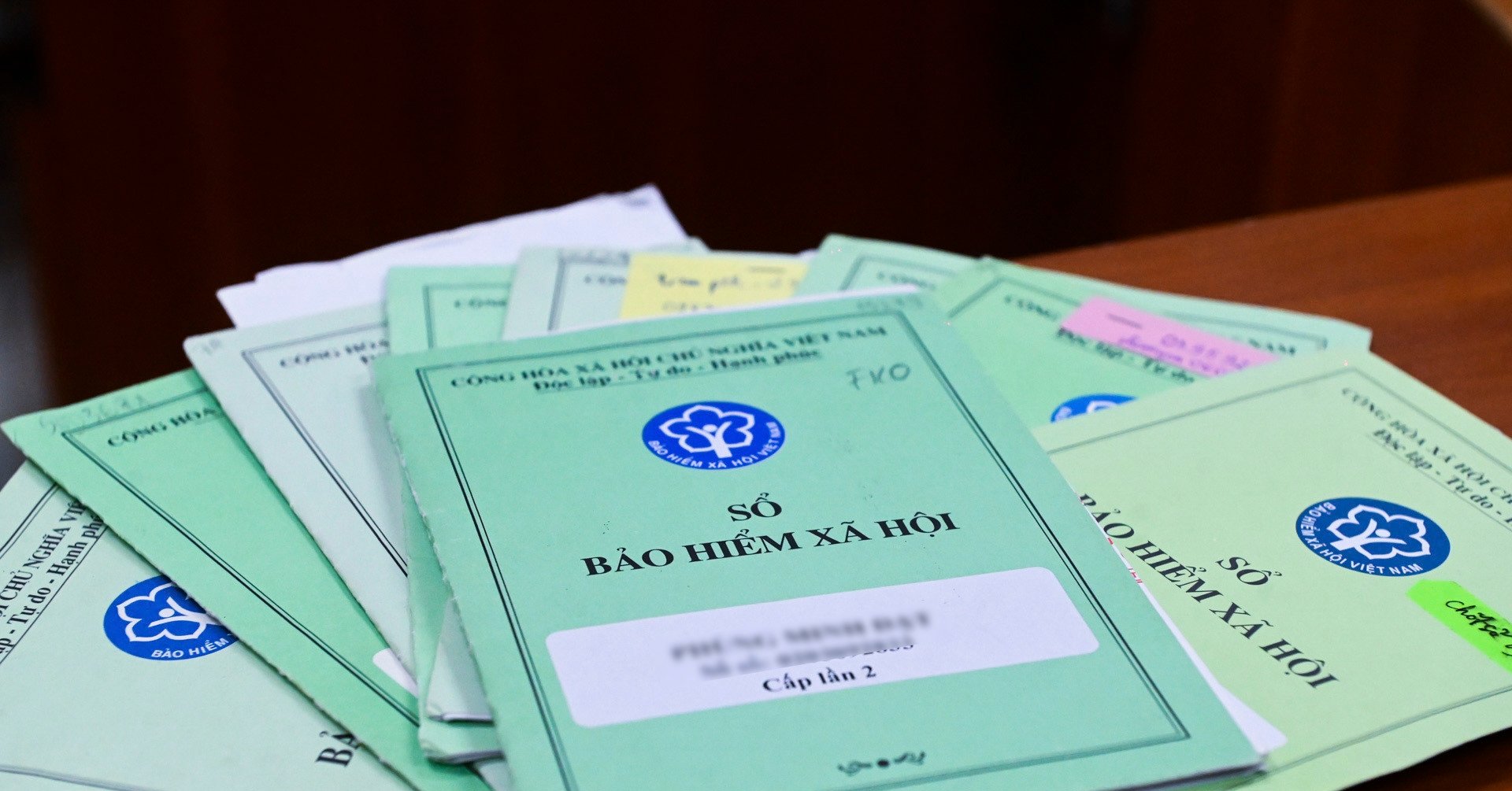

According to the Ho Chi Minh City Social Insurance (HSI), in 2024 there will be many changes in pension, social insurance, and health insurance policies towards increasing the benefits of beneficiaries. Specifically:

1. Increase retirement age, change pension conditions

According to the provisions of the 2019 Labor Code, from January 1, the retirement age for male workers under normal conditions is 61 years old, and for female workers is 56 years and 4 months old (compared to 2023, the retirement age for men is 60 years and 9 months old and for women is 56).

Employees participating in compulsory social insurance will receive pension when they have paid social insurance for 20 years or more and reach the adjusted retirement age.

