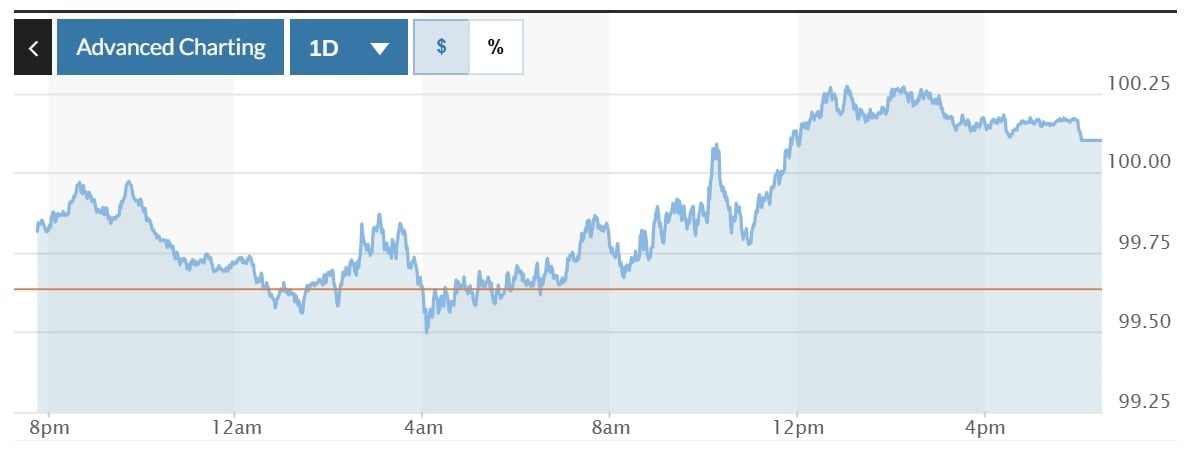

Meanwhile, in the US market, the US Dollar Index (DXY) measuring the greenback's fluctuations against six major currencies (EUR, JPY, GBP, CAD, SEK, CHF) increased by 0.46% to 100.10.

USD exchange rate today in the world

The US dollar rose against the euro and the Japanese yen in the last trading session, showing signs of a cautious recovery after a sharp sell-off that sent the DXY index down more than 3% last week.

However, investors remain cautious over concerns about the impact of trade tariffs from the Trump administration on the US economy.

|

| DXY Index volatility chart over the past 24 hours. Photo: Marketwatch |

The rapid changes in tariff announcements sent investors fleeing to safe-haven assets, sending Treasury yields surging last week and denting the greenback’s appeal.

“The dollar is largely driven by asset flows rather than traditional short-term drivers like interest rate differentials,” said Vassili Serebriakov, FX and macro strategist at UBS.

Factors driving investors to seek safer haven assets include “the slowdown in the US economy, tariff uncertainty, uncertainty in US policy in general, improved sentiment towards Europe…”, Mr. Serebriakov commented.

Data released on April 15 showed U.S. import prices unexpectedly fell in March, dragged down by lower costs for energy products, the latest sign that inflation was easing before Mr. Trump’s tariffs take effect.

Trading is relatively quiet this week so far, but investors remain cautious and await more clarity on tariff policy.

On the other hand, the euro fell 0.70% on the day to $1.127, after hitting a three-year high of $1.1473 last week. The shift from US assets to European assets could pave the way for a rally in the euro.

New data shows that German investor sentiment fell the most in April since the Russia-Ukraine conflict broke out in 2022, due to uncertainty over US tariff policy.

Euro zone banks also restricted access to credit for companies last quarter and are expected to continue tightening credit standards due to growing concerns about the economic outlook.

The European Central Bank (ECB) is expected to cut interest rates by 25 basis points at the end of its two-day meeting tomorrow, April 17.

The dollar rose 0.12 percent against the Japanese yen to 143.16 yen, not far from a six-month low of 142.05 hit late last week.

Japan will seek to completely eliminate additional tariffs imposed by Mr. Trump, the country’s top negotiator, Ryosei Akazawa, said on April 15, ahead of a three-day visit to Washington.

The dollar rose 0.91% to 0.822 Swiss francs after falling to a 10-year low against the Swiss currency last week.

The pound rose 0.15 percent to $1.3209 after hitting $1.3252, its highest since Oct. 3.

The AUD rose 0.32% against the greenback to $0.6345 and the NZD gained 0.39% to $0.5899.

|

| USD exchange rate today, April 16: USD recovers slightly. Photo: Reuters |

USD exchange rate today in the country

In the domestic market, at the beginning of the trading session on April 16, the State Bank announced the central exchange rate of the Vietnamese Dong against the USD increased by 5 VND, currently at 23,891 VND.

* The reference exchange rate at the State Bank's transaction office increased slightly, currently at: 23,697 VND - 26,085 VND.

USD exchange rates at commercial banks are as follows:

USD exchange rate | Buy | Sell |

Vietcombank | 25,620 VND | 26,010 VND |

Vietinbank | 25,485 VND | 26,065 VND |

BIDV | 25,685 VND | 26,045 VND |

* The EUR exchange rate at the State Bank's buying and selling exchange center decreased slightly, currently at: 26,797 VND - 29,618 VND.

EUR exchange rates at commercial banks are as follows:

EUR exchange rate | Buy | Sell |

Vietcombank | 28,543 VND | 30,108 VND |

Vietinbank | 28,280 VND | 29,780 VND |

BIDV | 28,910 VND | 30,166 VND |

* The Japanese Yen exchange rate at the State Bank's exchange office for buying and selling has slightly decreased, currently at: 165 VND - 182 VND.

Japanese Yen Exchange Rate | Buy | Sell |

Vietcombank | 174.55 VND | 185.64 VND |

Vietinbank | 176.18 VND | 185.88 VND |

BIDV | 177.21 VND | 185.49 VND |

MINH ANH

* Please visit the Economics section to see related news and articles.

Source: https://baodaknong.vn/ty-gia-usd-hom-nay-16-4-dong-usd-phuc-hoi-nhe-249527.html

![[Photo] Closing of the 4th Summit of the Partnership for Green Growth and the Global Goals](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/c0a0df9852c84e58be0a8b939189c85a)

![[Photo] General Secretary To Lam receives French Ambassador to Vietnam Olivier Brochet](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/49224f0f12e84b66a73b17eb251f7278)

![[Photo] Promoting friendship, solidarity and cooperation between the armies and people of the two countries](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/0c4d087864f14092aed77252590b6bae)

![[Photo] Nhan Dan Newspaper announces the project "Love Vietnam so much"](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/362f882012d3432783fc92fab1b3e980)

![[Photo] National Assembly Chairman Tran Thanh Man meets with outstanding workers in the oil and gas industry](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/1d0de4026b75434ab34279624db7ee4a)

![[Photo] Welcoming ceremony for Chinese Defense Minister and delegation for friendship exchange](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/fadd533046594e5cacbb28de4c4d5655)

![[Video] Viettel officially puts into operation the largest submarine optical cable line in Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/f19008c6010c4a538cc422cb791ca0a1)

Comment (0)