State Bank strives to remove difficulties

Real estate is one of the risky sectors, not on the priority list. However, this is still a major contributor to the economy, so banks are still open to lending for real estate.

The State Bank of Vietnam (SBV) has also issued many regulations and circulars to support the real estate market: Circular 02/2023/TT-NHNN regulating the restructuring of debt repayment terms and maintaining debt groups by credit institutions and foreign bank branches to support customers in difficulty; Circular 11/2022/TT-NHNN regulating bank guarantees; Managing the lowering of lending interest rates to support the development of the real estate market...

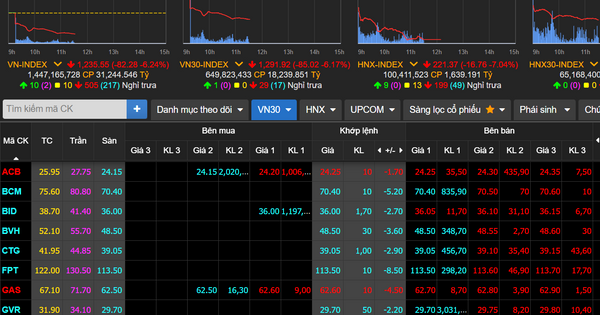

Governor of the State Bank of Vietnam Nguyen Thi Hong said that as of June 27, credit growth was 4.03% compared to the beginning of the year and 9.08% compared to the same period last year. In terms of structure, credit for real estate business in the first 5 months of the year increased by 14%.

Real estate is risky but banks are still open to lending in this field. Illustrative photo

Deputy Governor of the State Bank of Vietnam Dao Minh Tu said that the State Bank of Vietnam has directed commercial banks to implement a credit program of VND120,000 billion from capital sources of commercial banks with lending interest rates 1.5% - 2% lower than the average lending interest rates of banks in the market in accordance with the Government's direction for investors, buyers of social housing, workers' housing, and projects to renovate and rebuild old apartments.

Commercial banks open doors for real estate loans

Regarding commercial banks, Military Commercial Joint Stock Bank (MB) is one of the units that still has open doors for real estate loans.

Mr. Pham Nhu Anh, General Director of MB, said that in the first 6 months of 2023, the real estate market had many fluctuations. In that situation, the Government and the Prime Minister held many meetings and issued many resolutions and decrees to support the real estate market. The Government's decrees have created a legal corridor for localities to support investment funds in completing legal procedures, helping customers have a corridor to continue lending, supporting the real estate market.

On MB's side, it is determined that the real estate industry still plays an important role in economic development, greatly affecting other industries and professions, so MB still reserves credit room to finance this sector (about 20%).

Regarding policy, MB builds specific credit access orientations for each type of real estate, in which residential real estate focuses on the mid-range segment, serving the housing needs of the people. Promote access to real estate in industrial parks and export processing zones, creating a premise for the development of industries and manufacturing and processing with high technology content.

“Thanks to the flexible management policy of the State Bank, early allocation of credit growth limits has created favorable conditions to promote credit access. In the first 6 months of 2023, MB did not encounter a shortage of credit room for customers,” said the MB General Director.

Results of real estate credit situation in the first 6 months of 2023 at MB: Total outstanding debt in the real estate sector reached about 147,000 billion VND, up 4.2% compared to 2022, of which: 80% of outstanding real estate debt is loans to individual customers buying houses, equivalent to 115,400 billion VND for about 38,000 customers, accounting for 21.5% of total outstanding debt of MB; 20% of financing for corporate customers, approximately 31,600 billion VND with 165 customers, accounting for 6% of total outstanding debt of MB.

At the same time, the Joint Stock Commercial Bank for Investment and Development (BIDV) also opened its doors to real estate when implementing a social housing loan program according to Resolution No. 33/NQ-CP dated March 11, 2023 and Document 2308/NHNN-TD of the State Bank of Vietnam with a disbursement scale of VND 30,000 billion. BIDV is the first bank to announce the approval of credit for a social housing project in Phu Tho province in the program.

Still need to continue to remove difficulties

Mr. Pham Nhu Anh said that although the Government has closely directed to remove legal obstacles, according to Mr. Anh, the progress of resolution is still slow, especially in land valuation and planning approval, there are still problems with authority, procedures, and calculation methods at localities.

For corporate customers who are investors, they are facing difficulties and cannot complete the project according to the expected schedule due to legal problems, difficulties in capital sources, high debt pressure and maturing bonds, declining revenue, and home buyers putting pressure to return the product.

For individual homebuyers, in addition to the reduction in income to repay debt, legal problems of the project also cause loss of confidence for homebuyers, delay debt repayment, and affect the credit quality of the bank.

According to Mr. Anh, although there have been some positive changes, in the last 6 months of 2023 and 2024, the real estate market is expected to face many difficulties and potential risks, projects are still in the process of completing legal procedures, investors have not completed construction, and have not yet delivered products according to plan. The decline in homebuyers' confidence has directly affected their demand for loans, compliance with payment commitments under the sales contract with investors, and loan repayment commitments with banks.

Source

![[Photo] Special relics at the Vietnam Military History Museum associated with the heroic April 30th](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/3/a49d65b17b804e398de42bc2caba8368)

![[Photo] General Secretary To Lam receives Japanese Ambassador to Vietnam Ito Naoki](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/3/3a5d233bc09d4928ac9bfed97674be98)

![[Photo] Moment of love: Myanmar people are moved to thank Vietnamese soldiers](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/3/9b2e07196eb14aa5aacb1bc9e067ae6f)

Comment (0)