On the morning of May 29th, during a discussion session, Deputy Chair of the National Assembly's Judicial Committee Nguyen Thi Thuy (from Bac Kan province) emphasized that the regulations on the personal income tax deduction for dependents are "outdated." According to Representative Thuy, the deduction of 4.4 million VND per month for dependents "is no longer appropriate for the current situation, especially in large cities, causing losses for taxpayers."

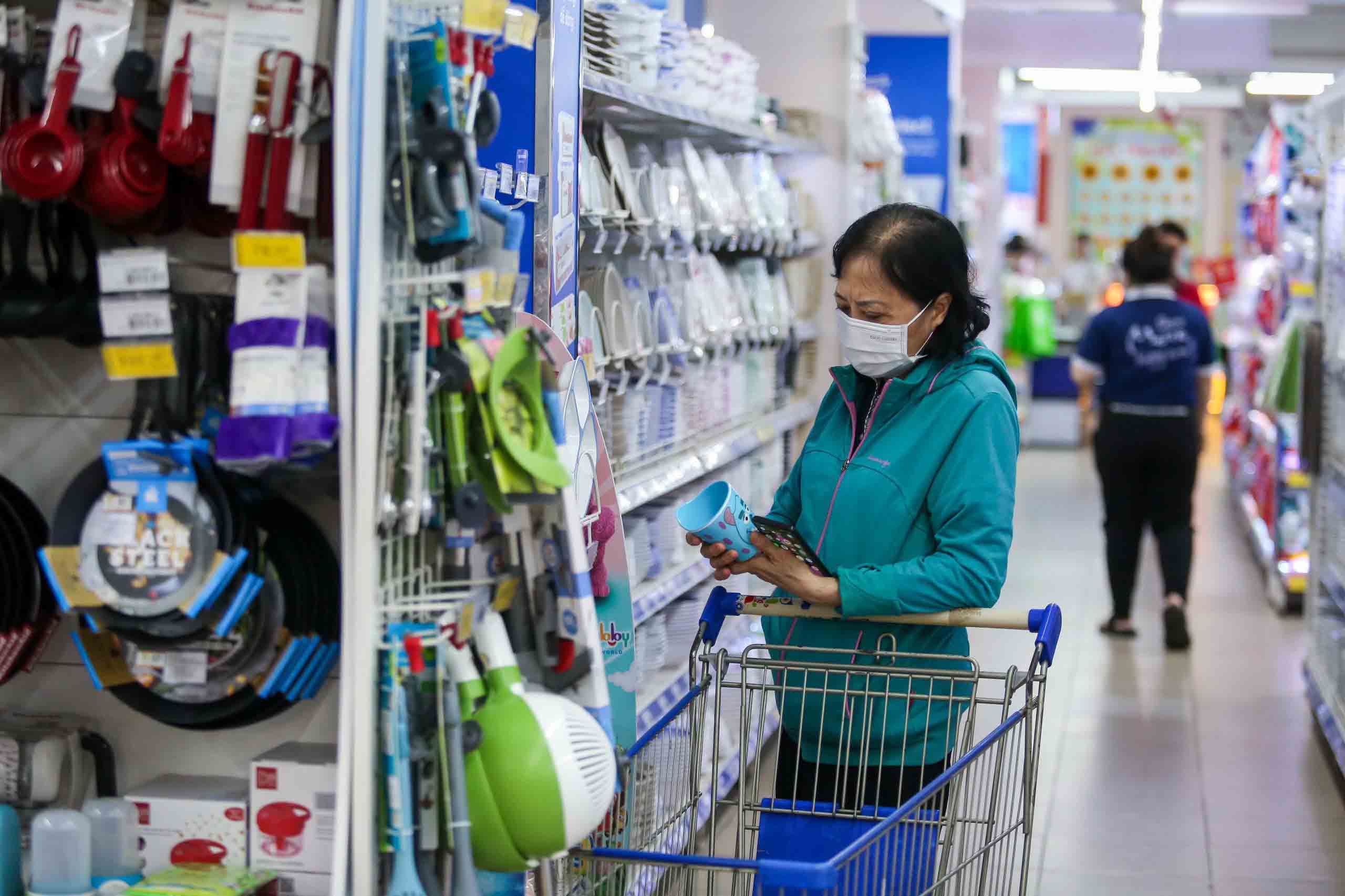

Consumer prices have been assessed as rising recently.

This tax deduction has been maintained since 2020, while recently many essential goods and services have increased faster than income. According to the General Statistics Office, compared to 2020, the price of education services increased by 17%, food prices increased by 27%, and gasoline prices increased by as much as 105%... "If we have to wait another two years (until 2026) to approve the proposed amendment to the Personal Income Tax Law, many people will have to tighten their belts but will still be subject to paying personal income tax," Ms. Thuy said, and suggested that the Government should submit the amendment to the Personal Income Tax Law to the National Assembly in October of this year for approval at the May 2025 session.

Representative Dang Bich Ngoc (Hoa Binh delegation) cited figures showing that the personal income tax settlement in 2009 was 14,318 billion VND, rising to 162,790 billion VND in 2022, accounting for 11.2% of total domestic revenue and 11.4 times the 2009 settlement amount. Ms. Ngoc proposed that the Government should soon research and comprehensively amend the Personal Income Tax Law to only tax high-income earners. This would be consistent with the scale of economic development and would not negatively impact low-income earners.

In his explanation that afternoon, Minister of Finance Ho Duc Phoc stated that personal income tax (PIT) was first applied in 2009, with an initial tax base of 4 million VND and a dependent deduction of 1.6 million VND per person. After adjustments in 2013, the tax base was 9 million VND and the deduction was 3.6 million VND. According to the law, when the CPI fluctuates by more than 20%, the Standing Committee of the National Assembly will adjust the family allowance deduction. In 2020, the National Assembly passed a resolution increasing the income tax base from 11 million VND and the dependent deduction to 4.4 million VND.

Explaining why the personal income tax rate has not been adjusted, Mr. Phớc said that the current average income, according to the General Statistics Office, is 4.46 million VND/person/month, while the tax rate is from 11 million VND, which is 2.2 times higher than the average income, and less than 1 time higher than the global average.

"Besides, the CPI has only increased by 11.47% since 2020. According to the law, the personal allowance deduction only needs to increase by over 20%. Therefore, the Ministry of Finance is acting in accordance with the law on personal allowance deductions," Mr. Phớc said, adding that the National Assembly Standing Committee has included the adjustment of personal income tax in its legislative agenda. Accordingly, the Personal Income Tax Law will be amended in October 2025 and may be passed at the May 2026 session. However, "if the National Assembly Standing Committee decides to draft the law at the end of this year and apply it from 2025, we will comply," Mr. Phớc said.

Source: https://thanhnien.vn/nguoi-dan-that-lung-buoc-bung-dong-thue-thu-nhap-185240529235040122.htm

![[Photo] Walking amidst the coffee blossoms in the Central Highlands](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2026/02/22/1771736214034_ndo_bl_img-3460-8365-jpg.webp)

Comment (0)