Domestic gold price today

Early morning of June 29 , SJC 9999 gold price today remained unchanged compared to the close of yesterday's trading session.

The price of 9999 gold was updated by Saigon Jewelry Company Limited (SJC) at 8:25 a.m. and the price of 9999 gold was listed by Doji Jewelry Group at 8:53 a.m. as follows:

| Buy | Sell | |

| SJC Hanoi | 66,400,000 VND/tael | 67,020,000 VND/tael |

| SJC HCMC | 66,400,000 VND/tael | 67,000,000 VND/tael |

| SJC Danang | 66,400,000 VND/tael | 67,020,000 VND/tael |

| Doji Hanoi | 66,350,000 VND/tael | 66,950,000 VND/tael |

| Doji HCMC | 66,450,000 VND/tael | 66,950,000 VND/tael |

SJC and DOJI gold price list updated early morning June 29

At the end of the trading session on June 28, the domestic 9999 gold price was listed by SJC and Doji Gold and Gemstone Group in the following order of buying and selling:

SJC Hanoi: 66,400,000 VND/tael - 67,020,000 VND/tael

Doji Hanoi: 66,350,000 VND/tael - 66,950,000 VND/tael

SJC HCMC: 66,400,000 VND/tael - 67,000,000 VND/tael

Doji HCMC: 66,450,000 VND/tael - 66,950,000 VND/tael

The central exchange rate on June 29 announced by the State Bank is 23,783 VND/USD, an increase of 23 VND compared to yesterday. The USD price at commercial banks this morning (June 29) was traded around 23,360 VND/USD (buy) and 23,730 VND/USD (sell).

