Banks have to pay higher costs when issuing bonds, but this channel helps them balance the mobilization ratio and capital safety.

In the first half of this year, the volume of new bonds issued reached VND202,400 billion, of which 70% were issued by the banking sector, according to VIS Rating. In July, banks issued an additional VND27,000 billion, according to data from FiinRatings - a credit rating company under FiinGroup. This level accounted for 87% of the total market value, more than double compared to the same period last year.

BVBank offered 15 million bonds to the public with an interest rate of 7.9% per year. From the second year, the interest rate will be equal to the reference interest rate plus a margin of 2.5%. Similarly, at the end of August, HDBank also issued 1,000 billion VND in bonds with an interest rate 2.8% higher than the average 12-month deposit rate of banks at the time of payment.

A series of other banks such as BIDV, VPBank, MB, BIDV, ACB, OCB... also have many separate bond issuances - exclusively for professional securities investors - with interest rates about 1-1.5% higher than deposits.

In fact, the main activity of banks is "money trading", that is, they mobilize capital and lend it out. This operating profit is determined by the difference between the cost of capital and the interest on loans. To increase business efficiency, banks often aim to reduce the cost of capital, instead of increasing lending interest rates.

Compared to the current 12-month deposit interest rate of 5.5 to 6% per year, bonds have a more expensive capital cost, but banks have still sought this mobilization channel in recent times. Ms. Le Phuong Uyen - VPBankS banking analyst explained that this channel helps banks increase their equity capital, meeting safety standards. Because bonds help banks mobilize Tier 2 capital (additional capital) with large value to expand operations without having to reduce ownership ratio through issuing shares.

The capital adequacy ratio (CAR) according to Basel standards is calculated based on size compared to risk-weighted assets. As banks maintain credit growth of 14-15% per year, the denominator of this formula continuously increases. To ensure the CAR ratio, banks are required to increase capital.

In addition, bonds are a long-term capital mobilization channel, helping banks ensure their capital structure according to regulations. Since the end of last year, banks have had to reduce the maximum ratio of short-term capital used for medium- and long-term loans to 30%, instead of 34% as before; lending on total mobilized capital must be below 85%.

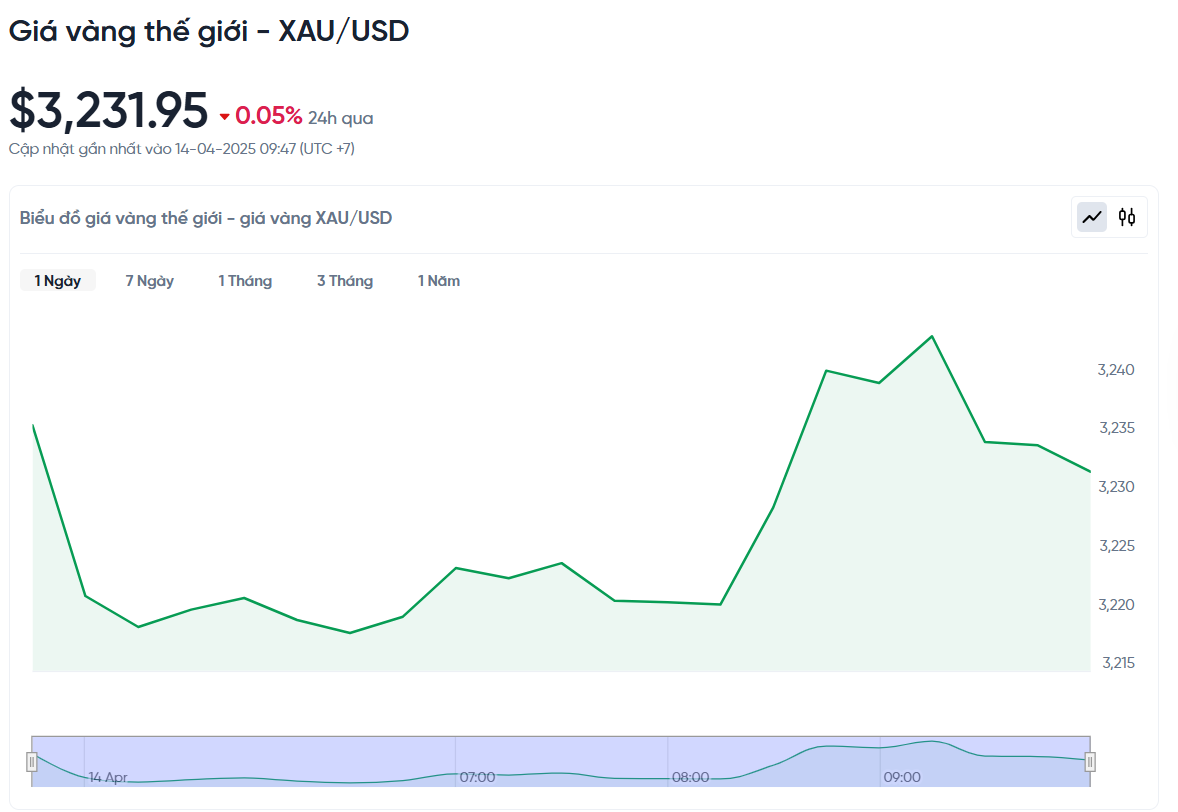

Meanwhile, deposit mobilization has slowed since the beginning of this year due to less attractive interest rates compared to other investment channels. Normally, depositors tend to choose longer terms when interest rates are low, to optimize benefits. However, this development is often appropriate in the context of no alternative solutions. But in the first half of this year, alternative safe investment channels, such as gold, became hot spots.

In the state-owned group, Vietcombank (VCB) had credit growth of more than 8% in the first 6 months of the year, while mobilization increased by only 2%. In the private group, the gap between credit and mobilization is even larger. Credit growth of the top private banks such as Techcombank, VPBank or ACB is at the threshold of more or less twice that of mobilization.

"The ceiling of 30% for short-term capital for medium and long-term lending forces banks to promote medium and long-term capital sources, and bonds are a viable option," commented an expert from VPBankS. Compared to the average deposit interest rate, bond interest rates are often higher. However, compared to some long-term capital mobilization measures, the cost of this channel is still in the most optimal group.

In addition, bonds issued with different maturities help banks manage cash flow and interest rate risks more effectively. This channel is also a way to diversify capital sources, avoiding dependence on mobilization from residents and economic organizations.

According to the head of consulting at a securities company in Hanoi, the fact that banks continuously issue and simultaneously buy back old bonds before maturity during periods of fluctuating interest rates shows the calculations in their capital cost structure.

FiinRatings' analysis team believes that the banking sector will continue to increase bond issuance for the rest of this year, in order to have more medium and long-term capital for more than 3 years when credit growth gradually improves. Meanwhile, credit rating agency VIS Rating forecasts that in the next 1-3 years, banks will need about VND283,000 billion in bonds to increase Tier 2 capital. This resource will support banks' internal capital and maintain capital safety ratios.

Source

![[Photo] General Secretary To Lam chairs the third meeting to review the implementation of Resolution No. 18-NQ/TW](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/10f646e55e8e4f3b8c9ae2e35705481d)

![[Photo] Opening of the 44th session of the National Assembly Standing Committee](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/03a1687d4f584352a4b7aa6aa0f73792)

![[Photo] Touching images recreated at the program "Resources for Victory"](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/99863147ad274f01a9b208519ebc0dd2)

![[Photo] Children's smiles - hope after the earthquake disaster in Myanmar](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/9fc59328310d43839c4d369d08421cf3)

Comment (0)