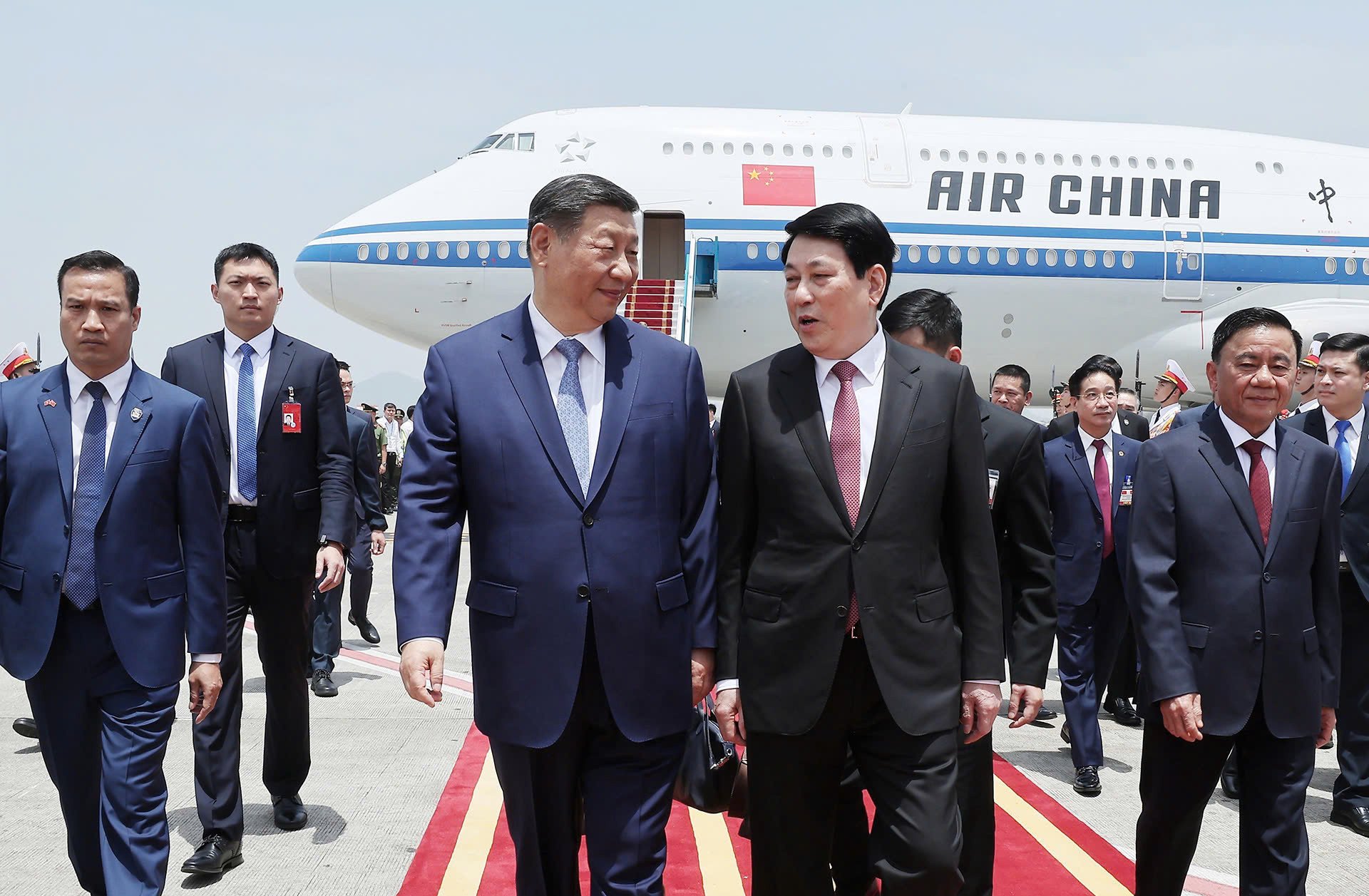

![[Photo] Prime Minister Pham Minh Chinh meets with General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/893f1141468a49e29fb42607a670b174)

