► Some stocks to watch on December 9

The bullish trend is back.

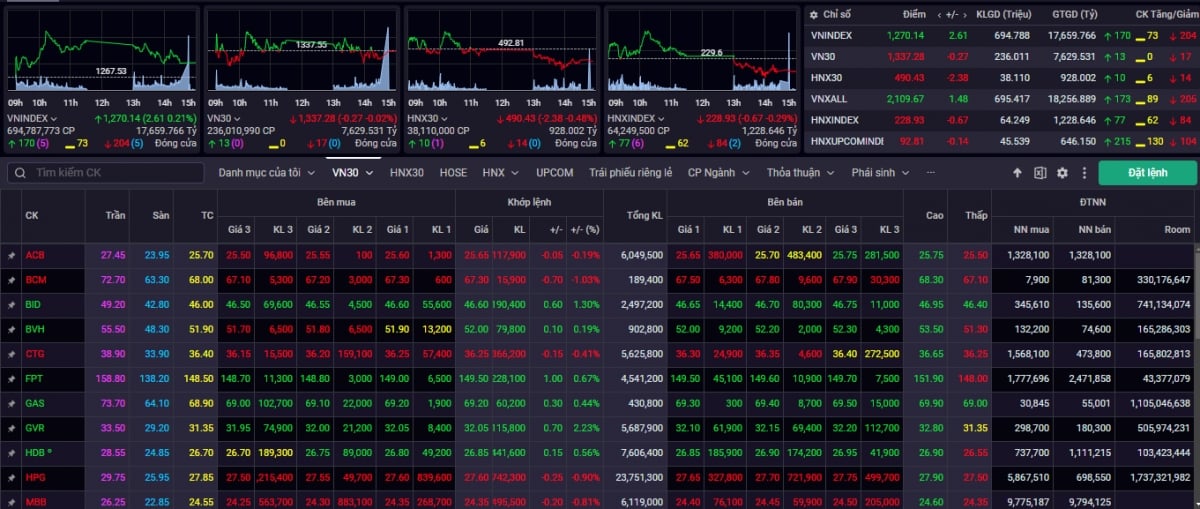

The first trading week of December witnessed a major turning point in the trend when the market had an explosive session following the official momentum to confirm the bottom at the 1,200-point zone. The VN-Index started the month relatively slowly with the first two sessions of the week struggling sideways around the reference level. The peak of disappointment was pushed up in the session on December 4 when the index suddenly plummeted in the afternoon session to close to 1,240 points. Surprises are always the great "spice" of the stock market. Contrary to the skepticism of most investors, the market exploded strongly in both price and volume immediately after that. The above increasing session was also the most explosive session in the past 4 months, surpassing the MA200-day threshold. The increase slowed down somewhat in the last session of the week but still managed to bring the market to the 1,270-point mark. Closing the trading week from December 2 to December 6, the VN-Index closed at 1,270.14 points, up 19.68 points (+1.57%), completely regaining what was lost in the previous month.

Order matching liquidity had an explosive trading week, equivalent to the average level of 20 order matching weeks. Accumulated to the end of the trading week, the average trading liquidity on the HSX floor reached 628 million shares (+35.75%), equivalent to VND 16,027 billion (+31.06%) in trading value.

Green had an overwhelming week on the market opening with 19/21 industry groups gaining points. Leading the market's boom last week were industry groups such as: Insurance (+5.38%), Chemicals (+4.85%), Securities (+4.22%), Plastics (+4.04%),... On the contrary, selling pressure still overshadowed some industry groups such as: Consumer goods (-4.01%), Aviation (-2.94%).

According to experts from Kien Thiet Securities Company (CSI), the green color was maintained in the last trading session of the week despite the significant increase in selling pressure, forcing the VN-Index to narrow its increase towards the end of the session. The liquidity of the last trading session on December 6 decreased compared to the explosive session on December 5, but in terms of matched volume, it was still higher (+14.23%) than the average of 20 sessions, so the positive signal was still maintained. On the weekly chart, the VN-Index had its third consecutive week of increase with matched volume increasing compared to the previous two weeks. Moreover, last week there was a momentum-driven explosive session, surpassing the long-term moving average MA200, thereby confirming the previous bottom of 1,200 points of the VN-Index, showing that the optimistic trend has returned.

“Investors should hold their portfolios and continue to open buying positions for the next sessions. There is a high possibility that the VN-Index will have a session to retest the MA200 average line, equivalent to the 1,260 point mark. At this level, we can open positions and increase the proportion of stocks. Prioritize large-cap and market-sensitive stocks such as: Banks, Securities, Real Estate, Steel…”, CSI experts expressed their opinions.

VN-Index may retest the 1,267 point level

According to the analysis team of ASEAN Securities Company (ASEANSC), the market moved narrowly above the reference range when the excitement from the spike gradually returned to caution and wait. The positive point in the session was that the index maintained its green color along with the cash flow remaining at a high level, showing good absorption capacity of demand. The market tends to continue consolidating the price range above 1,266 points to reduce short-term momentum and re-accumulate on the upward trend towards the old peak. On the macro side, Vietnam received a lot of good news about the economic situation in November when the service component recorded good growth with the recovery of domestic consumption and international tourists, while industrial production continued to increase by nearly 9% despite a slight decrease in exports, showing that domestic output is improving significantly. In addition, inflation remained low at 2.8%, paving the way for the Government's economic stimulus measures in the coming period.

“The market will continue to recover well in the coming time. Investors can consider increasing disbursement when long-term investment stocks are at attractive valuations, focusing on businesses with positive fundamentals and business prospects, and increasing the proportion when the market shows clear signs of growth accompanied by confirmation of trading volume. In addition, investors should continue to monitor the developments of DXY, world markets and domestic exchange rates to manage short-term risks,” said ASEANSC experts.

Meanwhile, experts from Yuanta Vietnam Securities Company (YSVN) believe that the market may experience a correction and the VN-Index may retest the 1,267-point level in the first trading session of the week, December 9. At the same time, the market is still in a period of strong fluctuations in a positive direction, so the correction may quickly end during the session. In addition, the short-term sentiment indicator continues to increase strongly, showing that investors have shifted to a more optimistic state with the current market developments.

“The short-term trend of the general market remains at an upward level. Therefore, investors can continue to take advantage of the correction to increase the proportion of stocks to a high level and make new purchases. The price chart of the VN-Index has surpassed the 20-week moving average and the market is showing signs of entering a period of strong fluctuations in a positive direction, especially positive developments concentrated in large-cap stocks. In addition, the medium-term trend of the general market remains neutral. Therefore, investors can continue to hold a balanced proportion of stocks and prioritize holding large-cap stocks,” YSVN experts recommended.

Source: https://vov.vn/thi-truong/chung-khoan/nhan-dinh-chung-khoan-912-vn-index-co-the-kiem-dinh-lai-muc-1267-diem-post1140710.vov

![[Photo] Prime Minister Pham Minh Chinh receives Mr. Jefferey Perlman, CEO of Warburg Pincus Group (USA)](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/18/c37781eeb50342f09d8fe6841db2426c)

![[UPDATE] April 30th parade rehearsal on Le Duan street in front of Independence Palace](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/18/8f2604c6bc5648d4b918bd6867d08396)

Comment (0)