Conference "Promoting bank credit, contributing to economic growth in Region 7" - Photo: VGP/HT

Enterprises expect banks to support sustainable development

From the perspective of enterprises, Mr. Le Van Phuong - General Director of Lam Son Sugar Joint Stock Company assessed: bank credit has long become an essential resource to help enterprises not only maintain operations but also invest in depth, develop technology, and expand scale. Especially in the agricultural sector, where there is a close connection with farmers, the role of banks has become more essential than ever.

Over the years, Lam Son Sugarcane has cooperated closely with major banks such as VietinBank, MB, Techcombank, ACB, etc., especially VietinBank Thanh Hoa with a relationship lasting more than 30 years. This cooperation not only provides credit but also brings flexible financial solutions, optimizing production and business activities.

However, Mr. Le Van Phuong also frankly pointed out some difficulties such as: Many sugarcane farmers are having difficulty accessing preferential capital. Banks need to implement more flexible credit packages, with appropriate repayment mechanisms according to the season. In addition, there should be more policies to support investment in mechanization, development of new sugarcane varieties, towards a sustainable agricultural development model.

Ms. Tran Thi Loan - Chairwoman of the Board of Directors and General Director of Ha Nam Food Joint Stock Company emphasized the importance of digital transformation in credit activities.

"As a food production enterprise - an essential industry to ensure national food security, we identify the role of bank credit as not only a source of capital, but also a 'companion' in the modernization process," said Ms. Tran Thi Loan.

According to Ms. Tran Thi Loan, with the food industry being seasonal and prices fluctuating strongly, businesses need flexibility in credit policies: longer loan terms, preferential interest rates and quick procedures. Over the years, the Company has received active support from Agribank, BIDV, VietinBank, both in terms of capital and service improvements. In particular, these 3 banks have proactively reduced interest rates, optimized loan procedures and always accompanied during difficult times.

"We expect banks to continue to promote the application of digital technology, encrypt credit data, and integrate AI to increase security, transparency, and reduce the risk of fraud. In addition, financial consulting programs are needed to help businesses use capital more effectively," Ms. Tran Thi Loan emphasized.

Solutions to accompany the goal of regional economic growth

From a banking perspective, Mr. Ho Van Tuan - Deputy General Director of Joint Stock Commercial Bank for Foreign Trade of Vietnam (Vietcombank) shared a series of strategic solutions to boost credit in Region 7.

"In 2025, Vietcombank aims to increase credit growth in this area by over 15%, with some branches such as Bac Thanh Hoa being assigned to grow much higher. This clearly demonstrates our commitment to accompanying the local development," said Mr. Ho Van Tuan.

Mr. Ho Van Tuan - Deputy General Director of Joint Stock Commercial Bank for Foreign Trade of Vietnam (Vietcombank) spoke at the Conference - Photo: VGP/HT

Mr. Ho Van Tuan said that Vietcombank is always a pioneer in many priority areas such as: Acting as a focal bank to arrange capital for hydropower, wind power, and solar power projects in line with the national energy development strategy; financing expressway projects, regional connectivity, attracting FDI investment; supporting production, export business and SMEs, supporting access to preferential capital, increasing international competitiveness; supporting industry, high technology, digital transformation...

"We have successfully deployed an online disbursement solution for corporate customers. This is a big step forward in helping to reduce costs and shorten loan processing time," said a Vietcombank representative.

Speaking at the conference, Mr. Pham Quang Dung, Deputy Governor of the State Bank of Vietnam, said: 2024 was a year full of difficulties and challenges for the domestic and global economies. However, Vietnam still achieved very positive results: economic growth reached nearly 7.1%, exceeding the target set by the National Assembly; inflation was controlled at 3.63%; major balances of the economy were ensured.

Although credit is usually low at the beginning of the year, by the end of March 2025, credit for the entire system had grown by nearly 2.5%, much higher than the increase of only 0.26% in the same period last year. The capital utilization ratio of market 1 reached about 103%, showing that credit institutions have mobilized maximum capital to serve the economy.

In Region 7 alone, the total outstanding credit balance of the region is estimated to reach more than VND 560,000 billion, an increase of 1.2% compared to the end of 2024, accounting for about 3.5% of the national outstanding debt. The region's credit scale and capital mobilization rank 7th out of 15 - showing that the development potential is still very large.

However, in addition to the achieved results, credit activities in region 7 are also facing many difficulties such as: Locally mobilized capital only meets about 90% of credit capital demand, some localities only reach 68-70%; the international environment has many potential risks, especially when the US recently imposed high tax ceilings on Vietnamese goods.

Mr. Pham Quang Dung, Deputy Governor of the State Bank of Vietnam, speaking at the Conference - Photo: VGP/HT

Deputy Governor Pham Quang Dung emphasized: By 2025, the National Assembly and the Government have set a national economic growth target of at least 8%. Particularly for localities in Region 7 including Thanh Hoa, Ninh Binh, Nam Dinh and Ha Nam, the growth targets are assigned at a high level, from 10.5% to 12%. This places great demands on the demand for social investment capital, in which bank credit continues to play the role of the main capital channel.

