Savills Prospects data shows that Asia Pacific real estate investment activity is set to decline by 6% in 2022, compared to a 15% decline in North America and a 28% decline in Europe. Asia’s total investment also accounts for a larger share of global investment.

Mr. Simon Smith, Director of Research, Savills Asia Pacific, commented: Investment activities will continue to be difficult while there are many geopolitical uncertainties on a global scale.

Demand for investment in Asian real estate has dropped sharply. (Photo: TN)

“However, the growth prospects for real estate in Asia remain strong, making the region attractive to investors,” said Mr. Simon.

Real estate investment today is more risky with countless factors that can affect investment efficiency such as inflation, legal, geopolitical instability, slowing growth or changing habits and needs from consumers. Real estate investors need to accurately assess the risks to make the right decisions.

Mr. Simon also pointed out the risk groups that real estate investors in Asia - Pacific at this time need to pay attention to, including: structural risks, cyclical risks and market risks.

First is structural risk, digitization has already brought about a major change in market structure in most regions. Cloud computing, e-commerce, online video and social media are driving more and more of our daily activities online.

This trend has been even further accelerated during the pandemic and is expected to grow even faster in the coming time.

For example, in South Korea – one of the world's largest online retail shopping markets – it is estimated that 37% of transactions will be paid online in 2022, a figure that is expected to increase to 45% in the next 5 years.

In other markets, e-commerce is considered a very potential field, and will even be able to record a lot of room for development. The development of online retail will promote more attention of investors to the data center and logistics segments, changing the face of the retail industry, especially direct retail.

Second is cyclical risk, in which inflation is a cyclical risk that real estate investors not only in Asia but around the world are facing.

The recent sharp rise in interest rates has pushed up property prices. On the positive side, inflation is falling. In Australia, inflation fell to 6.8% in March 2023 from a peak of 8.4% in December 2022.

However, high interest rates, along with rising material and labor costs, will continue to be major concerns for investors. High interest rates also pose risks to growth.

According to the International Monetary Fund (IMF), global GDP growth will slow to 2.7% in 2023, from 3.2% in 2022 and 6% in 2021. If high interest rates persist, the risk of slowing growth will continue to exist.

Third is the risk from internal market problems. The real estate market always faces the risk of oversupply, which is the main reason for the sluggishness in this sector. Oversupply is a problem in many different markets and segments. For example, the retail market in China.

Mr. James McDonald, Director of Research and Policy, Savills China, commented: “The oversupply of retail space in some locations in China is reaching record highs, with vacancy rates in major markets in the first months of 2023 reaching double digits.

Many places still have a large existing supply backlog and even a large future supply. Meanwhile, retail space continues to be under pressure from the boom of e-commerce.

Other market risks include the regulatory framework. Also in China, real estate investors must pay more attention to government policies. Despite moves to ease financial restrictions, the country’s real estate crisis shows no signs of ending.

Meanwhile, in developing countries like Indonesia, investors need to pay attention to market transparency. Next is political stability, for example, political instability in Thailand continues to be a major barrier to investment.

In Vietnam, the first months of the year have seen clear support from the Government in resolving difficulties in the real estate sector with newly issued Decrees and Resolutions. In addition, in March, the State Bank reduced the operating interest rate to stabilize the monetary market and support the economy to accelerate growth.

According to Mr. Troy Griffiths, Deputy Managing Director, Savills Vietnam: “These policies are expected to have a positive impact on the market, however, the market needs time to absorb them. A brighter outlook is expected to start from the third quarter of 2023”.

The bigger challenge revolves around deal structures and legal paperwork, especially for projects under development. This is also an issue that needs intervention and support with a clear legal framework, thereby accelerating the pace of foreign investment activities in Vietnam.

It can be seen that each market has its own investment risks. Risk groups often overlap and are not clearly separated. To solve these difficulties, there needs to be synchronous measures and advice from experienced experts in the market. Given the current market situation, investors need to coordinate with professional units to prepare scenarios in advance to minimize the impact of risks on their investment decisions.

