(CPV) - It is necessary to harmonize the interests between the State and enterprises, between domestic and foreign enterprises and between types of enterprises in using the Investment Support Fund; at the same time, there must be a mechanism to inspect and supervise the management and use of the Fund, to prevent policy exploitation...

This requirement was emphasized by the Standing Committee in the afternoon meeting on December 11 when giving opinions on the draft Decree regulating the establishment, management and use of the Investment Support Fund.

Perfecting and increasing the effectiveness of the policy system on investment incentives and support

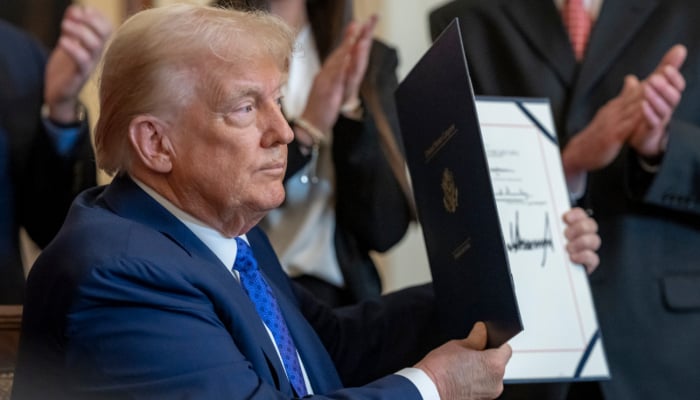

|

| Deputy Minister of Planning and Investment Nguyen Thi Bich Ngoc |

Deputy Minister of Planning and Investment Nguyen Thi Bich Ngoc stated that the development of the Government's Decree on the establishment, management and use of the Investment Support Fund has sufficient political, legal and practical basis. "The issuance of the Decree on the establishment, management and use of the Investment Support Fund is extremely necessary, in order to promptly concretize the orientations and policies of the Party and State on investment incentive policies; consolidate Vietnam's competitive position in the context of many changes in the international arena, fierce competition to attract investment among countries and perfect and increase the effectiveness of the policy system on investment incentives and support" - Deputy Minister Nguyen Thi Bich Ngoc emphasized.

The Draft Decree has 6 Chapters and 45 Articles, stipulating the legal status, legal entity, functions, tasks, powers and management structure of the Fund; organization and powers of the Fund Management Board; Chairman and members of the Fund Management Board; Fund management agency. Cost support (methods, items, subjects, criteria and conditions; cost support levels of items); and initial investment cost support (subjects, criteria, conditions and support levels)...

Reviewing the Draft Decree, Chairman of the Finance and Budget Committee Le Quang Manh said that the Standing Committee of the Committee agreed with the issuance of the Government's decree to ensure the implementation of the contents stipulated in the laws and resolutions of the National Assembly to deploy support policies and attract investment in the new context of implementing global minimum tax (GTM), maintaining the attractiveness of the investment environment in Vietnam, meeting practical requirements and in line with international practices.

The draft Decree stipulates that the subjects eligible for investment support are mainly multinational enterprises (subject to TTTC) in the high-tech sector, not including all enterprises affected by TTTC; at the same time, there are also enterprises that do not pay TTTC (for example, due to losses or not being subject to TTTC) that can still receive support from the Fund; domestic enterprises will find it difficult to meet the conditions and criteria to be able to receive support from the Fund.

Therefore, the Finance and Budget Committee recommends that the Government consider aiming for the Fund to also be used to encourage investment in domestic enterprises and other investment-encouraging sectors according to Resolution 110/2023/QH15; at the same time, it is necessary to pay attention to ensuring the settlement of complaints about investment guarantees of foreign-invested enterprises that must pay additional corporate income tax but do not receive support from the Fund.

Ensure transparency in support levels and targets

Agreeing with the viewpoint of the examining agency, Vice Chairman of the National Assembly Nguyen Khac Dinh emphasized that the goal of issuing the Investment Support Fund is to support all economic sectors, both foreign and domestic enterprises if they meet the criteria. Accordingly, the Vice Chairman of the National Assembly suggested reviewing how many enterprises and how many industries would be supported when this Decree is issued.

“If we do not calculate specifically, when issuing a decree to review and not see any businesses, it will not be successful. I want those mechanisms and policies to be applied immediately in practice” - the Vice Chairman of the National Assembly expressed his opinion.

