Last September, social network X was valued at just under $10 billion. But in a recent secondary deal, investors valued X at $44 billion.

Billionaire Elon Musk. Photo: X/elonmusk

Since taking over, Musk has loosened the platform’s moderation policies, leading to a exodus of advertisers. The company’s valuation has fallen below $10 billion, according to a disclosure from Fidelity Investments in late September. However, X reported about $1.2 billion in adjusted earnings before interest, taxes, depreciation, and amortization in 2024, which is about the same as before Musk took over.

A group of seven Wall Street banks, including Morgan Stanley, Bank of America, Barclays and MUFG, sold nearly all of the $12.5 billion loan Musk used to finance his 2022 acquisition of Twitter. Investor interest in the loans surged after Trump’s election victory in November, given Musk’s close ties to the new administration.

Additionally, Musk transferred a 25% stake in his artificial intelligence startup xAI to X investors early last year. xAI is now valued at $45 billion, providing new security for X’s creditors and boosting the platform’s value.

To diversify its revenue streams, X plans to launch X Money, a peer-to-peer e-wallet and payment service, with Visa as its first partner. X also works closely with xAI to integrate AI technology into the platform, recently launching the latest version of its AI chatbot Grok 3 for premium users.

Cao Phong (according to X, FT, Forbes)

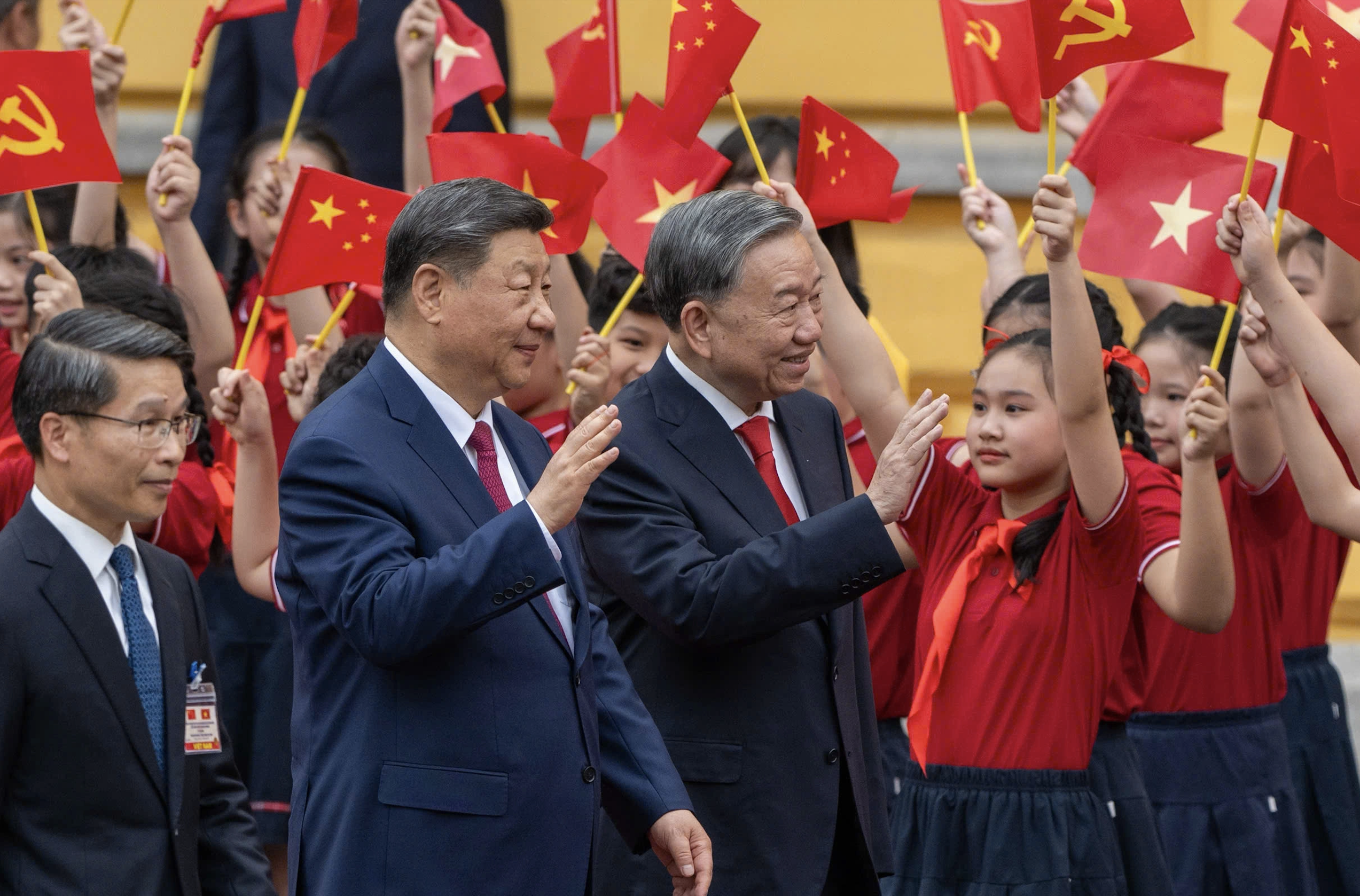

![[Photo] Ceremony to welcome General Secretary and President of China Xi Jinping on State visit to Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/5318f8c5aa8540d28a5a65b0a1f70959)

![[Photo] Hanoi people warmly welcome Chinese General Secretary and President Xi Jinping on his State visit to Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/d6ac6588b9324603b1c48a9df14d620c)

![[Photo] Prime Minister Pham Minh Chinh chairs conference to review the implementation of Resolution No. 18-NQ/TW](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/dcdb99e706e9448fb3fe81fec9cde410)

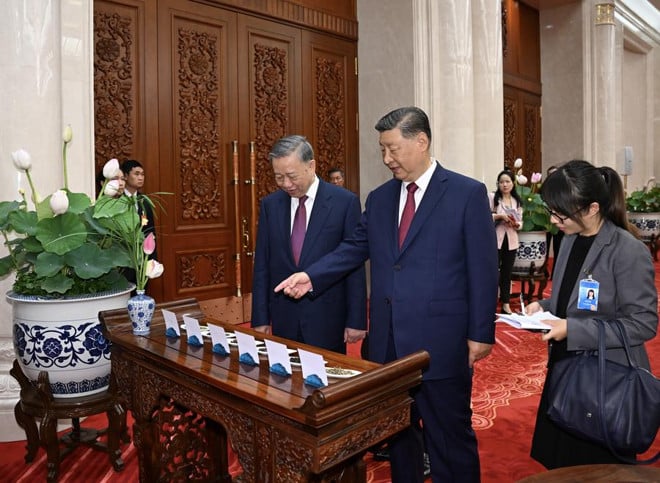

![[Photo] General Secretary To Lam holds talks with General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/b3d07714dc6b4831833b48e0385d75c1)

Comment (0)