Stable exchange rate is an opportunity to expand business and invest capital in the stock market - Photo: Q.D

Tuoi Tre spoke with Mr. Truong Van Phuoc - former acting chairman of the National Financial Supervision Committee.

Mr. Truong Van Phuoc

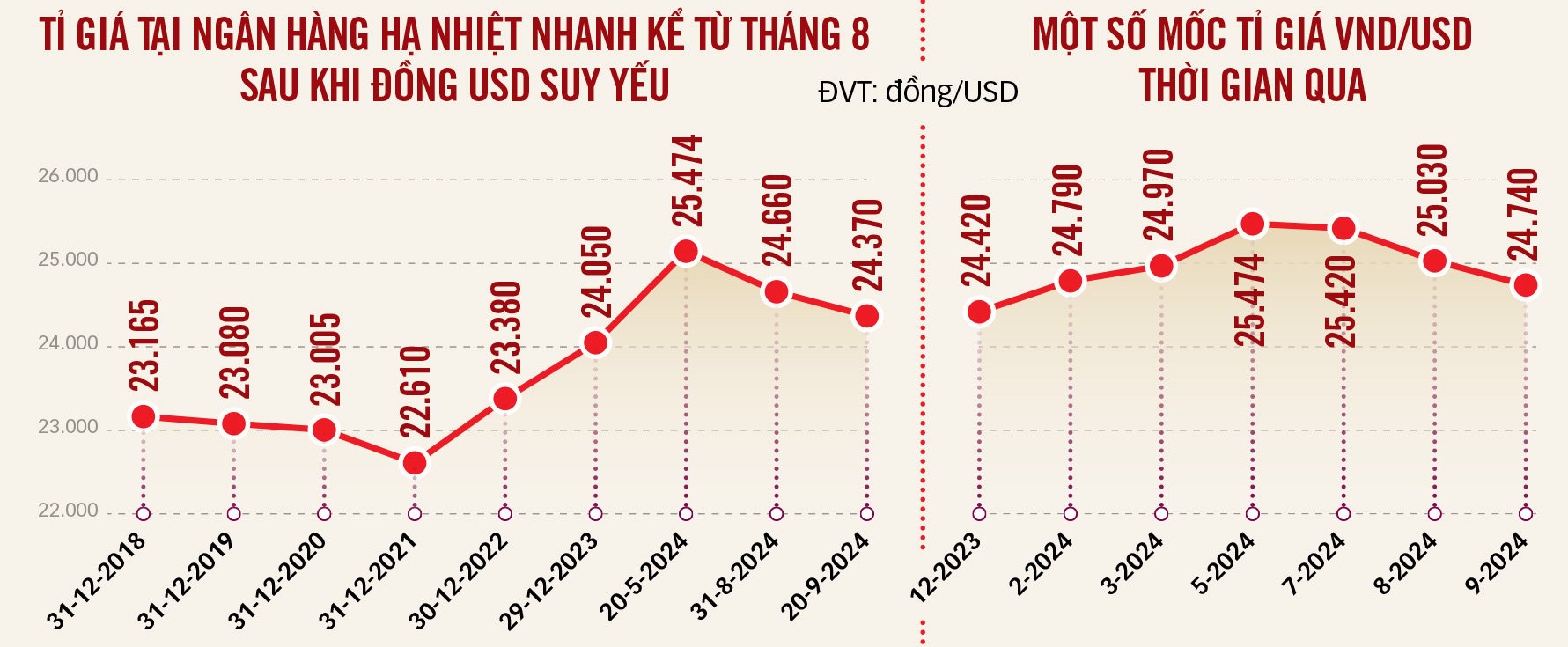

* Sir, in early 2024, VND "suddenly" lost more than 5% of its value against USD, but now it has strengthened. Why is this development different from previous years?

- In recent years, the market psychology and trend is that the USD/VND exchange rate is always linked to USD fluctuations in the international market through the USD Index (including a USD basket with 6 key currencies such as EUR, Japanese yen, British pound...).

Meanwhile, the USD also has its own story: it is COVID-19; countries loosen monetary policy to support the economy, especially in the US. Therefore, after the pandemic, inflation is high, forcing the US to raise interest rates to tighten monetary policy with a peak of 5.5%, the highest in the past 40 years.

High-interest money always has value. But using high interest rates to reduce inflation also creates difficulties for economic growth, employment… .

However, in the US, despite high interest rates, inflation is still persistent, affecting economic growth, many indicators such as employment... are not as forecasted. At the beginning of 2024, people thought that the US would lower interest rates, but waiting for a long time still did not make the market shocked, pushing the USD Index up to 106 in the first quarter and April 2024 was the peak.

As mentioned, the VND/USD exchange rate is always linked to the USD, so in the first months of the year, VND has lost more than 5% of its value compared to the USD, at one point 25,500 VND/USD. Now that the USD Index has dropped to 100, VND has regained its value, at one point only 24,500 VND can buy 1 USD.

* VND is getting stronger, will it return to 24,000 VND/USD?

