Some Vietnamese enterprises were in the group that did not provide or did not provide complete information as requested by Canadian authorities, so they were subject to an anti-dumping tax of 37.4%.

Some Vietnamese enterprises were in the group that did not provide or did not provide complete information as requested by Canadian authorities, so they were subject to an anti-dumping tax of 37.4%.

|

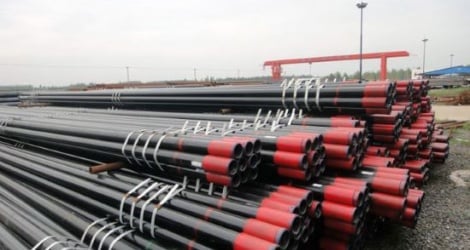

| Vietnam's oil pipes are subject to anti-dumping duties of 37.4% in Canada. |

Canada imposes 37.4% anti-dumping tax on Vietnamese oil pipelines

The Canada Border Services Agency (CBSA) has issued the conclusion of its review of normal value and export price for oil-based commodity tubular goods (OCTG) originating or imported from a number of countries, including Vietnam.

During this review, certain exporters and manufacturers from Taiwan (China), India, South Korea and Thailand provided complete information as requested by the CBSA and should be assessed separate tariffs for future shipments to Canada, effective from January 31, 2025.

Some Vietnamese enterprises were in the group that did not provide or did not provide complete information as required by CBSA, so they were subject to an anti-dumping tax rate of 37.4%.

In the face of the above situation, the Department of Trade Remedies (Ministry of Industry and Trade) recommends that businesses seek detailed information or contact the Foreign Trade Remedies Handling Department for support.

Thailand initiates final review of cold-rolled carbon steel imported from Vietnam

The Department of Foreign Trade of Thailand ( DFT ) has initiated a final review of the anti-dumping duty order on cold-rolled carbon steel originating or imported from Vietnam, China, and Taiwan (China).

Steel products under investigation are classified according to HS codes: 7209.1500, 7209.1600, 7209.1700, 7209.1820, 7209.1890, 7209.2500, 7219.2600, 7209.2700, 7209.2810, 7209.2890, 7209.9010, 7209.9090, 7211.2310, 7211.2320, 7211.2330, 7211.2390, 7211.2910, 7211.2920, 7211.2930, 7211.2990, 7225.5000.

In addition, the DFT has issued a questionnaire for foreign manufacturers and exporters. The deadline for submitting responses to the questionnaire is March 7, 2025.

To promptly respond to the incident, the Trade Defense Department recommends that the Vietnam Steel Association (VSA) should notify relevant manufacturing and exporting enterprises; recommend that enterprises participate if necessary.

For manufacturing and exporting enterprises, it is necessary to register to participate and answer the survey questionnaire within the prescribed time limit and format.

At the same time, cooperate fully and comprehensively with the investigating agency (including answering the investigation questionnaire, sending comments, etc.) throughout the entire process of the case to avoid being concluded as non-cooperative or incompletely cooperative (which often leads to unfavorable results). Ensure compliance with the prescribed instructions, procedures and deadlines.

Source: https://baodautu.vn/ong-dan-dau-cua-viet-nam-bi-ap-thue-374-tai-canada-d244732.html

Comment (0)