Therefore, the State Bank has set a credit growth target of 16% in 2025, higher than in recent years. In the first two months of the year, the State Bank has issued 10 documents directing credit management nationwide, focusing on four main groups of solutions.

In the coming time, the State Bank will continue to implement solutions such as: Reducing lending interest rates, continuing to lower interest rates to remove difficulties for people and businesses. Directing credit to the right target, ensuring safety and efficiency, prioritizing production and business sectors, priority sectors and growth drivers.

The banking sector also promotes the application of information technology, simplifies administrative procedures, and facilitates access to capital. Expands credit programs, especially for key industries to ensure food security, and implements credit policies under the direction of the Government and the Prime Minister.

Faced with that reality, to achieve the economic growth target of 8% nationwide and 10.5-12% in region 7, the entire banking industry needs to make greater efforts and be more determined in: Connecting credit needs between banks and enterprises; promptly grasping difficulties and obstacles, thereby providing effective and flexible solutions. Banks will increase credit support to the strong sectors of each locality.

In the context of many challenges, especially the recent developments when the interest rate trend is high in many countries, including Vietnam, to achieve the national credit growth target of 16% in 2024, contributing to achieving the national economic growth target of 8% and inflation rate from 4.0% to 4.5%, the banking industry, credit institutions and branches need to resolutely implement many solutions to promote the connection between banks and enterprises to promptly remove difficulties and obstacles and have specific and effective solutions.

"We hope that agencies such as the Provincial Party Committee and the People's Committee will continue to direct departments, branches, sectors, and authorities at all levels to promptly review difficulties and problems of enterprises to find solutions; strengthen the implementation of bank-enterprise connection programs and direct the effective coordination of credit programs under the direction of the Government and the Prime Minister, programs specific to localities and regions, and have policies to encourage investment attraction, increase credit demand for the region to create conditions for the banking sector to provide better capital sources for the regions," the Deputy Governor expressed his wish.

Deputy Governor of the State Bank of Vietnam Pham Quang Dung presented the decision to the Board of Directors of the State Bank of Vietnam Region 7 (including Thanh Hoa, Nam Dinh, Ha Nam and Ninh Binh provinces).

Deputy Governor Pham Quang Dung said: In the 7th session of the National Assembly, the Government will submit to the National Assembly for consideration and approval of the amended Law on Credit Institutions, including a proposal to legalize some important contents of Resolution 42 on bad debt handling.

"I propose that you, the National Assembly deputies in the provinces, will join us, share, and help the banking sector and credit institutions in the localities to apply these contents more conveniently. From there, we will provide financial support and reduce difficulties for businesses and people in the area," said the leader of the State Bank.

Also on April 4, in Thanh Hoa, the State Bank of Vietnam (SBV) held the Decision Announcement and launch of SBV Region 7 and the Conference on Promoting Bank Credit to Contribute to Economic Growth of Region 7 (including Thanh Hoa, Nam Dinh, Ha Nam and Ninh Binh provinces).

Previously, on March 1, 2025, the Governor of the State Bank issued Decisions on personnel transfer and appointment in Region 7, specifically: Mr. Tran The Hung, Deputy Director of the Internal Audit Department of the State Bank of Vietnam, holds the position of Director of the State Bank of Vietnam, Region 7 branch; Deputy Directors of the State Bank of Vietnam, Region 7 include Mr. Tong Van Anh, Dang Van Kim, Nguyen Van Khiet, and Ngo Lam Son.

At the Conference, Deputy Governor of the State Bank of Vietnam Pham Quang Dung presented the decision to the Board of Directors of the State Bank of Vietnam Region 7 and the heads and deputy heads of departments.

According to the leader of the State Bank: The consolidation of the State Bank's organizational structure, including 15 regional State Bank branches, is the result of serious and drastic efforts by the State Bank's Board of Directors and Steering Committee, implementing the consistent directions of the Central Committee, the Politburo, and the Secretariat on implementing the "revolution" of streamlining the apparatus.

Huy Thang

Source: https://baochinhphu.vn/tin-dung-ngan-hang-don-bay-thuc-day-tang-truong-ben-vung-102250404190033346.htm

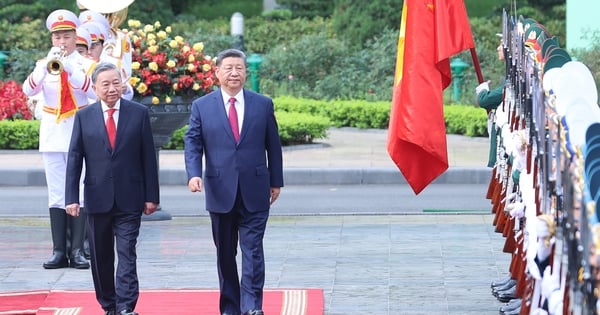

![[Photo] Reception to welcome General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/9afa04a20e6441ca971f6f6b0c904ec2)

![[Photo] National Assembly Chairman Tran Thanh Man meets with General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/4e8fab54da744230b54598eff0070485)

![[Photo] General Secretary To Lam holds talks with General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/b3d07714dc6b4831833b48e0385d75c1)

![[Photo] Prime Minister Pham Minh Chinh meets with General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/893f1141468a49e29fb42607a670b174)

Comment (0)