- It is true that the increase in the beginning of the year has caused confusion for businesses and people because in the past years they have been used to a "calm exchange rate", the highest year the VND also lost no more than 3%. Therefore, in the first quarter of 2024, the VND losing more than 5% of its value has made the market worried that the VND may lose more value in 2024.

This comes from the idea that even if the US reduces it further, USD interest rates will still be high in 2024 and USD is a strong currency and has a large payment market share. In essence, the exchange rate is always affected by two factors: the difference in inflation and interest rates between the US and Vietnam.

Currently, US inflation is going down, while Vietnam is striving to maintain the level of 4 - 4.5%, but there are many unfavorable factors such as natural disasters, salary adjustments... Therefore, the possibility of USD falling further compared to VND is not high.

The exchange rate of 24,500 VND/USD is probably quite balanced. The USD/VND price is forecast to fluctuate by 2.5 - 3% this year, meaning that USD/VND will still return to "calm" after the shocking increase at the beginning of the year.

Graphics: T.DAT

* The US has started the roadmap to reduce USD interest rates and November is the presidential election, with exchange rate management being two turning points, so what is Vietnam's response?

- Yes, those are two important turning points and will have many impacts on the world and the Vietnamese economy. Perhaps the Fed will further reduce interest rates in the remaining 3 months of 2024. As for the US election, there will certainly be many changes in policy.

There will be fluctuations in either direction. With the economy increasingly integrating, in my opinion, there needs to be a "shock absorber" to the maximum extent possible for those changes. The general trend is that the USD will weaken in the near future because the Fed's interest rate reduction roadmap will continue, possibly until 2025.

But it should also be noted that many international forecasts predict that global inflation will continue to decline for several more years. Therefore, monetary easing is not only in the US but also in other economies. Countries also reduce interest rates. When interest rates decrease, the USD weakens, but the currencies of countries that cut interest rates also weaken. This impact will keep the USD in a relatively stable exchange rate zone. This is an important factor and a signal that can lead to the USD/VND exchange rate.

With an economy steadfastly pursuing a high growth target and implementing a price marketization roadmap, maintaining the inflation target of 4 - 4.5% is still a challenge. For the exchange rate to be stable, the central exchange rate must be stable based on internal factors of the Vietnamese economy such as capital flows, economic growth, balance of payments, foreign investment, etc. in addition to the USD Index. That is the "shock buffer".

Tourists exchange money at a foreign exchange transaction point (District 1, Ho Chi Minh City) - Photo: TU TRUNG

* Many people look at the central exchange rate like listening to the program's theme song, so what other signals does the central exchange rate announced by the State Bank have to send besides the "shock buffer"?

- The current exchange rate management mechanism is the central rate announced by the State Bank. From the central rate, the market is allowed to fluctuate in two directions (+/-5%), meaning the market exchange rate has a fluctuation range of 10%.

Recently, when the central exchange rate increased by more than 3%, the market sometimes had to spend around 25,500 VND to buy 1 USD. From there, the market understood the trend of the exchange rate, creating expectations and forecasts for business such as some people holding USD, those who do not have USD are looking to buy... making the market even more tense.

Therefore, when announcing the central exchange rate, it is necessary to take into account many other factors from within the Vietnamese economy besides the USD Index fluctuation factor to avoid the market situation as speculated and reacted that if the USD Index goes up, USD/VND will also go up and vice versa.

In simple terms, the central exchange rate must transmit a stable signal, act as a shock absorber, similar to when we build a house at sea. To build, we need to determine the peak of sea level rise, the ability to respond and withstand when the water rises to avoid the situation of being too worried about the rising water and building a house far from shore, and then moving it down when the water does not rise like that. Running back and forth is very costly.

Here, businesses quickly buy and hold when the exchange rate goes up, but if they buy too much when the exchange rate goes down, they will lose.

Mr. TRUONG VAN PHUOC

Data: WiGroup - Graphics: T.DAT

* The USD/VND exchange rate has softened, so what is the trend of VND interest rates? Is it strong enough to change the trend of holding assets (VND, USD...)?

- Interest rates are like a shadow of inflation. If inflation is at 4 - 4.5%, deposit interest rates can fluctuate around the inflation rate plus 1 - 2% as expected by everyone depositing money in Vietnam, which is a positive real interest rate.

In the first 9 months of 2024, interest rates have two different trends: in the first 3 months of the year, interest rates decreased sharply, from April 2024 to now, they have increased by 1%. Interest rates are forecast to continue to increase but not too hot and slow down, estimated to increase by 0.3 - 0.5%.

The reason is that in the last 3 months of the year, banks have to increase lending capital to an amount approximately equal to the amount lent in the first 8 months of the year, so the bank's demand for mobilization has also increased. Surely everyone will have to consider holding assets when the USD/VND exchange rate returns to its inherent rhythm, increasing no more than 3%/year, lower than the VND mobilization interest rate.

* USD interest rates decrease, foreign capital flows will return. What is the important factor to attract capital, especially into the Vietnamese stock market?

