According to the Vietnam General Confederation of Labor, there are workers who have never been unemployed their entire lives, although their contributions to the unemployment insurance fund increase with seniority, but they never receive benefits from the unemployment insurance fund.

Need to review the case of paying social insurance for more than 144 months without being reserved

To contribute to the completion of the revised Law on Employment, the Vietnam General Confederation of Labor has organized many conferences to consult opinions on this draft law. Notably, many delegates did not agree with the regulation on the period of receiving unemployment insurance.

According to the draft amended Law, the monthly unemployment benefit is equal to 60% of the average monthly salary for the last 6 months of unemployment insurance contributions before unemployment, but not exceeding 5 times the regional minimum monthly wage.

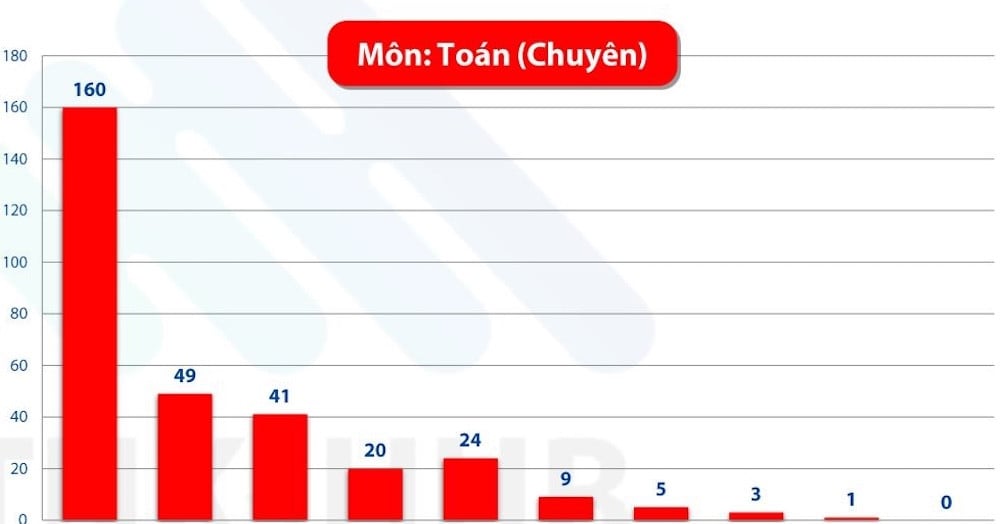

People who have paid social insurance for 12 to less than 36 months will receive 3 months of benefits. After that, for every additional 12 months of payment, add 1 month of benefits, up to a maximum of 12 months. People who have paid for 144 months (ie 12 years) will receive a maximum of 12 months of benefits. Payment periods of more than 144 months will not be retained for calculating unemployment benefits for the next time.

This means that people who have paid social insurance for more than 12 years will only receive unemployment benefits for a maximum of 12 months. If they have never quit their job to receive benefits, they will not be able to reserve their surplus time.

The General Confederation of Labor, through consultation, found that this is an unreasonable regulation, so the law needs to be amended in the direction of not regulating a ceiling on the period of enjoyment but following the principle of contribution - enjoyment.

The purpose is to help workers ensure benefits commensurate with the level and duration of social insurance contributions; support workers in difficult times when they cannot find a job, especially for the elderly or in specific occupations...

The law drafting agency - the Ministry of Labor, Invalids and Social Affairs (now the Ministry of Home Affairs) believes that unemployment insurance is a short-term insurance with high risk sharing. The non-reservation for payment periods of more than 144 months is not a new regulation but inherits the current regulations of the 2013 Employment Law. The current regulations also aim to ensure fund balance.

The General Confederation of Labor believes that currently there is no regulation defining the unemployment insurance fund as a short-term fund. It is necessary to have a longer-term calculation for this fund, using the surplus to have a policy to support workers participating in unemployment insurance without becoming unemployed or when the unemployment situation is resolved, the unemployment insurance fund can become a social security fund, preventing risks for force majeure situations that affect employment.

