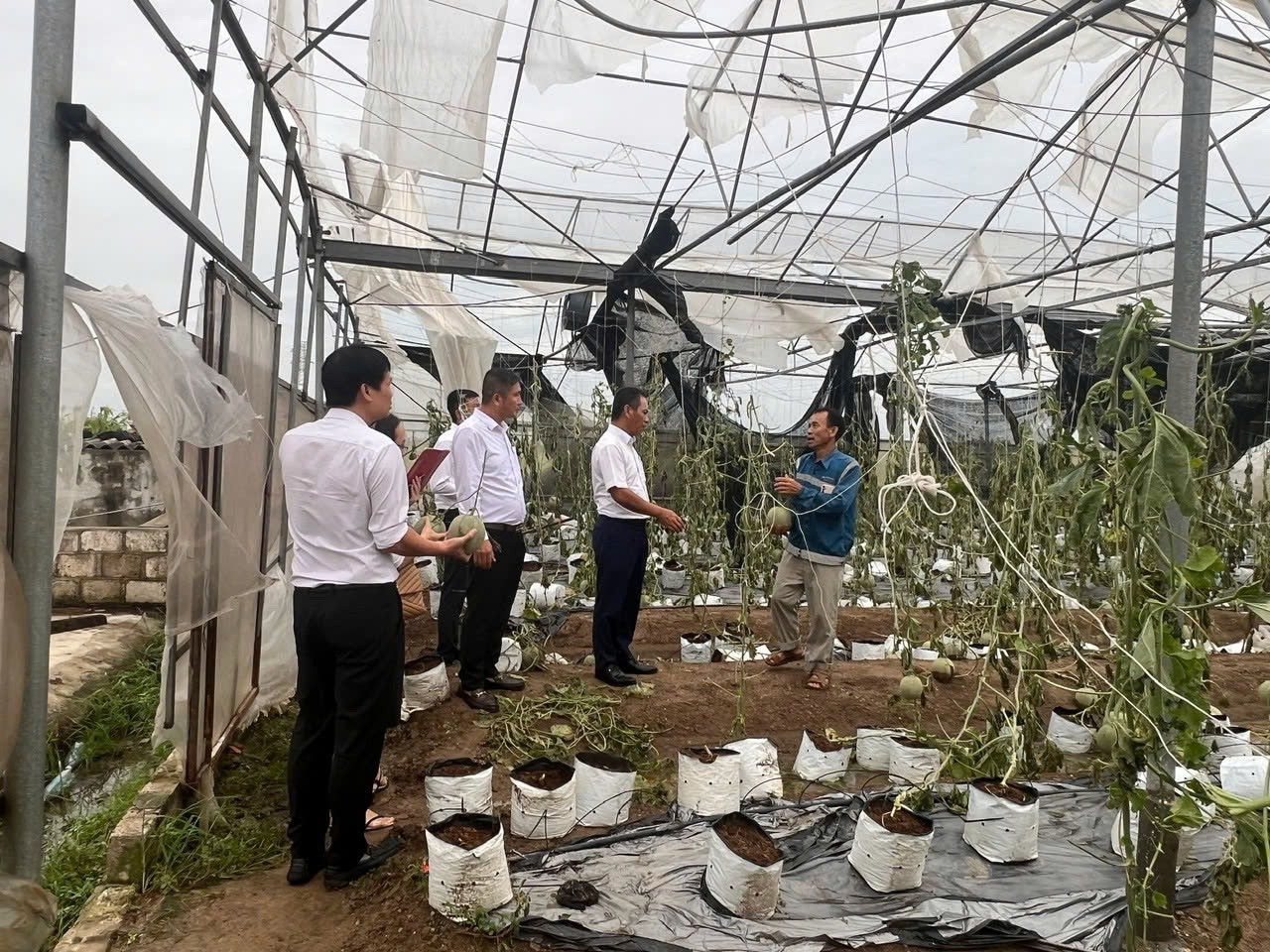

Beneficiaries of preferential policies are individual customers who suffered damage due to storm No. 3 and post-storm floods in 26 provinces and cities (Quang Ninh, Hai Phong, Thai Binh, Nam Dinh, Hoa Binh, Lao Cai, Yen Bai, Son La, Lai Chau, Dien Bien, Ha Giang, Cao Bang, Bac Kan, Thai Nguyen, Tuyen Quang, Phu Tho, Vinh Phuc, Lang Son, Bac Giang, Bac Ninh, Hai Duong, Hanoi, Hung Yen, Ha Nam, Ninh Binh, Thanh Hoa) who need to borrow capital to implement projects and plans for planting and raising livestock.

The program applies to disbursements arising from October 7 to December 31, 2024. Customers can borrow capital one time, borrow capital according to the limit, borrow capital according to the small scale limit and borrow capital according to the overdraft limit.

Previously, for existing outstanding loans as of September 6, 2024, based on the level of damage to customers, Agribank reduced the loan interest rate by 0.5 - 2%/year and exempted 100% of overdue interest and late payment interest during the period from September 6 to December 31, 2024. In addition, to support customers to stabilize their lives and restore production and business activities, for new loans arising from September 6 to December 31, 2024, Agribank reduced the loan interest rate by 0.5%/year for each subject and field, applied for a maximum period of 6 months from the date of disbursement.

In addition to credit and interest rate policies, up to now, Agribank has donated more than 18.5 billion VND to support overcoming the consequences of storm No. 3. Agribank staff and employees donated 1 day's salary, estimated at over 20 billion VND to share with people affected by storms and floods.

Dinh Son

Source: https://vietnamnet.vn/agribank-uu-dai-lai-vay-doi-voi-khach-hang-bi-thiet-hai-do-bao-lu-2332906.html

Comment (0)