For female workers retiring in 2024, the monthly pension rate is calculated at 45% corresponding to 15 years of social insurance contributions, then for each additional year of social insurance contributions, an additional 2% is calculated; the maximum benefit is equal to 75% of the average monthly salary for social insurance contributions.

For male workers retiring in 2024, the monthly pension rate is calculated at 45% corresponding to 20 years of social insurance contributions, then for each additional year of social insurance contributions, an additional 2% is calculated; the maximum benefit is equal to 75% of the average monthly salary for social insurance contributions.

Schedule for payment of pensions and social insurance benefits during Lunar New Year: Combined January and February

2. Increase pensions and social insurance benefits

On November 10, 2023, the National Assembly passed Resolution 104 on the state budget estimate for 2024.

Accordingly, from July 1, 2024, comprehensive reform of salary policy will be implemented according to Resolution 27/2018 of the 7th Conference of the 12th Central Executive Committee, adjusting pensions, social insurance benefits, monthly allowances, preferential allowances for meritorious people and a number of social security policies currently linked to the basic salary.

However, to determine how much the pension will increase in 2024, we are waiting for detailed regulations from the Government.

The Department of Labor, Invalids and Social Affairs informed that it will try to advise that the pension increase be at least 15% compared to the salary increase of 23.5% for civil servants and public employees; advise to raise the standard social allowance from 360,000 VND/month to 500,000 VND/month or 750,000 VND/month (this amount will be multiplied by a coefficient of 1 - 3, depending on the case according to regulations).

Calculations show that if the social allowance standard is raised to 750,000 VND, the elderly without pension and belonging to poor households will receive a subsidy = 750,000 VND x 3 = 2,250,000 VND/month; the elderly without pension or monthly social insurance allowance will receive 750,000 VND/month.

In 2024, especially when the basic salary is abolished (from July 1), pension and social insurance policies will have many breakthrough changes (NHAT THINH)

In 2024, especially when the basic salary is abolished (from July 1), pension and social insurance policies will have many breakthrough changes (NHAT THINH)

3. Changes in the calculation of minimum pension and some benefits

Current regulations, according to Clause 5, Article 56 of the 2014 Social Insurance Law, the lowest pension level when participating in compulsory social insurance is equal to the basic salary.

From January 1 to June 30, 2024, the basic salary will continue to be applied at 1.8 million VND/month and the salary will be calculated by the coefficient x basic salary. Therefore, the lowest pension level is 1.8 million VND/month.

From July 1, the basic salary will be abolished and replaced by a new salary regime according to Resolution 27. Therefore, there will be a new mechanism for determining pension levels. The Government will have a document specifying or guiding how to determine the lowest pension level.

In addition, with the draft revised Social Insurance Law expected to be passed in 2024, there will be adjustments to social insurance benefits such as childbirth allowance, postpartum recovery, post-sickness recovery, and monthly death benefits.

According to the 2014 Social Insurance Law, social insurance benefits are calculated based on the basic salary. For example, one-time benefits when giving birth, post-natal care benefits, post-sickness care benefits, funeral benefits, monthly death benefits.

Therefore, when there is no longer a salary coefficient and a basic salary, these allowances will also change. Currently, the Government is proposing allowances attached to the basic salary equal to the current highest level and specified in specific amounts, such as allowances for postpartum recovery and illness of 540,000 VND/day; one-time allowance for childbirth of 3.6 million VND/child.

Officially submit to the Government the plan to increase regional minimum wage from July 1

4. Change the social insurance price index coefficient

The social insurance price index will be implemented according to Circular 01 of 2023 of the Ministry of Labor, Invalids and Social Affairs. The change in the social insurance price index from 2023 to 2024, although not specifically announced, if it increases, will lead to a corresponding increase in regimes such as one-time social insurance, monthly pension, one-time retirement allowance and one-time death benefit.

5. Change in health insurance contribution level

Currently, the family health insurance contribution rate is as follows: the first person in the household will pay 4.5% of the basic salary; the second, third, and fourth persons will pay 70%, 60%, and 50% of the first person's contribution rate, respectively; from the fifth person onwards, the contribution rate is 40% of the first person's contribution rate.

For students, the monthly health insurance contribution is 4.5% of the basic salary, of which the budget supports 30%.

However, from July 1, 2024, the basic salary will be abolished, which will lead to a review and new guidance on health insurance contribution and benefits.

