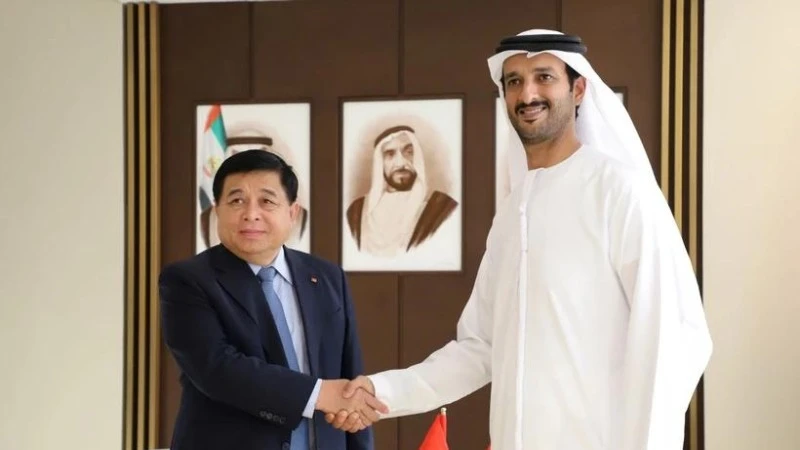

Dubai, a major financial hub in the Gulf, is emerging as a popular destination for many wealthy Asian businessmen and families, mainly Chinese, according to Reuters.

New destination for the super rich

Noah Holdings, one of China’s leading asset managers, is expected to receive a license to operate in Dubai by the end of this year. The Dubai office will serve Chinese entrepreneurs setting up businesses there. The company is expected to initially employ staff from China and then hire locally.

“Many Chinese entrepreneurs are looking for new markets and diversifying their supply chains, and many are excited about the opportunities the Middle East offers,” said Pan Shuang, chief financial officer of Noah Holdings.

Cars moving on Sheikh Zayed Road in Dubai

The post-Covid-19 economic recovery, neutral political stance, easy residency and business conditions, convenient time zones and tax-free status have all contributed to the Middle East attracting a wave of wealthy people in recent years.

Mr. Kashif Ansari, co-founder and CEO of real estate group Juwai IQI (Malaysia), in December 2023 made some comments to The South China Morning Post (SCMP). According to him, in 2023, more millionaires moved to Dubai than to Singapore, and also to the Eurozone, Central and South America or North America.

Geopolitical tensions between the US and China are also burnishing Dubai’s image as a “safe haven” for China, Ansari said, predicting home prices in the city could rise by at least 5% by 2024.

In addition, Western asset managers including Swiss private bank Lombard Odier are also looking to expand their business presence in the Middle East to attract a wave of wealthy foreigners, according to Reuters.

Investment opportunities in Dubai

In Asia, Hong Kong (China) and Singapore have long been the most popular destinations for wealthy overseas individuals. However, this trend is changing as more customers want more choices.

Lights illuminate the Burj Khalifa, the world's tallest building, during the 2024 New Year celebrations in Dubai

Reuters cited a study on the amount of assets in 2023 conducted by the consulting firm Capgemini (France), showing that the number of high-net-worth individuals (HNWI) globally decreased by 3.3% to 21.7 million in 2022, while HNWI in the Middle East increased by 2.8% in the same year.

The UAE saw the world's highest net millionaire inflow in 2022. UK-based investment firm Henley & Partners estimates the country will see a net inflow of 4,500 more people by 2023.

Betting on this trend, Singapore-based financial institution Farro Capital set up an office in Dubai last month. Patrick Tsang, chairman of Hong Kong-based Tsang Group, also said the financial firm plans to open new offices in Abu Dhabi and Riyadh, Saudi Arabia, this year, after breaking into Dubai in 2022.

"We are living in very interesting times where geopolitics is more important than ever to families," Manish Tibrewal, co-founder of Singaporean financial institution Farro Capital, told Reuters.

According to real estate consultancy Knight Frank (UK), demand from Chinese buyers has turned the Dubai real estate market into a "magnet" attracting wealthy individuals.

Knight Frank said that in the long term, this trend will make Dubai one of the leading financial centers like New York, London and Singapore, SCMP reported.

Dubai's office and residential real estate segment is expected to see price increases next year due to high demand and limited supply, according to expert Faisal Durrani, head of research for the Middle East and North Africa at Knight Frank.

“Dubai has reached its tipping point and instead of jostling for recognition, the city is competing with the world’s established centres as a magnet for the world’s wealthy,” said Durrani.

The expert added that Dubai's transport infrastructure, global connectivity and forward-thinking leadership have enhanced its reputation and standing globally: "This is evidenced by the continued desire of high net worth individuals across the globe to own a second home here or move to the region."

Source link

![[Photo] Prime Minister Pham Minh Chinh chairs conference to review the implementation of Resolution No. 18-NQ/TW](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/dcdb99e706e9448fb3fe81fec9cde410)

![[Photo] National Assembly Chairman Tran Thanh Man meets with General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/4e8fab54da744230b54598eff0070485)

![[Photo] General Secretary To Lam holds talks with General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/b3d07714dc6b4831833b48e0385d75c1)

![[Photo] Ceremony to welcome General Secretary and President of China Xi Jinping on State visit to Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/5318f8c5aa8540d28a5a65b0a1f70959)

Comment (0)