Clear mission

State budget revenue has been a bright spot in Hai Duong province's economy in recent times, especially in 2024 when total budget revenue exceeded VND30,000 billion for the first time, reaching an all-time high.

In 2025, Hai Duong province is assigned to collect domestic tax of VND 23,680 billion and import-export tax of VND 3,900 billion. However, based on the results achieved in 2024, Hai Duong has developed a scenario to strive for a state budget revenue of VND 31,900 billion. Of which, domestic budget revenue will reach VND 28,000 billion, an increase of 7.5% compared to 2024, an increase of over 18.2% compared to the domestic revenue estimate for the whole year.

Specifically, in the first quarter of 2025, Hai Duong strives to collect VND9,375 billion in state budget revenue, of which domestic revenue is VND8,400 billion, an increase of 30.2% over the same period in 2024. In the second and third quarters, the province strives to collect VND7,135 billion each quarter, of which domestic revenue is VND6,160 billion, an increase of 1.6% and 6% over the same period, respectively. In the fourth quarter, it strives to collect VND8,255 billion, of which domestic revenue is VND7,280 billion, equivalent to the same period in 2024.

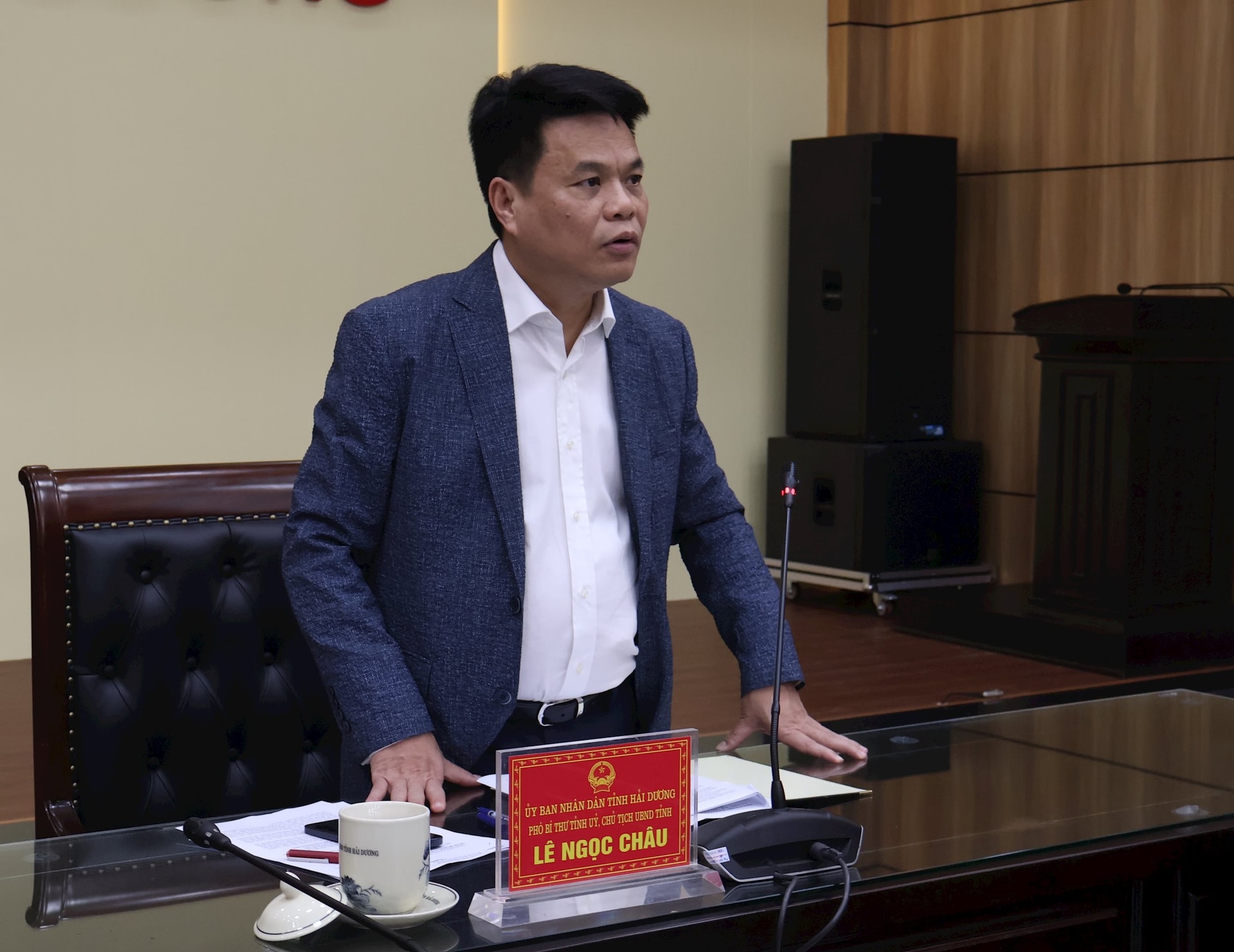

However, it is forecasted that in 2025, the world economy will continue to develop in a complex and unpredictable manner, greatly affecting the domestic and provincial economies, some revenue sources may continue to decrease... so budget collection will face many difficulties. In order to complete the task of collecting the state budget at the highest level, from the beginning of this year, the Provincial People's Committee has directed departments, branches and localities to strengthen collection measures, deploy many positive solutions to proactively reform collection work. Branches and localities must analyze and closely assess the situation, prepare scenarios, with specific solutions and main tasks.

Stick to reality, act effectively

According to the Hai Duong Tax Department, as of February 21, the total domestic tax revenue of the province reached nearly VND5,841 billion, equal to 25% of the assigned estimate and increased by 22% over the same period last year. Excluding land use fees, lottery, profits, and dividends, the total domestic tax revenue reached nearly VND4,956 billion, equal to 32% of the assigned estimate and increased by 32%.

Areas with large revenue potential currently achieve high revenue rates such as the foreign-invested enterprise sector reaching 33%; the local state-owned enterprise sector reaching 40% and the non-state tax collection sector reaching 46%, all compared to the annual revenue estimate. The rates of registration fee collection, fees, charges, and personal income tax collection compared to the annual estimate are all better than the average rate.

From the beginning of the year to February 21, the revenue from 15 key enterprises reached nearly 1,855 billion VND. Among them, there are high domestic tax payments such as the following companies: Ford Vietnam Co., Ltd., Hoa Phat Steel JSC, Hoa Phat Energy JSC, Brother Vietnam Industrial Co., Ltd., Jaks Electricity, Oriental Sports Vietnam Industrial JSC, Hai Duong Petroleum Supplies JSC...