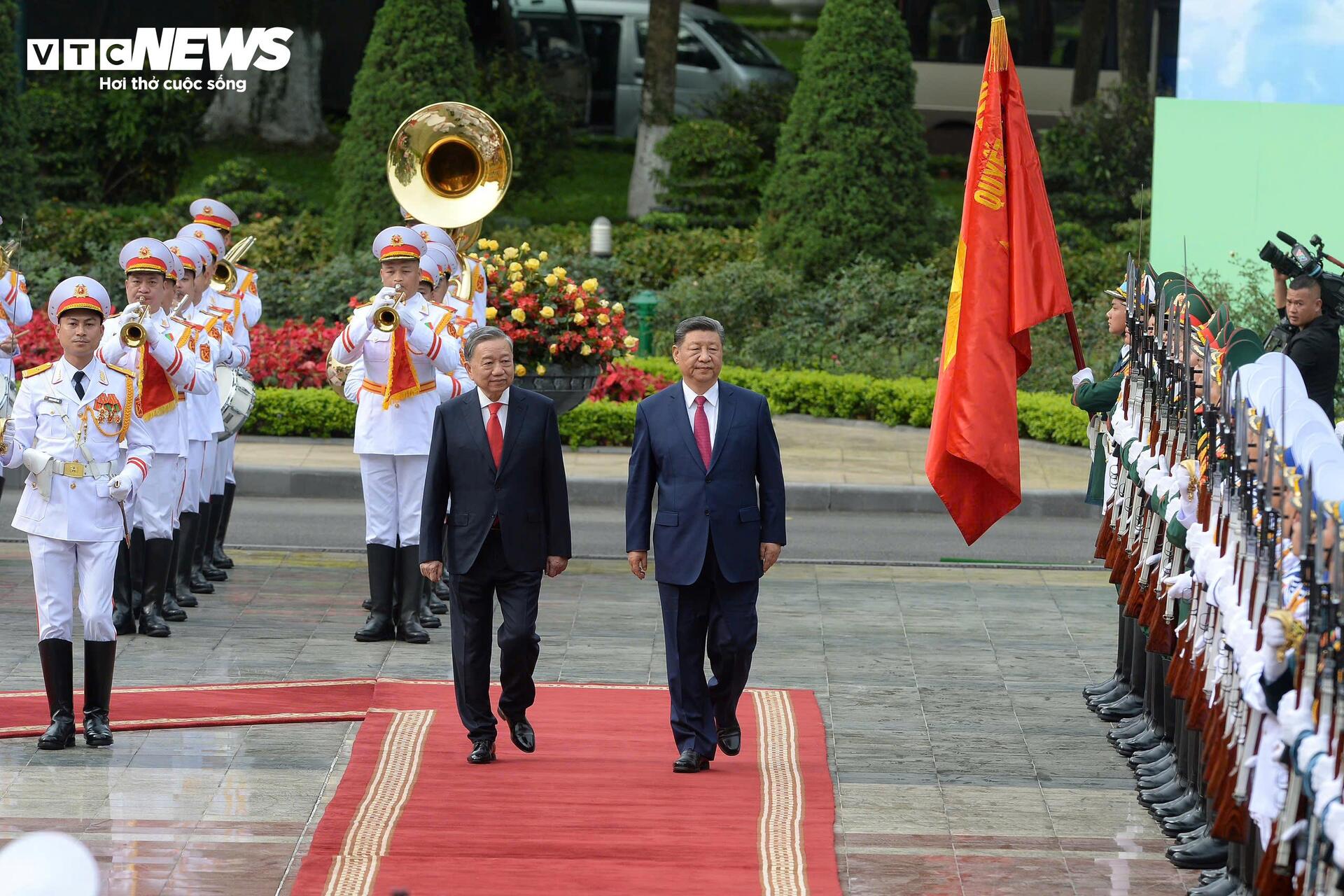

![[Photo] Reception to welcome General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/9afa04a20e6441ca971f6f6b0c904ec2)

![[Photo] General Secretary To Lam holds talks with General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/b3d07714dc6b4831833b48e0385d75c1)

Comment (0)