Cooling down exchange rate pressure allows the State Bank to be more flexible in operating monetary policy, thereby giving the operator more policy space to support market liquidity through the open market channel as well as conditions to supplement foreign exchange reserves by the end of this year.

List of promising stocks in August, banks lead the way

|

|

| Cooling down exchange rate pressure allows the State Bank to be more flexible in managing monetary policy. |

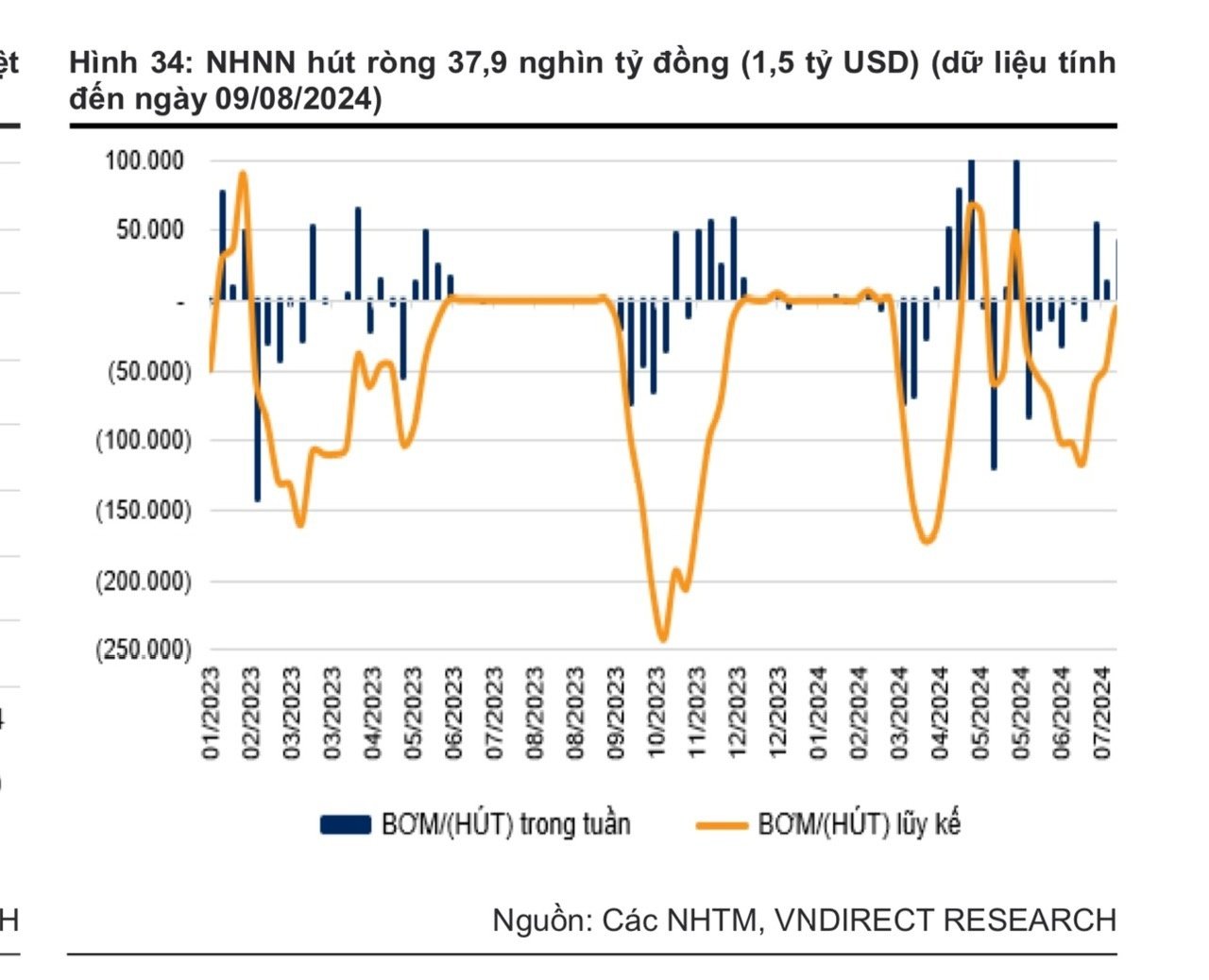

In the macro report, experts from VNDirect assessed that the State Bank of Vietnam had a notable shift in monetary policy in early August after reducing both OMO interest rates and treasury bill interest rates to 4.25%/year from the previous 4.5%.