In 2024, Hai Duong Petroleum Supplies Joint Stock Company will have a revenue of 7,100 billion VND, paying 592 billion VND to the budget. This is the enterprise paying the largest environmental protection tax in the province. This year, the unit strives to increase its budget payment by 10% compared to 2024. "To ensure business efficiency and serve as a basis for budget payment, we focus our budget payment sources on Hai Duong province, where our headquarters is located. Continue to coordinate and support partners, especially traders who have received the right to retail gasoline...", Mr. Nguyen Tuan Anh, Director of Hai Duong Petroleum Supplies Joint Stock Company shared.

In 2025, Hai Duong City is assigned the largest budget revenue estimate among localities, striving to reach nearly 8,500 billion VND, an increase of over 16.4% of the assigned estimate, of which land use fees are nearly 7,500 billion VND. To achieve this goal, Hai Duong City has developed a revenue scenario that closely follows the characteristics and advantages in production and business of each unit and locality on a monthly basis.

From the beginning of the year to February 18, the total domestic tax revenue minus land use fees managed by the Hai Duong City Tax Department reached nearly VND274 billion, equal to 28% of the annual estimate and up 68% over the same period last year. Of which, non-state tax revenue, mainly value added tax and corporate income tax, reached nearly VND161 billion, equal to 36% of the annual estimate and up 60%. Business license fee revenue reached over VND11 billion, exceeding the estimate by 4% and up 5%.

Other localities are not left behind in the "race". In the first two months of the year, the Nam Thanh Tax Department collected nearly 239 billion VND in land use fees. According to Mr. Hoang Phuong, Head of the Nam Thanh Tax Department, this revenue was mainly collected in Thanh Ha district. This is the result of the proactive and effective coordination of authorities at all levels and relevant sectors in removing existing difficulties of investment projects to build residential and urban areas, especially problems related to site clearance.

In recent days, the provincial Tax Department has stepped up propaganda, dialogue, and solving tax problems, focusing on guiding and supporting taxpayers to implement the Government's policies on removing difficulties for production and business. "The tax sector has strengthened inspection, examination, and support for organizations and individuals to promptly declare correctly and pay fully, especially in foreign investment areas; land use fees, land rent; e-commerce activities; production and trading of construction materials, especially filling materials...", said Mr. Do Cong Tien, Director of Hai Duong Tax Department.

Hai Duong Customs Branch strives to collect import-export taxes of VND5,000 to VND5,300 billion in 2025, an increase of 14.4 - 21.3% compared to 2024 and exceeding the assigned estimate by 28.2% to nearly 35.9%. To best complete the task of collecting the state budget, since the beginning of the year, each department and civil servant of the unit has coordinated with relevant forces of the province to combat revenue loss through import-export management, proactively combat, prevent and promptly and strictly handle acts of smuggling and trade fraud. "The unit has launched emulation and determined growth targets for each specific month," informed Mr. Nguyen Van Thanh, Head of Hai Duong Customs Branch.