Source

![[Photo] Prime Minister Pham Minh Chinh receives Chairman of Commercial Aircraft Corporation of China (COMAC)](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/93ca0d1f537f48d3a8b2c9fe3c1e63ea)

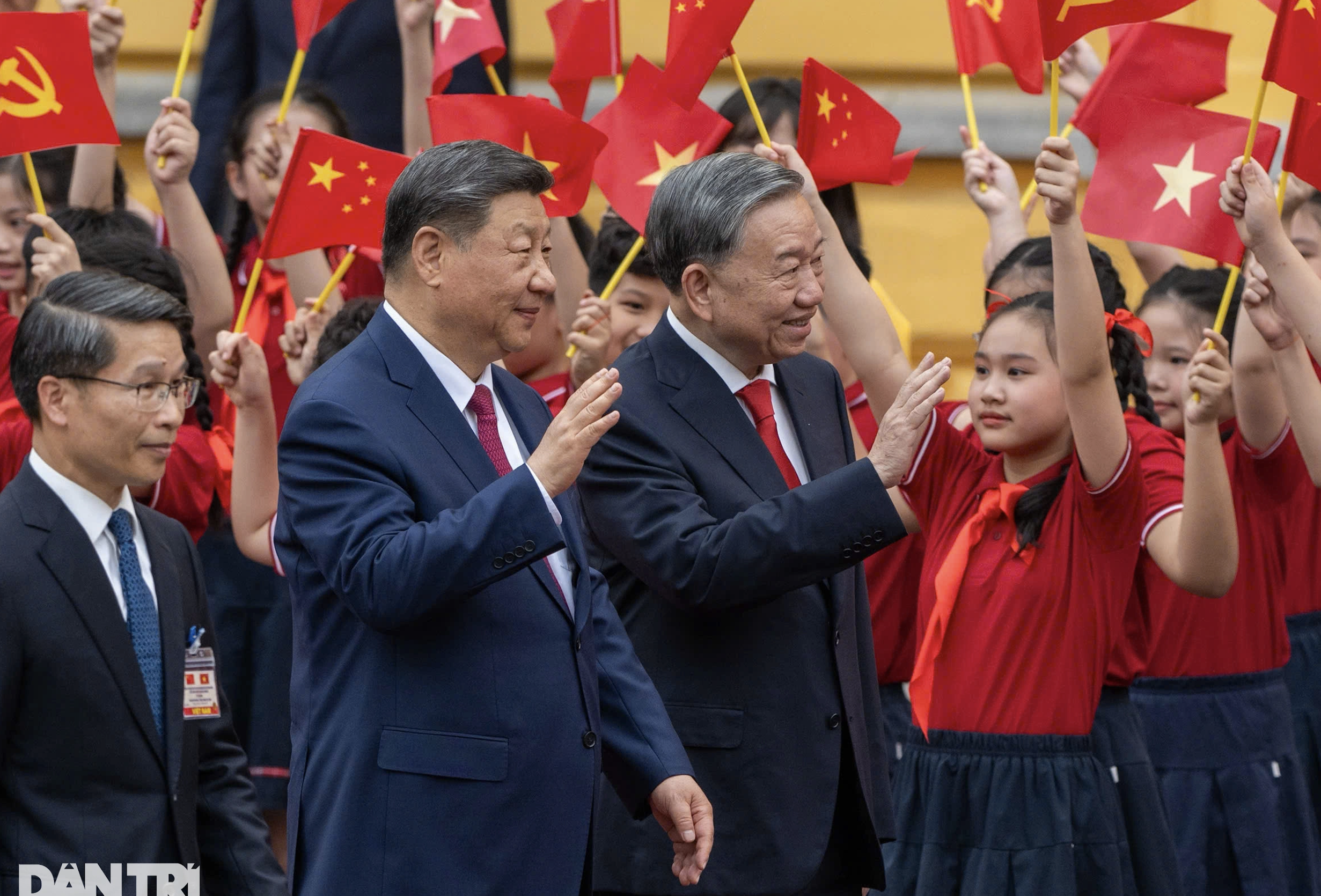

![[Photo] General Secretary and President of China Xi Jinping arrives in Hanoi, starting a State visit to Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/9e05688222c3405cb096618cb152bfd1)

Comment (0)