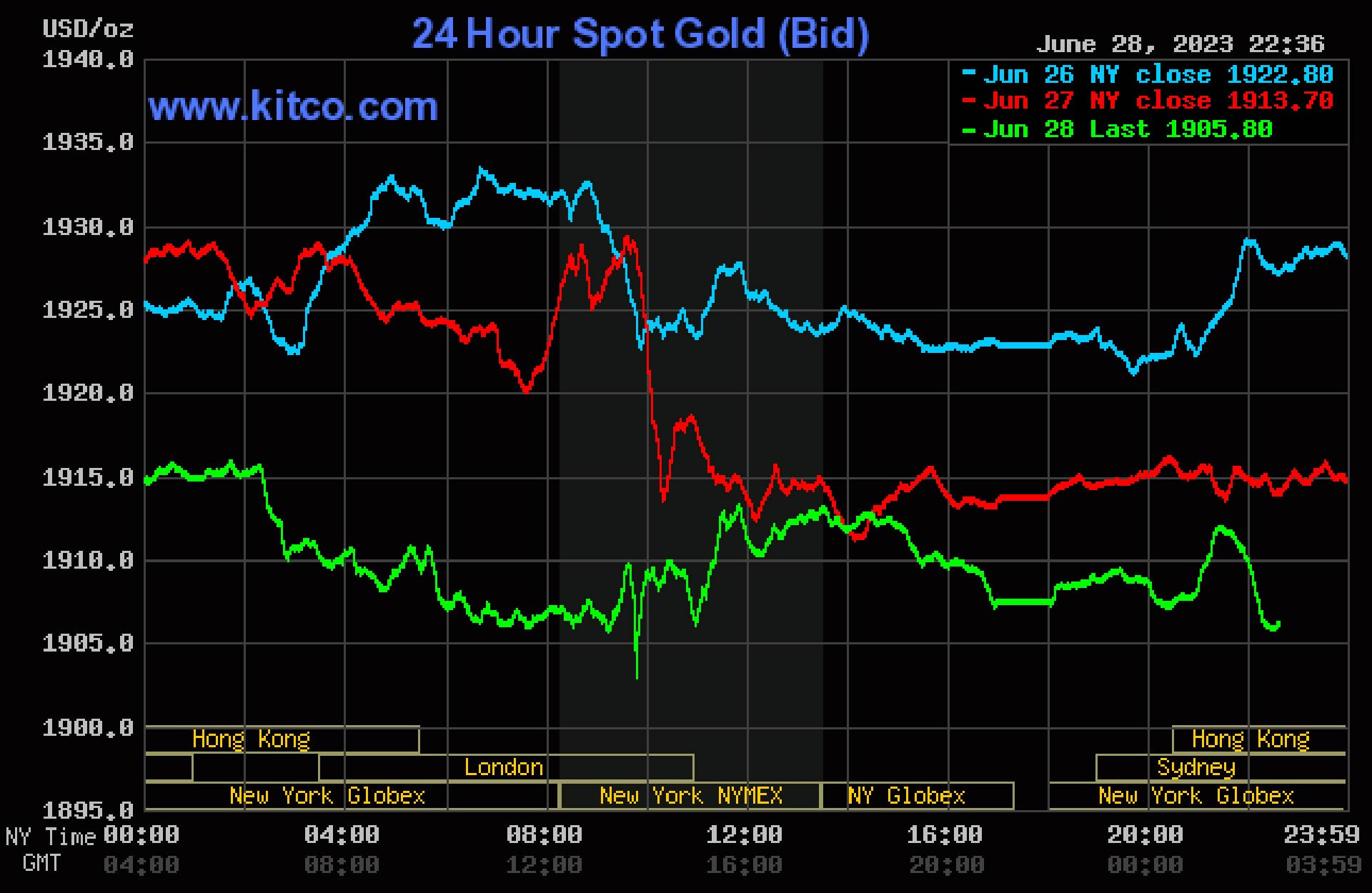

International gold price today

At 9:34 a.m. today (June 29, Vietnam time), the world spot gold price stood at around 1,905.8 USD/ounce, down 1.2 USD/ounce compared to yesterday. The price of gold futures for August delivery on the Comex New York floor was at 1,914.4 USD/ounce.

On the night of June 28 (Vietnam time), the world spot gold price stood at around 1,907 USD/ounce. Gold for August delivery on the Comex New York floor was at 1,929 USD/ounce.

The world gold price on the night of June 28 was about 4.6% higher (83 USD/ounce) than at the beginning of 2023. World gold converted to the bank USD price was 54.9 million VND/tael, including taxes and fees, about 12.1 million VND/tael lower than the domestic gold price as of the end of the afternoon session on June 28.

The price of gold on the international market plummeted to the sensitive threshold of 1,900 USD/ounce, while the domestic gold price suddenly increased to over 67 million VND/tael. The difference widened to 12 million VND.

Gold fell as the US dollar and some major currencies tended to rise after the US Federal Reserve (Fed) and the European Central Bank (ECB) were believed to step up the fight against inflation with interest rate hikes in July.

Gold is still under selling pressure as it falls to the sensitive threshold of $1,900/ounce.

Inflation is still a matter of concern, with the Fed and ECB continuing to talk about raising interest rates.

The latest macro data from the US is supporting the Fed to further tighten monetary policy. The Conference Board's consumer confidence report rose to 109.7 points in June, the best score since January 2022.

This suggests that the risk of a recession is no longer significant. It also means that the Fed will raise interest rates by another 25 basis points at its upcoming meeting.

Signals from the CME FedWatch tool show that there is a 77% chance that the Fed will raise interest rates by 25 basis points in July. Morgan Stanley has also just updated its forecast that the Fed will continue its streak of rate hikes next month.

Gold Price Forecast

In Europe, ECB President Christine Lagarde warned that inflation is now in a new phase and could last for some time, signaling more interest rate hikes to come.

According to Christine Lagarde, the ECB cannot confidently declare that interest rates have peaked in the near future. Accordingly, unless there is a significant change in the economic outlook, the ECB will continue to raise interest rates in July.

The market is expecting the ECB to raise interest rates to 4%. That means another rate hike is coming.

Inflation remains a global problem despite strong monetary tightening in many countries over the past year.

The gold market is not doing well with prices possibly falling below $1,900/ounce in the short term.

Source

![[Photo] Unique folk games at Chuong Village Festival](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/cff805a06fdd443b9474c017f98075a4)

![[Photo] Phuc Tho mulberry season – Sweet fruit from green agriculture](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/1710a51d63c84a5a92de1b9b4caaf3e5)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting to discuss tax solutions for Vietnam's import and export goods](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/19b9ed81ca2940b79fb8a0b9ccef539a)

Comment (0)