Royal International Joint Stock Company (RIC) is a foreign-invested company, established in 1994. The company's main activities include: operating the 5-star Sheraton Royal hotel system; Royal villa and restaurant area; entertainment area with prizes for foreigners and the coastal commercial area of Royal Park...

According to the recently released Q4/2023 Financial Report, RIC's net revenue for the last quarter of the year was nearly VND25 billion, up 21% over the same period last year, coming from two activities: clubs (accounting for 56%) and hotels - villas (accounting for 44%). However, continuing to operate below cost price still caused RIC to incur a gross loss of more than VND5 billion.

Financial revenue increased by more than VND2 billion, thanks to the evaluation of exchange rate differences at the end of the period. However, financial expenses also increased by nearly VND6 billion, due to the increase in outstanding loan principal.

The positive point is that RIC has reduced sales costs and business management costs to nearly 4 billion VND and nearly 7 billion VND.

Ultimately, RIC posted a net loss of more than VND18 billion, not as much as the same period last year, but marking the 17th consecutive quarter of losses. The last time investors saw RIC make a profit was in the third quarter of 2019.

According to RIC, the economic situation in 2023 in general and the tourism market in particular after the pandemic will still face many difficulties, with domestic people limiting travel. In addition, in the fourth quarter of 2023, China - a market that contributes a large number of international visitors to RIC - will still apply measures to restrict people from traveling abroad, leading to a sharp decrease in the number of visitors.

Accumulated for the whole year of 2023, RIC's net revenue decreased by 5% to nearly 112 billion VND and net loss was nearly 73 billion VND, marking 5 consecutive years of only knowing the smell of loss.

Previously, the consecutive losses in 2019, 2020, 2021 were also the main reason why RIC shares were delisted from HOSE from May 13, 2022, to switch to trading on UPCoM from May 26, 2022. Since then, RIC shares have been priced at only VND 4,000/share for a cup of iced tea at the end of January 22, 2024.

As of December 31, 2023, RIC's total assets were over VND 904 billion, down 3% compared to the beginning of the year. Of which, fixed assets accounted for 88%, equivalent to a value of over VND 795 billion, down 3%.

Regarding capital structure, RIC has outstanding loans of more than VND181 billion (accounting for 20%), up 15% compared to the beginning of the year. In addition, with continuous losses, RIC's undistributed profits are negative VND548 billion.

Source

![[Photo] Official welcoming ceremony for the King and Queen of the Kingdom of Belgium](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/9e1e23e54fad482aa7680fa5d11a1480)

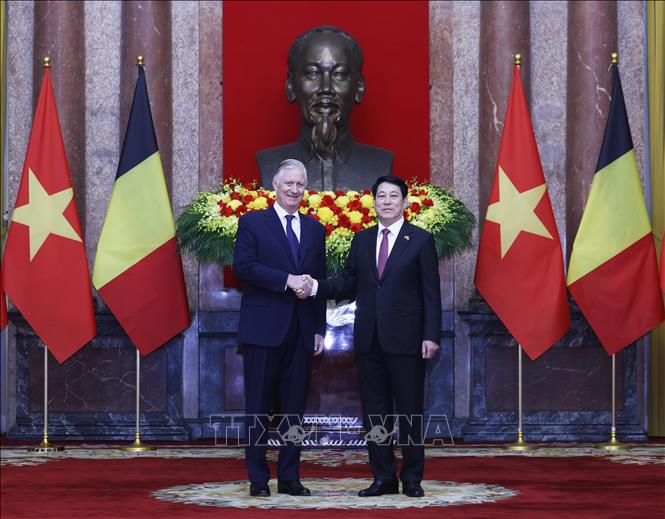

![[Photo] President Luong Cuong meets with King Philippe of Belgium](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/1ce6351a31734a1a833f595a89648faf)

![[Photo] Queen of the Kingdom of Belgium and the wife of President Luong Cuong visit Uncle Ho's Stilt House](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/9752eee556e54ac481c172c1130520cd)

![[Photo] National Assembly Chairman Tran Thanh Man meets with King Philippe of Belgium](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/c6fb3ef1d4504726a738406fb7e6273f)

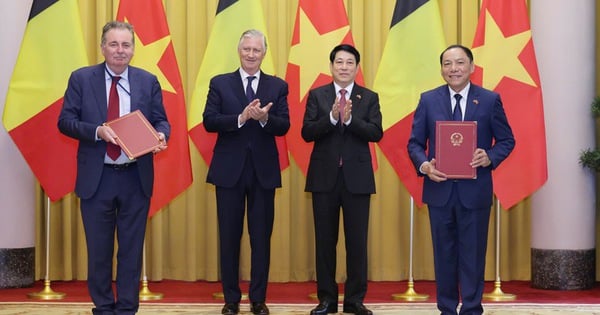

![[Photo] President Luong Cuong and the King of Belgium witness the Vietnam-Belgium document exchange ceremony](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/df43237b0d2d4f1997892fe485bd05a2)

![[Infographic] - Planning for Quang Nam seaport waters in the 2021-2030 period requires about 5,236 billion VND](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/02cef2d3a85748d9b4786ad363a72693)

Comment (0)