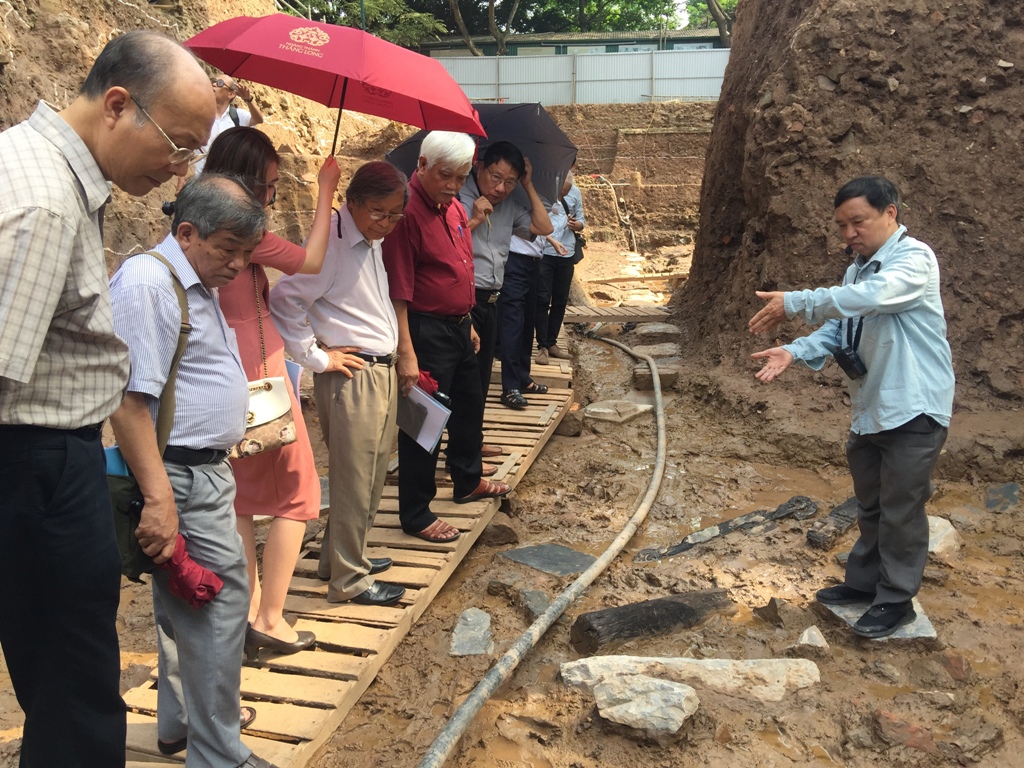

|

| Vice Chairman of the National Assembly Nguyen Khac Dinh speaks |

Chairman of the Law Committee Hoang Thanh Tung analyzed that according to the spirit of the Draft Decree, it mainly supports enterprises in the high-tech sector. This is completely correct because this is the sector we want to attract.

However, looking back at the current subjects paying TTTC tax according to the provisions of Resolution 107/2023/QH15 of the National Assembly, many large-scale enterprises investing in Vietnam, but not operating in the high-tech sector, do not fall within the scope of support under the provisions of this Decree. "There must be relative harmony to avoid the situation where, when applying the Decree, the support falls on a certain group of enterprises of a certain country investing in Vietnam; thus, it will invisibly lead to comparisons, negatively impacting the competitiveness and attractiveness of Vietnam's investment environment" - Chairman Hoang Thanh Tung said and emphasized that there must be fair treatment for investors, especially for countries with large investments in Vietnam.

Approving the Government's development of the Decree to create a favorable investment environment, attract and encourage all types of enterprises and economic sectors to contribute to the country's socio-economic development, National Assembly Chairman Tran Thanh Man suggested reviewing the content of the Draft Decree to ensure compliance with current legal regulations. At the same time, it is necessary to compare it with international treaties and commitments that Vietnam has signed to avoid legal conflicts, especially regulations on TTTC tax.

The National Assembly Chairman also emphasized that it is necessary to define the purpose of using the Fund to ensure harmony and fairness between foreign and domestic enterprises; ensure transparency in the level of support and the subjects of support. "The draft Decree provides many forms of support with different rates, some support amounts are regulated at maximum levels. Therefore, it is necessary to consider stipulating principles and criteria for determining the level of support for enterprises, avoiding the emergence of a mechanism of asking and giving, leading to complaints" - the National Assembly Chairman noted.

In addition, the National Assembly Chairman proposed to strengthen the inspection and supervision of the management and use of the Fund. The management and support of the Fund for enterprises must be strictly ensured, avoiding imbalance between the Fund's ability to respond and the total amount of support needed; studying the evaluation process to support costs to ensure transparency and objectivity.

Concluding the session, Vice Chairman of the National Assembly Nguyen Duc Hai requested the Government to study and absorb opinions, continue to review to ensure that the Decree meets the requirements in accordance with the regulations on TTTC tax; harmonize the interests between the State, enterprises, between domestic and foreign enterprises and between types of foreign enterprises in different countries. Along with that, ensure that the benefits obtained must be commensurate, greater than the costs incurred, ensuring budget balance and national financial security./.

Source: https://dangcongsan.vn/thoi-su/bao-dam-hai-hoa-cong-bang-trong-ho-tro-doanh-nghiep-dau-tu-686330.html

Comment (0)