(Dan Tri) - According to experts, by the end of 2024, there will be a wave of Northern real estate investors returning to the Southern market to seek investment opportunities, especially in satellite cities.

Positive cash flow to the South

The Vietnamese real estate market is clearly differentiated between Ho Chi Minh City and Hanoi. Investment-attracting products on the market such as apartments and private houses in Hanoi often have higher selling prices than in Ho Chi Minh City.

In the apartment segment, the Hanoi market has seen prices increase for two consecutive quarters. It is forecast that in 2025, the primary selling price will reach VND69 million/m2, up 6% quarter-on-quarter and 28% year-on-year. This price has exceeded the average price in Ho Chi Minh City.

In the land segment alone, over the past two years, the Hanoi market has increased in price by more than 30%, with the average price in November being 70 million VND/m2 while in Ho Chi Minh City it was 57 million VND/m2. Experts say that future real estate investment opportunities will focus on this area, welcoming the "falling point" of price increases predicted from the beginning of 2025 onwards.

Thanks to the legal foundation of new laws, the real estate market is entering a recovery cycle. Cash flow is returning to projects, especially in the southern market with many new sources of supply, quality, clear legal status and high growth potential. Satellite cities bordering Ho Chi Minh City are breaking out to become attractive investment destinations.

Also according to the report of batdongsan.com.vn, in the first 9 months of the year, the rate of customers from Ho Chi Minh City flocking to Long An to buy houses accounted for 77%, the highest compared to 50% in Binh Duong and about 45-49% in Dong Nai and Ba Ria - Vung Tau. The investment basket is quite diverse, besides land, there are also townhouses or villas in large-scale urban areas.

Neighboring markets of Ho Chi Minh City such as Long An are leading the rate of attracting investors, with outstanding product lines such as villas in standard-scale urban areas.

Sought-after riverside villas and mansions

One of the important driving forces of Long An real estate is the intra-regional and inter-regional infrastructure. Beltway 3, Beltway 4, Ben Luc - Long Thanh expressway, provincial road projects 830E, 823D... are focused on resources to deploy, complete, promote the connection between the province and Ho Chi Minh City, creating a circle of connections with provinces in the East and Southwest regions.

In the new phase, with the strong development of infrastructure from public investment sources such as Metro, belt roads, highways, etc., moving from satellite cities to the center of Ho Chi Minh City will not take much time. Accordingly, the demand for buying houses will shift to neighboring satellite cities - where housing prices are within the budget of the majority of people and the living environment is of better quality. This is also the trend of all mega cities (large cities surrounded by satellite cities) around the world.

In the context of the townhouse and villa segment in Ho Chi Minh City having little new supply and high prices, low-rise products in neighboring provinces have prices 50-70% lower than in Ho Chi Minh City, along with invested infrastructure, which has expanded demand.

One of the typical satellite cities in Long An is Waterpoint - a 355ha integrated urban area developed by Nam Long and Nishi Nippon Railroad (Japan).

Located at the intersection of important inter-regional traffic routes such as Ho Chi Minh City - Trung Luong Expressway, Ben Luc - Long Thanh Expressway, National Highway 1A, Ring Road 3, Ring Road 4..., Waterpoint has existing advantages, synchronous infrastructure and services with international inter-level schools, clinics, food supermarkets, 3ha sports complex, inter-regional bus system...

EMASI Plus International Bilingual Boarding School - Waterpoint Campus has a scale of up to 6 hectares.

In the last quarter of 2024 and early 2025, the launch of the most expensive collection of villas and mansions in Waterpoint at the "seasonal intersection" of the market with attractive sales policies has been attracting not only high-class customers in Ho Chi Minh City but also investors in the North who are looking for investment and asset accumulation channels.

The products introduced all have valuable and unique locations, belonging to 2 compounds (closed) of Waterpoint, The Aqua and Park Village. In particular, the contemporary Japanese-style villas and mansions of The Aqua are located next to the 8.6ha port bay and adjacent to the Vam Co Dong River, with prices starting from 10 billion VND/unit. Park Village is a collection of European villas and mansions located in the heart of the "green heart" of Central Park, with prices starting from 17.7 billion VND/unit.

Park Village has luxurious and elegant European architectural style.

Thanks to its strategic location and superior utility system spread across a harmonious living environment between nature and water, The Aqua and Park Village not only create a prosperous and happy community but also ensure outstanding potential for price increase in the future - an important factor when choosing long-term assets.

Customers who purchase Park Village products will receive a Mercedes GLC300 worth nearly VND2.8 billion. Customers who successfully transact The Aqua products will receive a Merry Fisher 895 yacht worth nearly VND8 billion.