The reservation combined with appropriate policies and incentives for those who have participated in social insurance for a long time will help limit policy exploitation and solve the problem of workers quitting their jobs many times...

What is the regime for people who pay social insurance but are never unemployed for life?

According to the Vietnam General Confederation of Labor, the regulation that does not allow for the retention of social insurance payment periods leads to the problem that there are workers who are never unemployed their entire lives but never receive benefits from the unemployment insurance fund. Although the level of contributions by workers to the unemployment insurance fund increases with their seniority.

Faced with this reality, the General Confederation of Labor proposed that it be possible to study regulations in the direction that relatives of workers who are not unemployed for life and who encounter employment risks will benefit from the unemployment insurance fund, or will receive a certain percentage of the amount contributed to the unemployment insurance fund upon retirement, or have a reward mechanism for those who have participated in unemployment insurance for a long time.

The above regulation will create positive thinking among workers about the continuity of unemployment benefits between generations.

Furthermore, maintaining and allowing employees to enjoy unemployment insurance for more than 144 months will help them feel secure in their work and stay with the company. Employees will no longer have to "reluctantly" become unemployed to enjoy unemployment insurance to reduce their losses, while the fund still ensures a stable source of income thanks to the fact that the longer these people work, the higher their contribution level will be.

In addition, people who have participated in social insurance for more than 144 months are often those who have stable jobs and may not even be unemployed throughout their lives.

Therefore, the General Confederation of Labor believes that regulating the fund in the direction of supporting relatives of workers when they face employment risks (possibly in the form of loans, vocational training support), or direct support when they retire, or a reward mechanism for those who have participated in unemployment insurance for a long time are reasonable and feasible benefits.

Minimum wage increase 2025

Changing the way pensions are calculated in the State sector from 2025

In which cases can one receive the maximum pension when retiring early?

Source: https://vietnamnet.vn/ca-doi-khong-that-nghiep-ve-huu-duoc-huong-them-tro-cap-2380512.html

![[Photo] Opening of the 44th session of the National Assembly Standing Committee](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/03a1687d4f584352a4b7aa6aa0f73792)

