HSBC expects the State Bank of Vietnam to keep its policy rate unchanged at 4.5% throughout 2024, as it forecasts inflation this year at 3.4%, much lower than its new inflation target of 4-4.5%.

|

| Export growth will contribute significantly to improving Vietnam's current account balance in 2023 - Photo: Dinh Hai |

In a recently released report, HSBC said that inflation is still a matter of concern for Vietnam, and price pressures have not completely disappeared. The risk of rising inflation due to energy and food remains, especially in the context that Vietnam is quite sensitive to these items due to their large proportion in the inflation calculation basket.

Rising healthcare costs are also a matter of close attention after Vietnam resumed its nationwide healthcare price adjustment after a four-year period. While mindful of the risk of price increases, HSBC expects the State Bank of Vietnam to keep its policy rate unchanged at 4.5% throughout 2024.

Previously, at a press conference on January 3, announcing the results of monetary policy management in 2023 and information on monetary policy orientation for the new year, the State Bank did not raise the issue of increasing interest rates in 2024.

In 2024, the State Bank granted a credit growth limit of 15% to banks at the beginning of the year. Standing Deputy Governor Dao Minh Tu chaired a press conference, saying that granting the credit growth limit is expected to contribute to creating demand to boost economic growth.

According to HSBC, the gradual recovery of external sectors brings good news to Vietnam's current account balance, which in some ways also helps protect the VND. After two consecutive years of current account deficit, Vietnam's current account balance is also on track to return to a fairly large surplus. The current account balance surplus in 2023 is due to stable remittances, increased tourism revenue and, most importantly, improved trade in the last six months of the year.

HSBC estimates the current account balance, calculated on the basis of the last four quarters, to be in surplus by Q3 2023 at nearly 5% of GDP, matching historical highs since 2019. Given the significant improvement in the trade surplus in Q4 2023, this trend is likely to continue even stronger.

HSBC believes that in 2024, a key policy focus for Vietnam will be the impact of a minimum corporate tax of 15%, in line with OECD international standards, on the prospect of attracting foreign direct investment (FDI) - an area in which Vietnam has consistently outperformed other countries in recent years.

“While it is too early to assess the impact, we believe it is likely to be manageable. We will closely monitor how the additional tax revenue is managed and what other methods or incentives will be used to offset the increased tax,” HSBC said in the report.

HSBC believes that Vietnam is on track to recover, with the potential to regain its 6% trend growth in 2024. As FDI inflows continue to increase production capacity, the manufacturing sector will show signs of recovery, providing opportunities for the export sector.

Source link

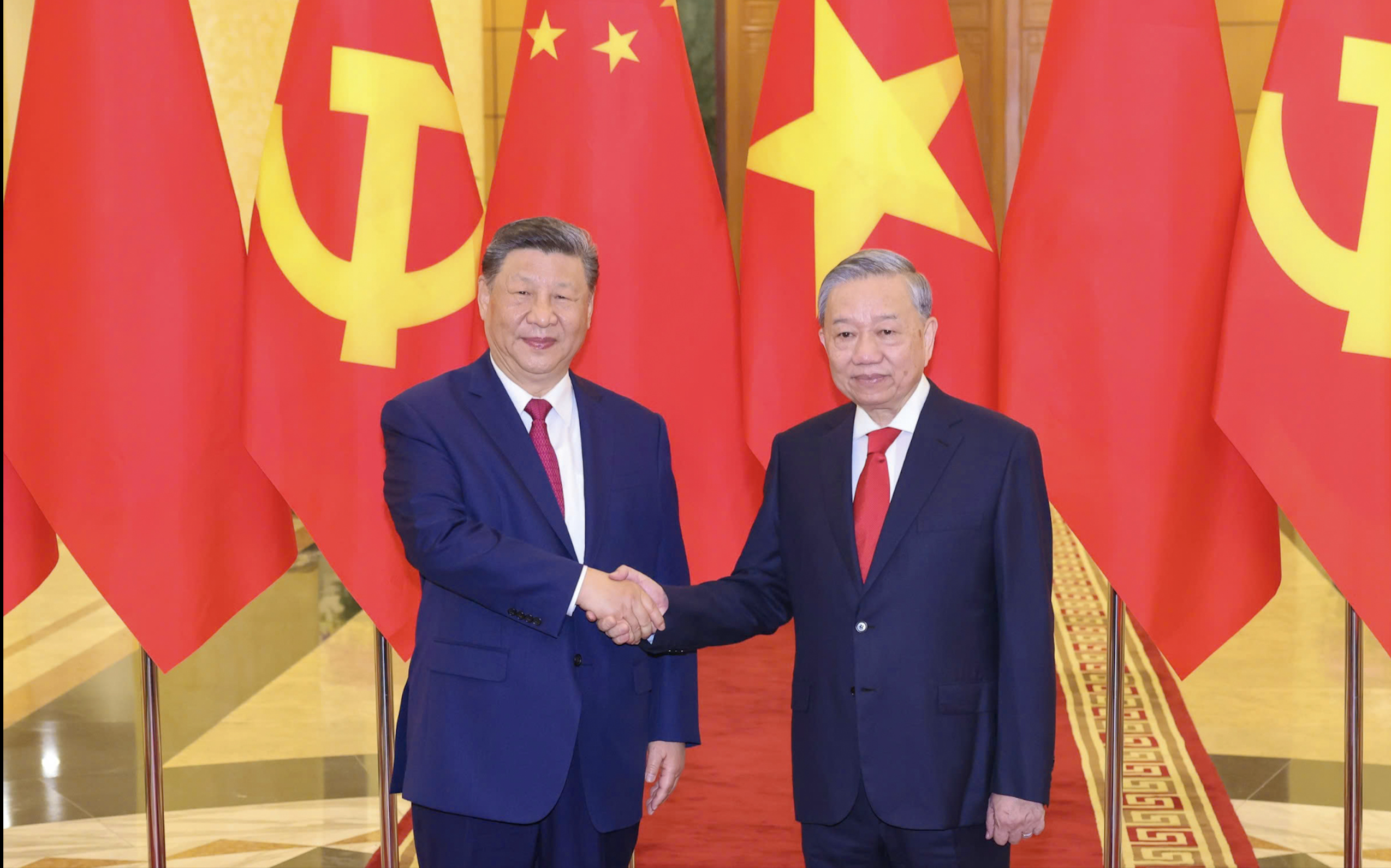

![[Photo] National Assembly Chairman Tran Thanh Man meets with General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/4e8fab54da744230b54598eff0070485)

![[Photo] Reception to welcome General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/9afa04a20e6441ca971f6f6b0c904ec2)

![[Photo] General Secretary To Lam holds talks with General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/b3d07714dc6b4831833b48e0385d75c1)

![[Photo] Prime Minister Pham Minh Chinh meets with General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/893f1141468a49e29fb42607a670b174)

Comment (0)