Pursuant to the Law on Tax Administration No. 38/2019/QH14 dated June 13, 2019 of the National Assembly; Pursuant to the Penal Code No. 100/2015/QH13 dated November 27, 2015 of the National Assembly; Pursuant to Decree No. 125/2020/ND-CP dated October 19, 2020 of the Government;

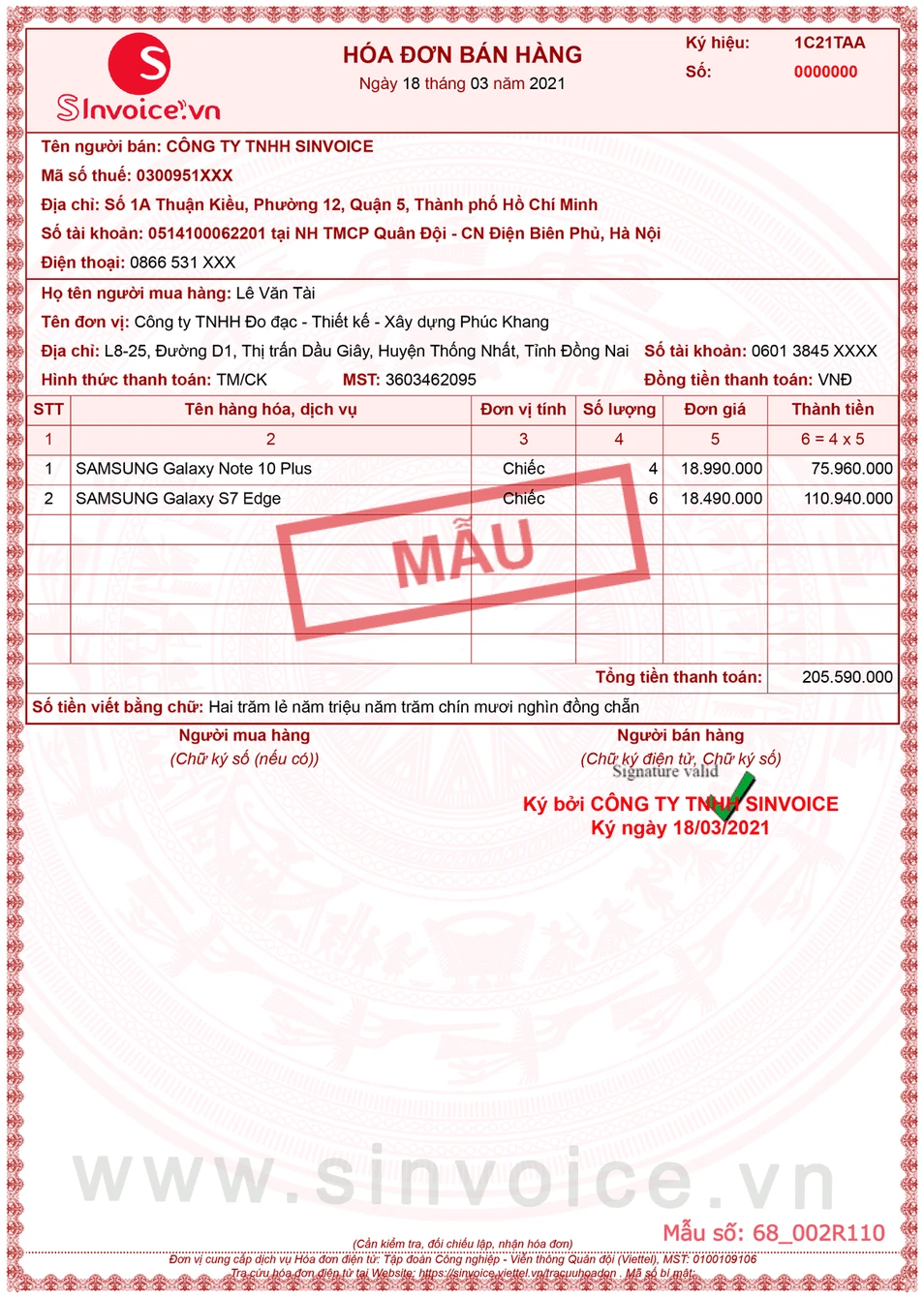

Accordingly, Decree No. 125/2020/ND-CP has devoted 1 chapter (from Article 20 to Article 31) to regulate administrative violations regarding invoices, penalties and remedial measures.

Depending on the circumstances, violations of using illegal invoices or using illegal invoices will be punished according to the act of false declaration leading to a shortage of tax payable or an increase in the amount of tax exempted, reduced, or refunded; or punished for tax evasion; or a fine from VND 20,000,000 to VND 50,000,000 according to regulations.

And the tax authority will transfer the case file of violations with signs of crime to prosecute criminal liability for tax evasion acts with an amount of VND 100 million or more or less than VND 100 million, having been administratively sanctioned for tax evasion or having been convicted of this crime or of one of the crimes specified in a number of articles of the Penal Code, not having had the criminal record cleared but still committing the violation.

Source

![[Photo] Prime Minister Pham Minh Chinh receives Deputy Prime Minister of the Republic of Belarus Anatoly Sivak](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/2/79cdb685820a45868602e2fa576977a0)

![[Photo] General Secretary To Lam receives Russian Ambassador to Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/2/b486192404d54058b15165174ea36c4e)

![[Photo] Prime Minister Pham Minh Chinh receives CEO of Standard Chartered Group](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/2/125507ba412d4ebfb091fa7ddb936b3b)

![[Podcast] News on March 27, 2025](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/2/de589137cda7441eb0e41ee218b477e8)

Comment (0)