Mr Trump has called for a digital tax investigation to be revived and has threatened to impose retaliatory tariffs on countries that tax US companies.

Mr. Trump speaks at the White House on February 21 - Photo: REUTERS

Reuters reported on February 22 that US President Donald Trump recently asked his trade representative to restore investigations, with the determination to impose import tariffs on countries that impose digital taxes on US technology companies.

A digital services tax is a tax levied on revenue from digital services such as online advertising, sale of user data, or digital platform services.

US responds to digital tax

The 78-year-old president has asked his administration to consider retaliatory measures, such as tariffs, to counter digital services taxes (DSTs), fines, and policies imposed by foreign governments on American companies, according to a White House official.

"President Trump will not allow other countries to hijack Washington's tax revenues for their own benefit," the person said.

The memo asks the US Trade Representative (USTR) to revive investigations into digital services taxes that were launched during Mr Trump's first term, and to investigate additional countries that use the tax to "discriminate against US companies".

For a long time, the issue of digital taxation on Washington's large technology corporations such as Google, Meta, Apple and Amazon has caused controversy in trade between the US and many countries around the world.

Currently, the UK, France, Italy, Spain, Turkey, India, Austria and Canada have levied taxes on the revenues of digital service providers, including US companies, operating within their territories.

During Trump’s first term, the USTR launched a Section 301 investigation into unfair trade practices and found that some of those countries had discriminated against American companies, setting the stage for Washington to impose retaliatory tariffs on some imports to pressure them to change their digital tax policies.

“What they do to us digitally is terrible,” Mr. Trump told reporters as he signed the memorandum.

In addition, Mr. Trump also asked the US administration to review whether the policies of the European Union (EU) or the UK "encourage US companies to develop or use technology in ways that undermine free speech or promote censorship."

The White House said it would specifically look at how US companies are treated under the EU's Digital Markets Act and Digital Services Act.

Major US technology corporations such as Google, Meta, and Amazon are the targets of many countries when imposing digital taxes on Washington - Photo: REUTERS

Difficulty in global tax negotiations

After the Trump administration launched investigations into digital taxes, former President Joe Biden’s trade representative Katherine Tai announced 25% tariffs on more than $2 billion in imports from six countries in 2021, but soon suspended them to continue negotiations on a global tax deal.

Those talks resulted in a proposal for a 15% global minimum corporate tax, which has yet to be passed by the US Congress. Discussions on an alternative mechanism for digital taxation have largely stalled and no agreement has been reached.

On his first day back in the White House, Mr. Trump announced that the US would withdraw from a global tax agreement with nearly 140 countries, asserting that the 15% minimum tax rate "has no effect in the United States" and asking the Treasury Department to prepare measures to protect US interests.

Mr. Trump did not disclose the specific retaliatory tariffs that would apply, nor the value of the goods affected.

Overall, the White House chief's decision not only strains trade relations between the US and its European allies, but also complicates the global digital policy landscape.

If retaliatory tariffs are imposed, trade tensions could escalate, hitting US tech companies as well as the global economy hard.

Source: https://tuoitre.vn/ong-trump-khoi-lai-thue-ky-thuat-so-san-sang-ap-thue-tra-dua-20250222103332166.htm

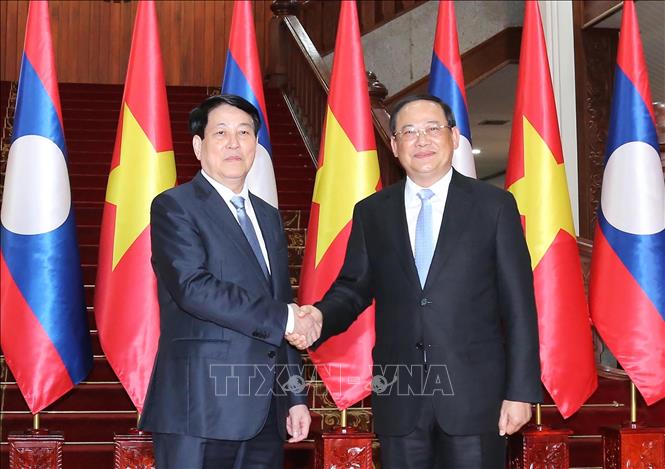

![[Photo] President Luong Cuong meets with Lao Prime Minister Sonexay Siphandone](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/25/3d70fe28a71c4031b03cd141cb1ed3b1)

![[Photo] Ho Chi Minh City welcomes a sudden increase in tourists](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/25/dd8c289579e64fccb12c1a50b1f59971)

![[Photo] Liberation of Truong Sa archipelago - A strategic feat in liberating the South and unifying the country](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/25/d5d3f0607a6a4156807161f0f7f92362)

Comment (0)