This rate cut reversed the trend of rate hikes in the first half of 2024, when both the OMO rate and the treasury bill rate were raised to 4.5% from 4.0% and 3.9%, respectively, at the beginning of the year.

VNDirect said that this move took place in the context of cooling exchange rate pressure, allowing the SBV to be more flexible in operating monetary policy. Accordingly, the operator will have more policy space to support market liquidity through the open market channel as well as conditions to supplement foreign exchange reserves at the end of this year.

The US Dollar Index (DXY) saw a sharp decline in July and early August as US economic data was weaker than expected, with CPI inching up 0.2% in July 2024 compared to a 0.1% decline in June 2024, in line with forecasts, and rising 2.9% year-on-year.

Meanwhile, the core personal consumption expenditures (PCE) price index, the Fed's preferred inflation gauge, rose just 0.1% month-over-month and 3.3% year-over-year.

Notably, non-farm payrolls growth in the US fell to just 114,000 in July 2024 compared to the revised 179,000 in June 2024 and the forecast of 185,000; the unemployment rate rose to 4.3%, reaching its highest level since October 2021.

After the release of the dismal jobs data, the DXY index fell below 103 before recovering slightly, while market expectations for a 25 basis point Fed rate cut by September 2024 fell to 26.5% from over 90% previously as expectations for a further 50 basis point cut jumped to 73.5% on August 5.

The recent sharp decline in the DXY index has not only helped cool down the USD/VND exchange rate but also supported the exchange rates of other currencies in the region. Since the beginning of the year, while the VND has depreciated by 3.4% against the USD, the Chinese Yuan (-0.7% YTD), Indonesian Rupiah (-3.5% YTD), Malaysian Ringgit (+3.9% YTD) and Thai Baht (-2.9% YTD) have depreciated.

While the SBV had to sell about $6 billion in foreign exchange reserves to curb the exchange rate increase in the first half of 2024, pressure from the foreign exchange market has decreased significantly since then, mainly due to the weakening of the DXY index and the gradual narrowing of the gold price gap after SBV's interventions.

Therefore, in early August, the State Bank of Vietnam made a move to reduce OMO interest rates and treasury bills. In general, VNDirect forecasts that the exchange rate will maintain a cooling trend towards the end of the year with the expectation that the Fed will start cutting interest rates from September, thereby causing the USD to continue to weaken, Vietnam will continue to record a high trade surplus of 14.5 billion USD in the first 7 months of 2024, abundant realized FDI capital increased by 8.4% over the same period and expectations of strong remittance flows in the fourth quarter.

|

With current favorable developments, VNDirect forecasts that the interbank USD/VND exchange rate will fall below 25,000 VND sooner in a positive scenario.

As of August 9, the average 12-month deposit interest rate of commercial banks increased to 4.96%/year, up 0.05 percentage points since the beginning of the month and +0.02 percentage points since the beginning of the year. While deposit interest rates increased moderately in July due to credit growth compared to the beginning of the year at only 5.66%, the deposit interest rate growth rate since the beginning of the month has increased by 0.05 percentage points, causing the current 12-month deposit interest rate to exceed 0.02 percentage points compared to the end of 2023.

In addition, while credit grew by 5.66% as of end-July, down 0.34 percentage points from 6.0% in 1H2024, credit improved from just 5.3% as of July 17 (-0.7 percentage points from 6.0% in 1H2024). This suggests that credit growth has recovered since mid-July, so deposit interest rates continued to increase moderately in July.

VNDirect experts expect the rate of increase in deposit interest rates to gradually decrease towards the end of the year, and will be mainly driven by the outlook for credit growth. Therefore, the forecast for the average 12-month deposit interest rate will increase to 5.2-5.3% by the end of this year, lower than the forecast of 5.3-5.5% in the previous mid-year strategy report. The change is based on the possibility that the Fed will cut interest rates more than previously expected. This means that the SBV will have more room to operate monetary policy more flexibly.

Source: https://thoibaonganhang.vn/vndirect-ty-gia-va-lam-phat-ha-nhet-mo-duong-cho-chinh-sach-tien-te-linh-hoat-hon-154974.html

![[Infographic] Import and export in the first half of February 2025 decreased by 7.9%](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/2/20/27c0060d06c84c17a06f2db0aaac5a89)

Comment (0)