- In recent years, capital flows from countries around the world have flowed into the US to enjoy high interest rates. Now that the US has started to lower interest rates, that trend is reversing. That trend will happen slowly. That capital flow will probably "return" to emerging markets, such as Vietnam, and the stock market is one destination.

But how much foreign capital is absorbed and received depends on the attractiveness and stability of those economies. Whatever is said, low inflation and stable exchange rates will create attractiveness for repatriated capital flows. Therefore, the important thing now is that Vietnam must maintain macroeconomic stability, control inflation as the set target and not let the USD/VND fluctuate too much.

Customers transact at Techcombank, District 1, Ho Chi Minh City - Photo: QUANG DINH

Businesses borrowing USD debt are less stressed

In the first half of this year, the VND/USD exchange rate increased by 5%, causing many businesses that borrowed in USD to feel like they were "sitting on hot coals". With the recent sharp downward trend of the exchange rate, along with the Fed's move to lower interest rates, these businesses can breathe a sigh of relief.

Mr. Truong Thai Dat - Director of DSC Securities Analysis Center - said that the exchange rate has cooled down, only increasing by more than 2% compared to the beginning of the year. The core reason comes from the reduced strength of the USD, thereby reducing the hoarding activities, making profit from foreign exchange differences and the net withdrawal pressure of foreign investors in the investment market.

It is impossible not to mention the regulatory efforts from the State Bank, which has sold about 6.5 billion USD from the national foreign exchange reserves, according to DSC experts. After the Fed started lowering interest rates, around the end of the third quarter - the beginning of the fourth quarter of this year, the State Bank can buy back foreign currency in the system to supplement the reserves that previously supported the market.

Mr. Dat also said that the value of the Vietnamese currency still maintains a certain level of depreciation compared to world currencies, helping to increase competitive advantages in exports and attract foreign investment capital.

Dr. Can Van Luc and the group of authors from BIDV Training and Research Institute believe that a more stable exchange rate will help reduce import costs. In addition, the research group also believes that the Fed's interest rate cut will help stabilize interest rates, reduce the cost of debt capital and foreign currency investment of enterprises.

In Vietnam, the decrease in foreign currency interest rates, especially USD, contributes to reducing the cost of foreign currency loans for both old and new loans, according to the research team.

In addition, Tuoi Tre statistics based on financial reports show that many large enterprises with USD loans have recorded "huge" exchange rate losses in the first half of 2024, such as Novaland, Vietnam Airlines, Hoa Phat and many electricity enterprises. When the exchange rate decreases, the most obvious thing is that the pressure of exchange rate losses for these enterprises will be reduced.

So what is the forecast for the exchange rate at the end of this year? Mr. Tran Duc Anh - director of macro and market strategy of KB Securities Vietnam (KBSV) - said that the pressure on the exchange rate from now until the end of the year is no longer too great.

The USD/VND exchange rate is forecast to decrease to around 25,000 VND/USD - an increase of 3.5% compared to the beginning of the year based on factors such as FDI disbursement, better remittances in the final period of the year, and the weakening of the USD after the Fed cut interest rates.

Source: https://tuoitre.vn/ti-gia-em-dem-vnd-manh-len-20240922085727229.htm

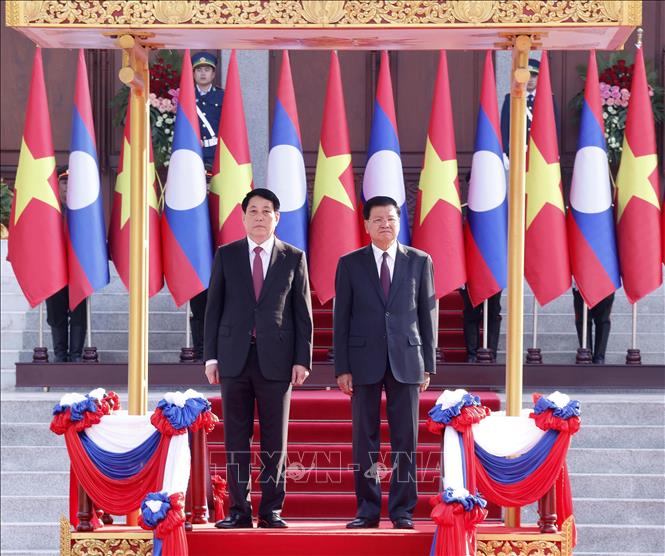

![[Photo] President Luong Cuong holds talks with Lao General Secretary and President Thongloun Sisoulith](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/24/98d46f3dbee14bb6bd15dbe2ad5a7338)

![[Photo] Tourists line up to receive special information publications from Nhan Dan Newspaper](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/24/3ac2c0b871244512821f155998ffdd60)

![[Photo] General Secretary To Lam receives Philippine Ambassador Meynardo Los Banos Montealegre](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/24/6b6762efa7ce44f0b61126a695adf05d)

![[Photo] Prime Minister Pham Minh Chinh works with the Academy of Posts and Telecommunications Technology](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/24/83f86984b516422fb64bb4640c4f85eb)

Comment (0)