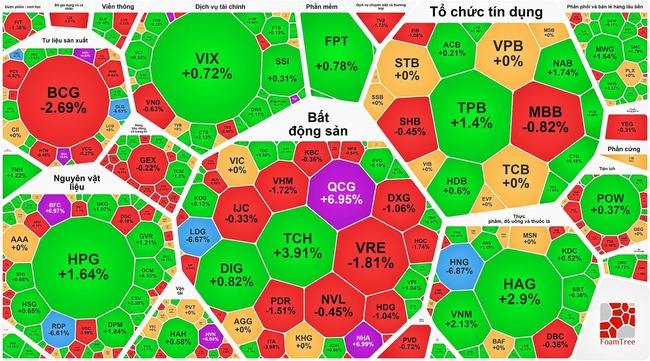

Investment comments:

Dragon Viet Securities (VDSC) : VN-Index continues to recover on low liquidity but is in a tug-of-war situation before the 1,250 point threshold. Liquidity increased compared to the previous session but remained low, showing that supply has not put much pressure despite the waiting to sell at high prices.

Overall, cash flow is at a low level after the negative impact of the recent sharp decline. It is likely that the VN-Index will continue to struggle and probe the resistance zone of 1,250 points in the trading session on July 30, but the current low demand situation may pose a risk of weakening the index in the coming time.

Stock market session 29/7.

Asean Securities (Aseansc): The market recovered amid doubts and a slight increase in supply pressure, focusing on mid- and small-cap stocks that do not represent the general market. On the contrary, in the large-cap group, short-term trading positions became more consensual as most stocks in this group continued to have a positive trading session.

Therefore, Aseansc believes that investors should avoid chasing green prices in the current context, temporarily hold a moderate proportion of stocks and observe the market.

Dong A Securities: Investors can continue to disburse funds and pay attention to basic production stocks such as banks, electricity, seaports, industrial parks, and mid-range residential real estate.

Stock news

- Vietnam had a trade surplus of more than 14 billion USD in the first 7 months of 2024. According to the socio-economic report for July and the first 7 months of 2024 announced by the General Statistics Office on the morning of July 29, the total import and export turnover of goods in July 2024 is estimated at 69.72 billion USD, up 8.7% over the previous month and up 21.8% over the same period last year.

In the first 7 months of 2024, the total import and export turnover of goods reached 439.88 billion USD, up 17.1% over the same period last year, of which exports increased by 15.7%; imports increased by 18.5%. The trade balance of goods had a surplus of 14.08 billion USD.

- Health insurance premiums increase according to the basic salary, pushing the CPI in July 2024 up 0.48%. According to the General Statistics Office, domestic gasoline prices increased according to world prices, increased demand for electricity, and health insurance premiums adjusted according to the new basic salary are the main reasons for the consumer price index (CPI) in July 2024 to increase by 0.48% compared to the previous month.

Compared to December 2023, CPI in July increased by 1.89% and compared to the same period last year increased by 4.36%. On average, in the first 7 months of 2024, CPI increased by 4.12% compared to the same period last year; core inflation increased by 2.73%.

Source: https://www.nguoiduatin.vn/lang-kinh-chung-khoan-30-7-tranh-mua-duoi-gia-xanh-204240729220637115.htm

Comment (0)