LONG THANHSource: https://baohaiduong.vn/hai-duong-chu-dong-thu-ngan-sach-ngay-tu-dau-nam-405885.html

![[Photo] Prime Minister Pham Minh Chinh receives Chairman of Commercial Aircraft Corporation of China (COMAC)](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/93ca0d1f537f48d3a8b2c9fe3c1e63ea)

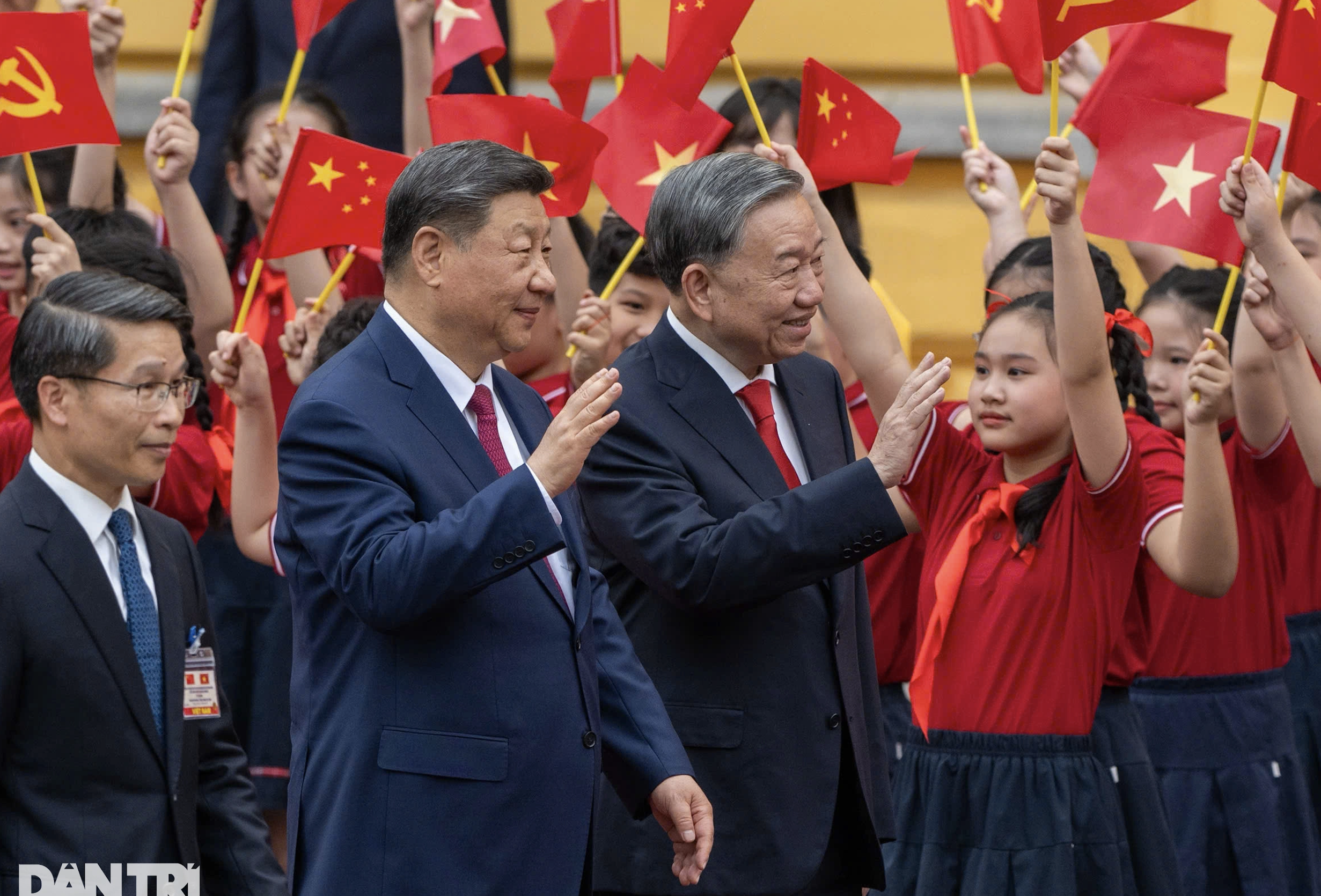

![[Photo] General Secretary and President of China Xi Jinping arrives in Hanoi, starting a State visit to Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/9e05688222c3405cb096618cb152bfd1)

Comment (0)