Foreign exchange rate, USD/VND exchange rate today, January 14, recorded that after soaring to the highest level in more than two years, peaking at 110.17, USD turned to decrease slightly.

Foreign exchange rate update table - USD exchange rate Agribank today

| 1. Agribank - Updated: January 14, 2025 07:30 - Time of website source supply | ||||

| Foreign currency | Buy | Sell | ||

| Name | Code | Cash | Transfer | |

| USD | USD | 25,190 | 25,200 | 25,540 |

| EUR | EUR | 25,477 | 25,579 | 26,665 |

| GBP | GBP | 30,363 | 30,485 | 31,458 |

| HKD | HKD | 3,195 | 3,208 | 3,314 |

| CHF | CHF | 27,150 | 27,259 | 28,119 |

| JPY | JPY | 157.15 | 157.78 | 164.64 |

| AUD | AUD | 15,307 | 15,368 | 15,882 |

| SGD | SGD | 18,181 | 18,254 | 18,771 |

| THB | THB | 711 | 714 | 745 |

| CAD | CAD | 17,279 | 17,348 | 17,852 |

| NZD | NZD | 13,882 | 14,376 | |

| KRW | KRW | 16.50 | 18.19 | |

Exchange rate developments in the domestic market

In the domestic market, according to TG&VN at 7:00 a.m. on January 14, the State Bank announced the central exchange rate of the Vietnamese Dong to the USD at 24,343 VND, an increase of 2 VND.

The reference USD exchange rate at the State Bank of Vietnam is listed at: 23,400 VND - 25,450 VND.

USD exchange rates at commercial banks are as follows:

Vietcombank: 25,170 - 25,560 VND.

Vietinbank: 25,065 - 25,560 VND.

|

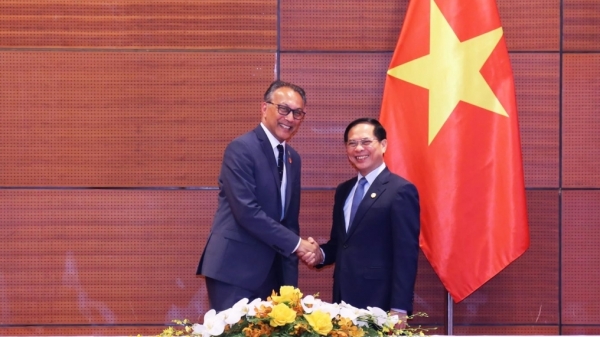

| Foreign exchange rates, USD/VND exchange rate today, January 14: USD turns down, EUR keeps going down. (Source: Getty Images) |

Exchange rate developments in the world market

The US Dollar Index (DXY) measuring the greenback's movements against six major currencies (EUR, JPY, GBP, CAD, SEK, CHF) decreased by 0.12% to 109.52.

The dollar cooled. The DXY index briefly surged to its highest level in more than two years, peaking at 110.17 before falling slightly.

US job growth unexpectedly accelerated in December 2024 and the unemployment rate fell to 4.1%, prompting traders to reduce bets on the possibility of the Fed cutting interest rates this year.

With the US inflation report due tomorrow, January 15, any increase in prices would support the Fed to pause future rate cuts. A series of Fed officials will also speak this week.

“With markets now pricing in just over one rate cut by year-end, their reaction to inflation data will also have a relative impact,” said Uto Shinohara, senior investment strategist at Mesirow Currency Management in Chicago. “The more important event is the inauguration of US President-elect Donald Trump this month, after which we will see the impact of Trump’s tariff policies.”

In a reverse move, the EUR fell 0.4% to $1.0208.

Earlier in the session, the common European currency hit its lowest level against the dollar since November 2022.

The pound fell 0.24 percent to $1.2167, after sliding to a 14-month low earlier in the session.

The pound has been under pressure from concerns about rising borrowing costs and growing uncertainty about Britain’s finances, falling 1.8% last week.

Source: https://baoquocte.vn/ty-gia-ngoai-te-ty-gia-usdvnd-hom-nay-141-usd-quay-dau-giam-eur-giu-nhip-di-xuong-300759.html

![[Photo] Closing of the 4th Summit of the Partnership for Green Growth and the Global Goals](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/c0a0df9852c84e58be0a8b939189c85a)

![[Photo] Promoting friendship, solidarity and cooperation between the armies and people of the two countries](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/0c4d087864f14092aed77252590b6bae)

![[Photo] The beauty of Ho Chi Minh City - a modern "super city" after 50 years of liberation](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/18/81f27acd8889496990ec53efad1c5399)

![[Photo] Nhan Dan Newspaper announces the project "Love Vietnam so much"](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/362f882012d3432783fc92fab1b3e980)

![[Photo] National Assembly Chairman Tran Thanh Man meets with outstanding workers in the oil and gas industry](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/1d0de4026b75434ab34279624db7ee4a)

![[Infographic] Tax implementation situation in the first quarter of 2025](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/18/fb173cb00d0f46989558e42c45269eee)

![[Photo] General Secretary To Lam receives French Ambassador to Vietnam Olivier Brochet](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/49224f0f12e84b66a73b17eb251f7278)

![[Video] Viettel officially puts into operation the largest submarine optical cable line in Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/f19008c6010c4a538cc422cb791ca0a1)

Comment (0)