|

| Deputy Governor of the State Bank Pham Quang Dung speaks at the Conference. (Photo: VGP). |

(PLVN) - Credit growth has increased compared to the same period but is still low compared to the target for 2024, so it is necessary to find ways to improve capital absorption capacity for businesses.

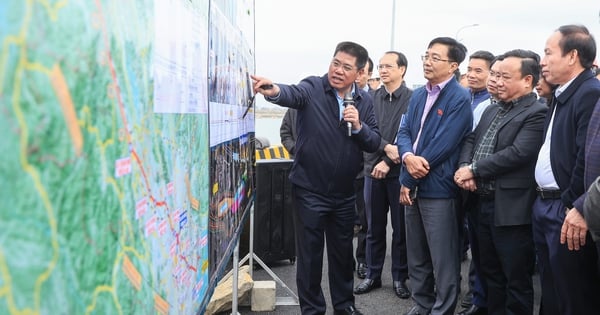

Reporting at the Government Standing Committee's meeting with joint stock commercial banks (JSC) on solutions to contribute to socio-economic development, Deputy Governor of the State Bank of Vietnam Pham Quang Dung said that credit growth of the entire system improved compared to the same period. By September 17, 2024, it reached 7.38% compared to the end of 2023 (the same period reached 5.73%). Of which, the private JSC increased by 8.6%, accounting for 45% of the market share, the highest increase in the entire system.

Credit growth for all sectors improved compared to the same period in 2023, the credit structure is consistent with the economic restructuring orientation. The credit structure of the private commercial joint stock bank sector is consistent with the general credit structure, in which credit for the trade and service sector increased positively, accounting for about 50% of outstanding loans for the trade and service sector of the whole system.

Credit continued to be directed towards production and business activities, priority sectors, and consumer credit recovered. Outstanding loans for living needs and outstanding credit via credit cards increased by 4.93% (down 0.2% in the same period).

However, Deputy Governor Pham Quang Dung commented that the credit absorption capacity of businesses and people is still low, many businesses have reduced or stopped production due to lack of orders, dissolution, closure, and declining financial health; the trend of tightening and cutting spending by people leads to low credit demand.

In addition, the pressure on bank credit continues to increase in the context of other capital mobilization channels of the economy facing many difficulties and not yet being effective. The real estate market has not yet recovered and stabilized, the difficulties of the real estate market also affect many satellite industries as well as consumer demand for housing.

According to Deputy Governor Pham Quang Dung, in order to increase credit absorption capacity, in addition to solutions from the banking sector, there needs to be comprehensive policies from ministries, sectors and localities. For example, it is necessary to continue improving the investment and business environment; Strengthening market confidence in economic recovery and growth, thereby restoring expectations for business investment expansion and promoting people's consumption.

Promote traditional growth drivers of investment, consumption, and export; continue to implement solutions to stimulate domestic consumption; Continue to effectively implement policies on exemption, reduction, and extension of payment deadlines for taxes, fees, charges, and land use fees; expand reasonable, focused, and key fiscal policies; Speed up the process of removing difficulties and sustainably developing the stock market, corporate bond market, and real estate market.

At the same time, it is necessary to maintain stable and suitable prices of goods managed by the State to avoid simultaneous impacts and resonance on domestic inflation and the efficiency of production and business activities of people and enterprises. Along with that, it is necessary to improve the capacity and ability to absorb capital of enterprises from both the enterprise side, as well as support mechanisms for enterprises to access capital through the Small and Medium Enterprise Guarantee Fund and the Small and Medium Enterprise Development Fund.

Source: https://baophapluat.vn/can-nhieu-giai-phap-de-tang-kha-nang-hap-thu-von-post526306.html

![[Photo] General Secretary To Lam holds talks with General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/b3d07714dc6b4831833b48e0385d75c1)

![[Photo] Prime Minister Pham Minh Chinh meets with General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/893f1141468a49e29fb42607a670b174)

![[Photo] National Assembly Chairman Tran Thanh Man meets with General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/4e8fab54da744230b54598eff0070485)

![[Photo] Reception to welcome General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/9afa04a20e6441ca971f6f6b0c904ec2)

Comment (0)