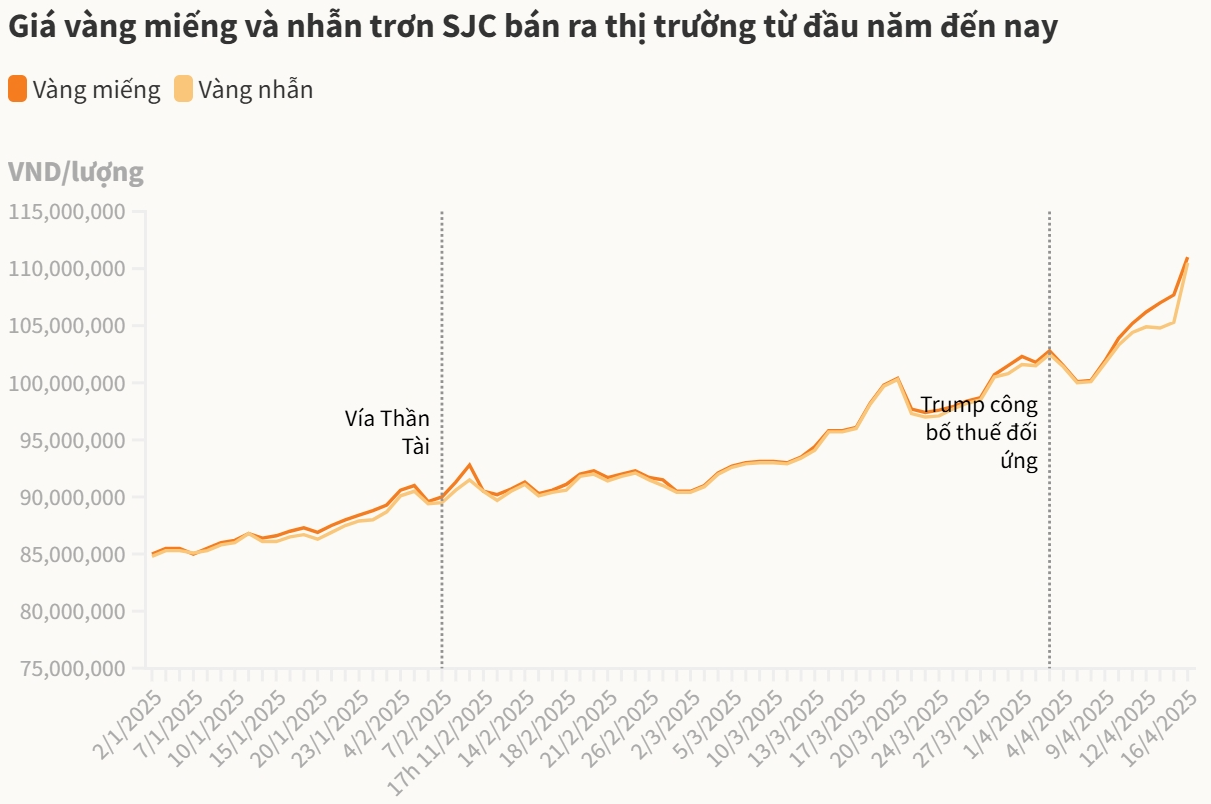

Domestic gold prices by early afternoon today increased sharply by 3-5 million VND per tael compared to the beginning of the day and were 7-8 million VND higher than the world price.

At 10:30, each tael of SJC gold bar increased sharply to the range of 108.5 - 111 million VND. In total, brands increased the buying and selling price of gold bars by 3 million VND this morning.

Plain gold rings have also increased sharply by VND5 million per tael after two adjustments, reaching approximately the same price as gold bars. Accordingly, SJC listed the price of plain rings at VND108 - 110.5 million per tael. Bao Tin Minh Chau buys and sells plain rings at VND108.3 - 111 million.

Earlier, on opening day, Saigon Jewelry Company (SJC) announced gold price pieces of 106.8 - 109.8 million VND, an increase of 1.3 million VND for buying and 1.8 million VND for selling compared to the end of yesterday. Some other major brands also listed corresponding gold bar prices. At Mi Hong, gold bars are bought and sold at 107.5 - 110.5 million VND per tael. The difference between buying and selling prices widened to 3 million VND per tael.

At the same time, SJC raised the price of plain rings to 105.3 - 108.8 million, 2.3 million VND higher for buying and 2.8 million VND higher for selling compared to yesterday. Bao Tin Minh Chau raised the price of plain rings to 106.5 - 109.5 million VND per tael.

Compared to the beginning of the year, each tael of gold increased by nearly 22 million VND. Investors who bought gold at the beginning of the year can record a profit of more than 25% up to this point.

Currently, the domestic gold price is also increasing faster than the precious metal in the international market. This morning, the domestic gold price is 6-7 million VND per tael higher than the world price, if converted according to Vietcombank's selling rate (excluding taxes and fees). At 9:00 a.m. Hanoi time, the spot gold price reached a record high of 3,271 USD per ounce, equivalent to 102.5 million VND per tael.

Goldman Sachs recently predicted that gold prices could reach $4,000 next year, thanks to central banks and ETFs buying in anticipation of a recession. Analysts at Goldman Sachs said central banks' demand for gold could average 80 tons per month this year, up from their previous estimate of 70 tons. Rising recession risks will also boost gold ETFs.

"Recent trading activity suggests that investors are seeking refuge amid rising recession risks and falling risk asset prices," Goldman Sachs said. The bank now sees a 45% chance of a US recession in the next 12 months. If that scenario plays out, "gold ETFs would accelerate their purchases, pushing prices to $3,880 by the end of the year."

Source

![[Photo] Prime Minister Pham Minh Chinh receives Mr. Jefferey Perlman, CEO of Warburg Pincus Group (USA)](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/18/c37781eeb50342f09d8fe6841db2426c)

Comment (0)