On November 27, the Russian Central Bank said it would stop buying foreign currency to reduce pressure on financial markets.

|

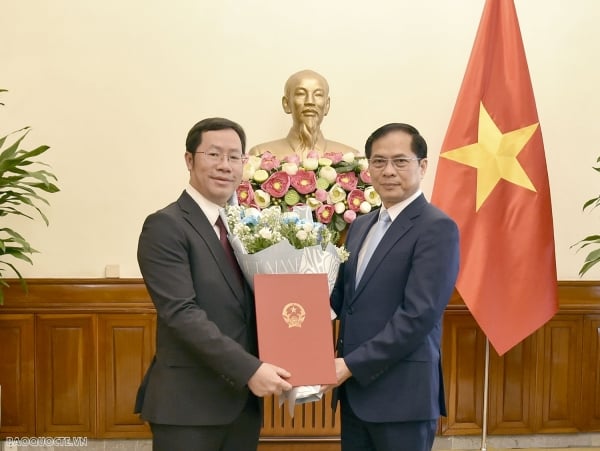

| The Ruble price plummeted, the Russian Central Bank continued to sell foreign currency to supplement the National Wealth Fund. (Source: Reuters) |

Specifically, the Bank has decided not to buy foreign currency in the domestic market from November 28 until the end of this year to reduce fluctuations in the financial market.

During the trading session on November 27, according to LSEG data, the Ruble at one point fell 7.25% to 113.15 Rubles per USD.

This development continues to fuel inflation, which is running at around 8% per year.

Russia's central bank estimates that every 10% fall in the ruble increases inflation by 0.5 percentage points, meaning the ruble's four-month decline could add 1.5 percentage points to inflation.

In parallel with the temporary suspension of USD purchases, the management agency will continue to sell foreign currency to supplement the National Wealth Fund.

Currently, foreign currency sales are worth about 8.4 billion rubles ($74 million) a day. However, these delayed dollar purchases will only resume in 2025, when the financial situation is more stable.

This is not the first time the Russian central bank has used this method. Last year, the agency also stopped buying dollars from August until the end of the year to prevent the ruble from weakening following sanctions related to the conflict in Ukraine.

However, the current situation is somewhat different.

New US sanctions target Gazprombank, Moscow's third-largest bank and a key player in processing payments for energy exports.

This restriction not only makes it difficult for foreign currency to flow into the country but also complicates international trade transactions.

Source: https://baoquocte.vn/nga-thong-bao-ngung-mua-ngoai-te-295413.html

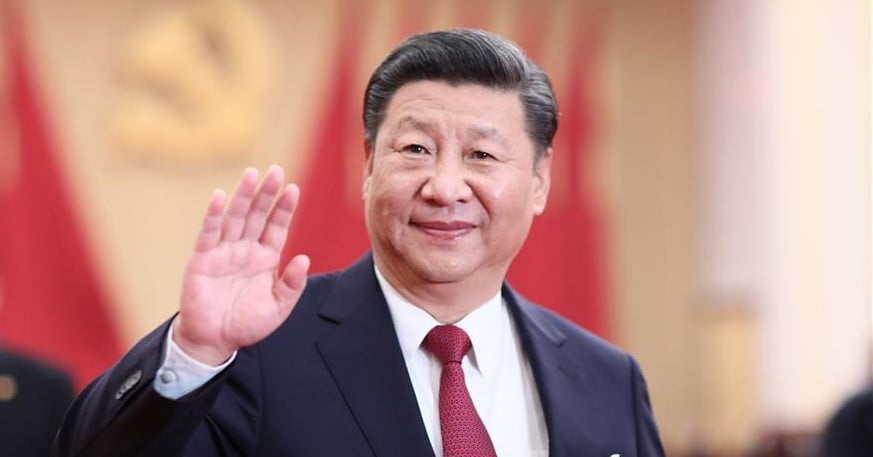

![[Photo] General Secretary and President of China Xi Jinping arrives in Hanoi, starting a State visit to Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/9e05688222c3405cb096618cb152bfd1)

![[Photo] Prime Minister Pham Minh Chinh receives Chairman of Commercial Aircraft Corporation of China (COMAC)](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/93ca0d1f537f48d3a8b2c9fe3c1e63ea)

![[Photo] Chinese youth delegates learn about the culture of Vietnamese ethnic groups](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/a1eeb0658ccf42ec900133c2ba83826c)

Comment (0)