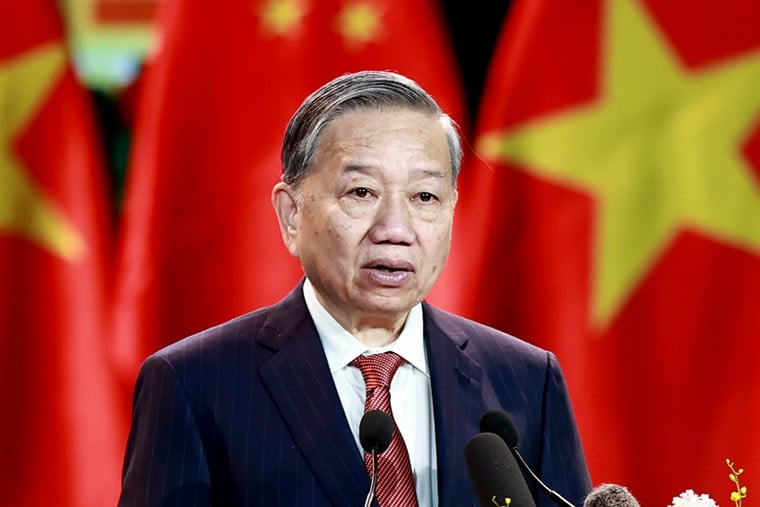

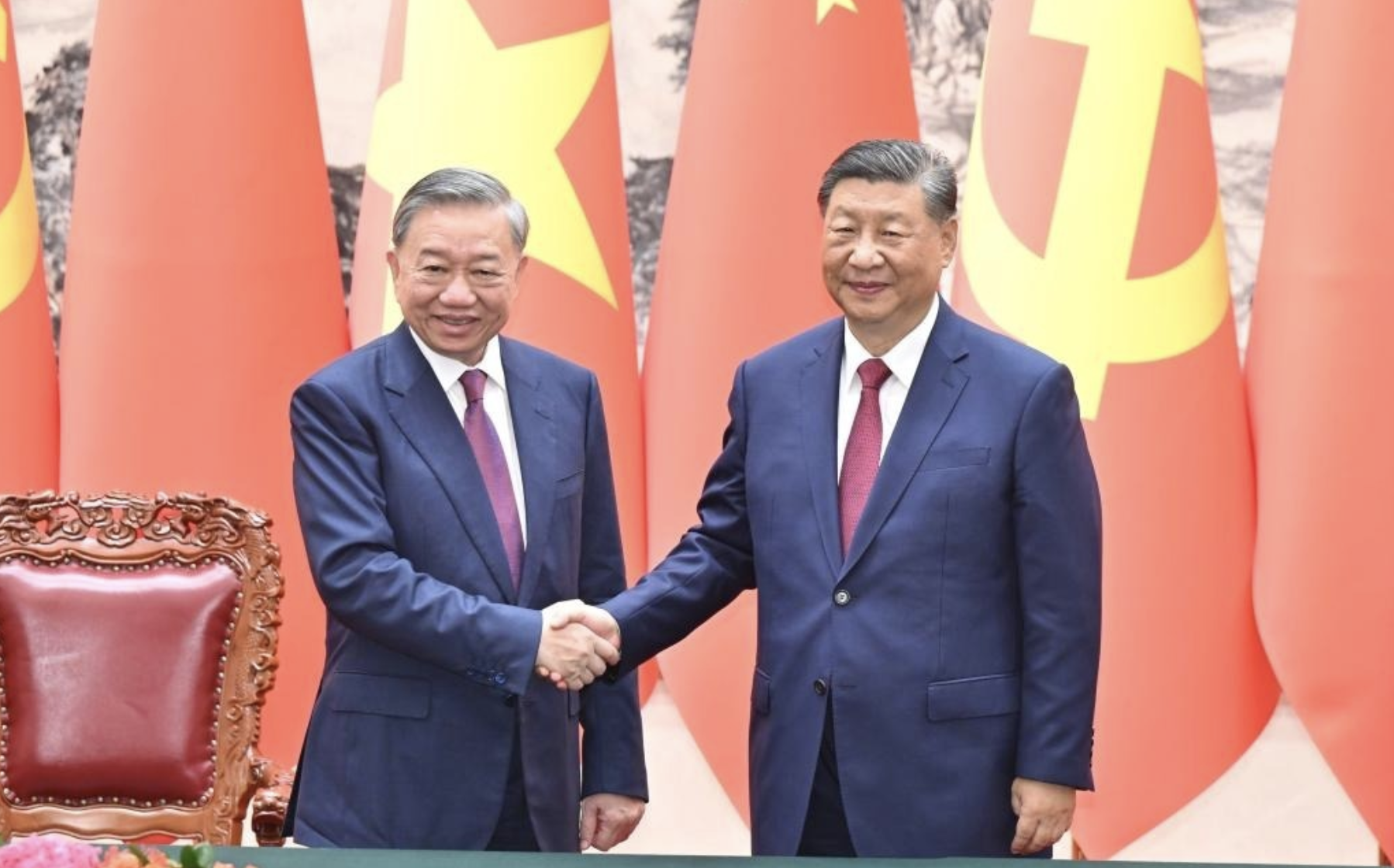

![[Photo] General Secretary To Lam chairs the third meeting to review the implementation of Resolution No. 18-NQ/TW](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/10f646e55e8e4f3b8c9ae2e35705481d)

![[Photo] Touching images recreated at the program "Resources for Victory"](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/99863147ad274f01a9b208519ebc0dd2)

Comment (0)