In addition, if previously the cost of medical examination and treatment was less than 15% of the basic salary (about 270,000 VND), it would be 100% covered by health insurance. However, from July 1, this cost will change and there will be specific instructions./.

According to thanhnien.vn

Source: https://thanhnien.vn/5-thay-doi-ve-chinh-sach-luong-huu-bao-hiem-xa-hoi-nam-2024-185240218214020534.htm

Source

![[Photo] Close-up of Vietnam's sniffer dog team searching for earthquake victims in Myanmar](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/d4949a0510ba40af93a15359b5450df2)

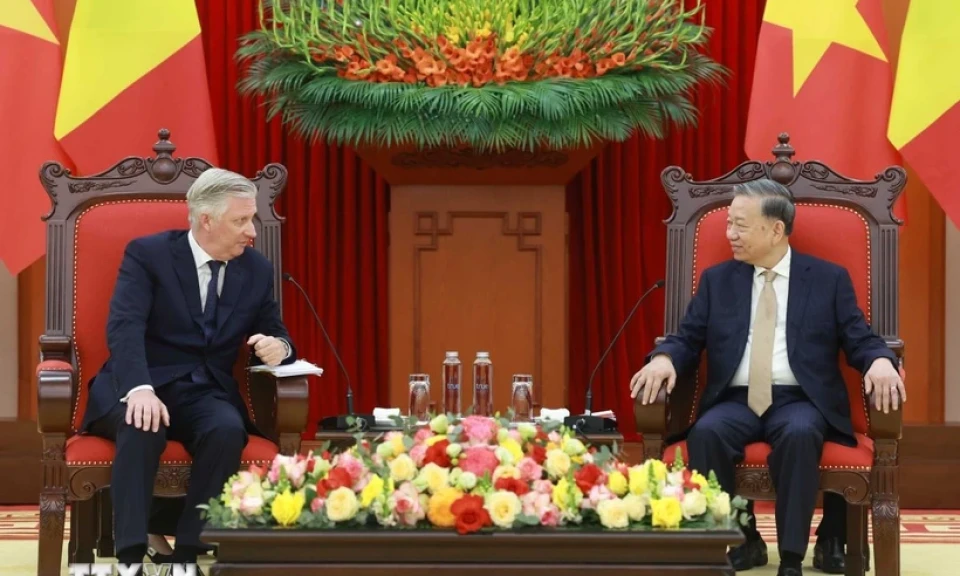

![[Photo] General Secretary To Lam receives King Philippe of Belgium](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/e5963137a0c9428dabb93bdb34b86d7c)

![[Photo] President Luong Cuong and King Philippe of Belgium visit Thang Long Imperial Citadel](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/cb080a6652f84a1291edc3d2ee50f631)

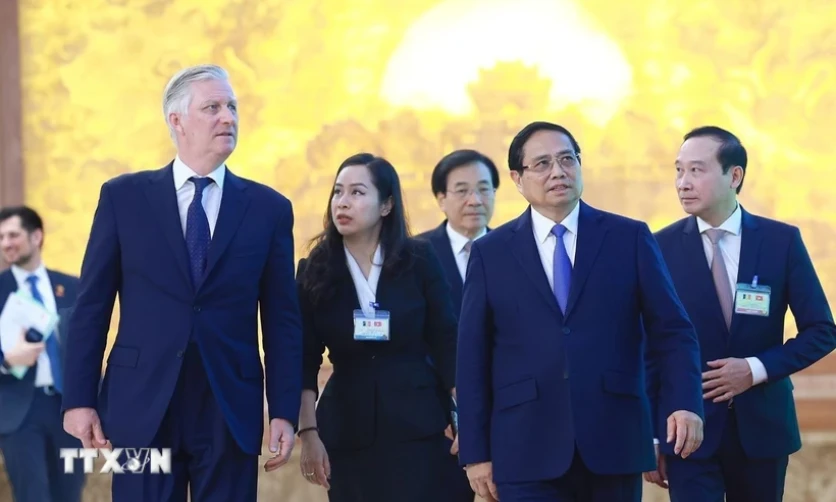

![[Photo] Prime Minister Pham Minh Chinh meets with King Philippe of Belgium](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/be2f9ad3b17843b9b8f8dee6f2d227e7)

![[6pm News] Of the 40 newly discovered gold mines, 4 are in Thanh Hoa](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/08644991aa1b4030a549159f2f87c0d6)

![[Photo] Myanmar's capital in disarray after the great earthquake](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/7719e43b61ba40f3ac17f5c3c1f03720)

Comment (0)