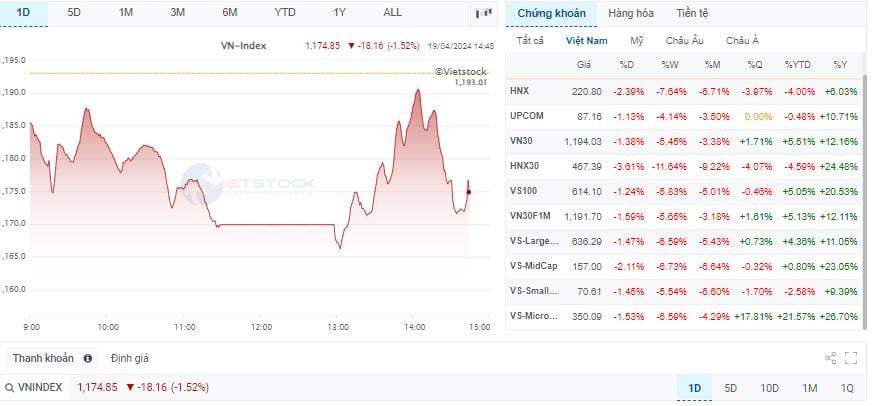

At the end of the last trading session of the week, VN-Index decreased by 18.16 points and stopped at 1,174.85 points; HNX-Index decreased by 5.4 points to 220.80 points. Although the trading volume in this session was only 1,279.8 million units, liquidity was quite high, more than 27,040 billion VND.

Notably, in this trading session, foreign investors net bought more with more than VND 2,614 billion, while net selling was lower by VND 600 billion, reaching VND 1,992.44 billion. Finance, securities, and real estate continued to be the sectors with the sharpest declines in this session. Similarly, the top 10 stocks with the sharpest declines were still VIC, CTG, VHM, TCB, BCM, FPT, BID, LPB, SAB, and GVR.

With today's decline, securities companies believe that the short-term outlook for the market is not optimistic yet, because investors are reacting to a lot of negative information. Therefore, experts recommend that investors take advantage of the recovery to reduce the proportion of stocks to a safe level, and should not buy at the bottom because the market has not shown any signs of stopping falling.

According to Ms. Nguyen Hoai Thu, General Director of Securities Investment, VinaCapital, in addition to the impact of political conflicts in the Middle East, investors are also concerned about fluctuations in exchange rates because the Fed is still maintaining high interest rates, and the USD/VND exchange rate has increased quite strongly in recent days. If calculated from the beginning of the year, the USD/VND exchange rate has increased by more than 4%. Exchange rate fluctuations have created more challenges for the State Bank in controlling the targets on interest rates - exchange rates - inflation.

Similarly, Shinhan Securities Vietnam Co., Ltd. (SSV) also said that the above impacts have caused the stock market to continuously decline. Thus, including the previous 3 sessions, the market has decreased by more than 100 points, losing the effort to increase points more than 2 months ago. Lack of bottom-fishing demand leads to strong inertia, causing the MA support levels to continuously be broken.

In addition, with the market's vulnerable psychology, many false rumors have contributed to the VN-Index once again failing to maintain the 1,250 zone. SSV expects that the VN-Index will have an accumulation period in this zone. Investors are advised to stay calm and take advantage of the recovery to reduce the proportion of stocks to a safe level, and not to buy at the bottom because the market has not shown any signs of stopping falling.

Holiday 4/30 - 5/1, stocks will not be traded on Saturday

On the make-up working day on Saturday (May 4, 2024), the stock exchanges and the Vietnam Securities Depository and Clearing Corporation (VSDC) will not conduct transactions and clearing and settlement activities. Therefore, the market will not have a make-up trading day for the second session (April 29, 2024).

Pursuant to Official Dispatch No. 2450/VPCP-KGVX dated April 12, 2024 of the Government Office on agreeing to the proposal to swap working days on the occasion of the April 30 Victory Day and May 1 International Labor Day holidays in 2024; Official Dispatch No. 2780/UBCK-PTTT on announcing the debt instrument market trading holiday schedule in 2024, the State Securities Commission recently announced the trading schedule during the holidays.

Accordingly, the Vietnam Stock Exchange (VNX), Ho Chi Minh City Stock Exchange (HOSE), Hanoi Stock Exchange (HNX), Vietnam Securities Depository and Clearing Corporation (VSDC) will implement the swap holiday according to Official Letter 2450/VPCP-KGVX dated April 12, 2024 of the Government Office. Officials, civil servants, public employees and workers of state administrative agencies and public service units will be off from Saturday, April 27, 2024 to Wednesday, May 1, 2024.

In total, the holiday lasts for five days, including the first three working days of the week due to the swap of working days from Monday, April 29, 2024 to Saturday, May 4, 2024. Trading on the stock exchange will therefore also be suspended during the above holidays.

At the same time, the State Securities Commission also said that on the make-up working day on Saturday, May 4, 2024, the stock exchanges and VSDC will also not conduct transactions and clearing and payment activities.

Source

![[Photo] Unique folk games at Chuong Village Festival](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/cff805a06fdd443b9474c017f98075a4)

![[Photo] Opening of the 11th Conference of the 13th Party Central Committee](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/f9e717b67de343d7b687cb419c0829a2)

![[Photo] April Festival in Can Tho City](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/bf5ae82870e648fabfbcc93a25b481ea)

Comment (0)