The General Department of Taxation (Ministry of Finance) has just sent a document to the tax departments of provinces and centrally-run cities and the tax departments of large enterprises on preventing and handling the situation of selling invoices on cyberspace.

Accordingly, the General Department of Taxation has recently directed tax authorities at all levels to strengthen solutions to prevent, detect and handle violations of the law on invoices; strengthen inspections to detect taxpayers with signs of invoice risks, and combat invoice fraud.

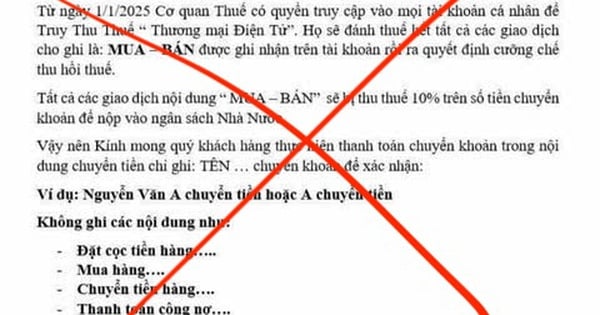

However, the situation of buying and selling electronic invoices on cyberspace still takes place openly with a complicated trend despite many cases. Buying and selling invoices and documents for budget payment has been criminally prosecuted.

To further improve the prevention and control of the buying and selling of electronic invoices, especially the advertising and selling of invoices on cyberspace, the General Department of Taxation requests tax departments of provinces and centrally run cities to drastically implement a number of measures.

Tax units are required to step up the synchronous implementation of solutions to prevent the buying and selling of invoices on cyberspace, proactively collect information about subjects selling invoices on cyberspace in the area... At the same time, take measures to prevent the dissemination and posting of information on the sale of electronic invoices on cyberspace and promptly investigate and handle violations of the law by subjects.

In addition, tax units must screen businesses at high risk of using illegal invoices and illegally using invoices; inspect and check to promptly detect violations; pay special attention to acts of buying and selling invoices in many provinces and cities to promptly provide information to local tax authorities for handling.

At the same time, when detecting signs of violations, tax authorities at all levels proactively coordinate closely with police agencies at the same level to handle them according to regulations.

The General Department of Taxation requires regular updates from competent authorities on organizations and individuals in the area managed by the tax department that have been prosecuted and investigated for signs of invoice trading crimes to promptly report to the General Department of Taxation.

Source

Comment (0)