Source: https://dantri.com.vn/bat-dong-san/nha-dau-tu-phia-bac-nam-tien-tim-bat-dong-san-ve-tinh-20241222225435072.htm

![[Photo] Tan Son Nhat Terminal T3 - key project completed ahead of schedule](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/85f0ae82199548e5a30d478733f4d783)

![[Photo] Prime Minister Pham Minh Chinh meets with General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/893f1141468a49e29fb42607a670b174)

![[Photo] National Assembly Chairman Tran Thanh Man meets with General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/4e8fab54da744230b54598eff0070485)

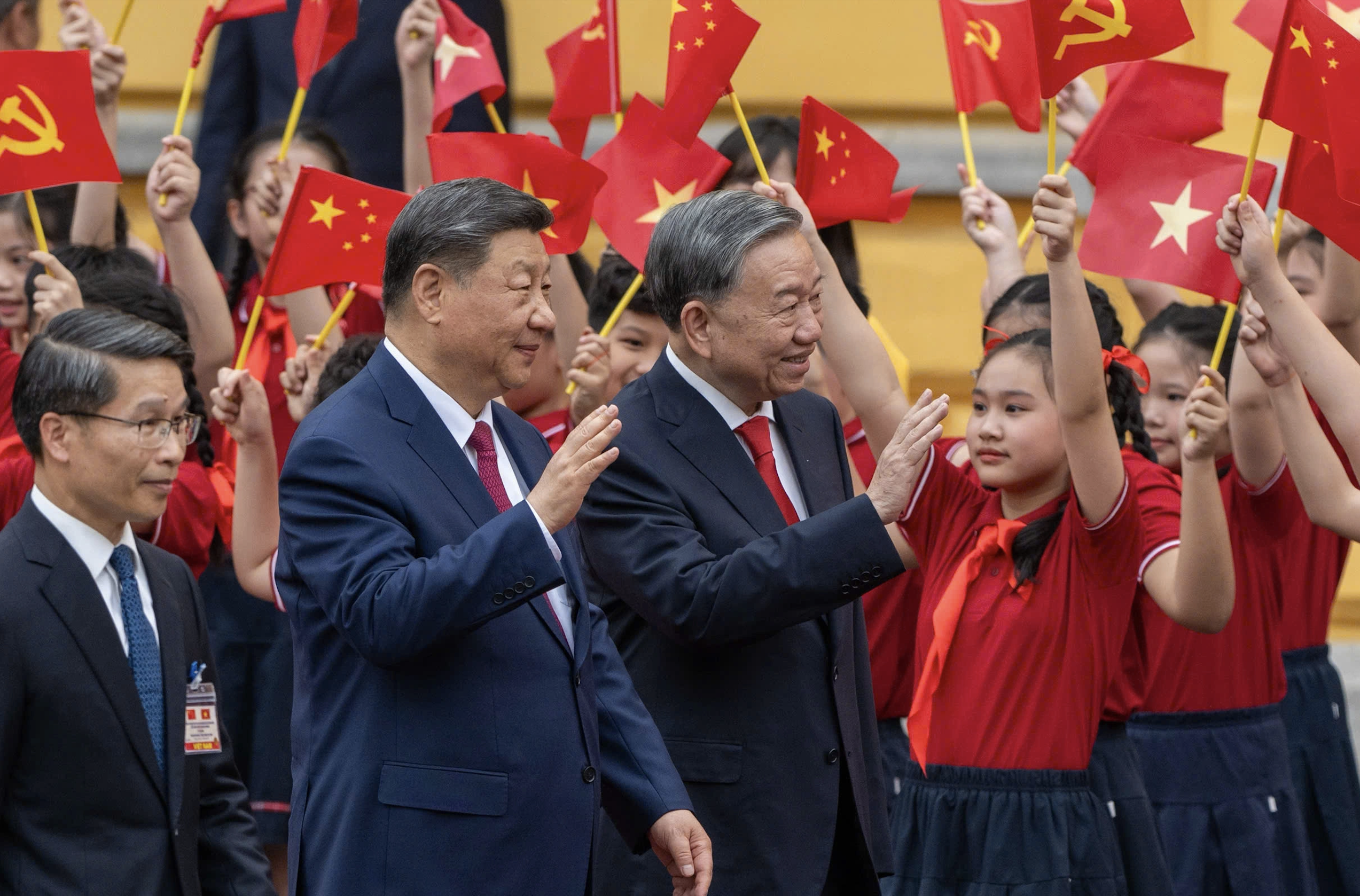

![[Photo] Reception to welcome General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/ef636fe84ae24df48dcc734ac3692867)

Comment (0)