Economists expect the U.S. personal consumption expenditures price index to be unchanged in May and the core index excluding food and energy to rise a minimum of 0.1%, based on the median forecast in a Bloomberg survey of economists.

The report, due Friday, is likely to show consumer prices rising 2.6% on an annual basis in both the headline and core measures. The expected increase in the core measure, which paints a better picture of underlying inflation, would still be the slowest since March 2021.

Since their last meeting, Fed officials have said that while they are encouraged by other inflation data — including consumer prices — they need to see several months of such progress before cutting rates. At the same time, the labor market — another part of the Fed’s dual mandate — remains strong, albeit at a slower pace. A “healthy” job market gives policymakers flexibility in when to cut rates.

The latest inflation figures, which will be accompanied by personal spending figures, will show spending on services, after recent retail sales data showed weaker demand for goods. Experts are calling for a modest increase in nominal personal consumption as well as incomes.

Economists do not believe that the slow pace of inflation will be enough to convince officials that by the time the Federal Open Market Committee (FOMC) meets in July 2024, inflation is on track to fall back to the Fed's 2% target.

Other data due next week will include consumer confidence for June 2024 and reports on new and existing home closings for May 2024.

In addition to the first-quarter economic growth forecast, the US government will release durable goods orders data for May 2024.

Source

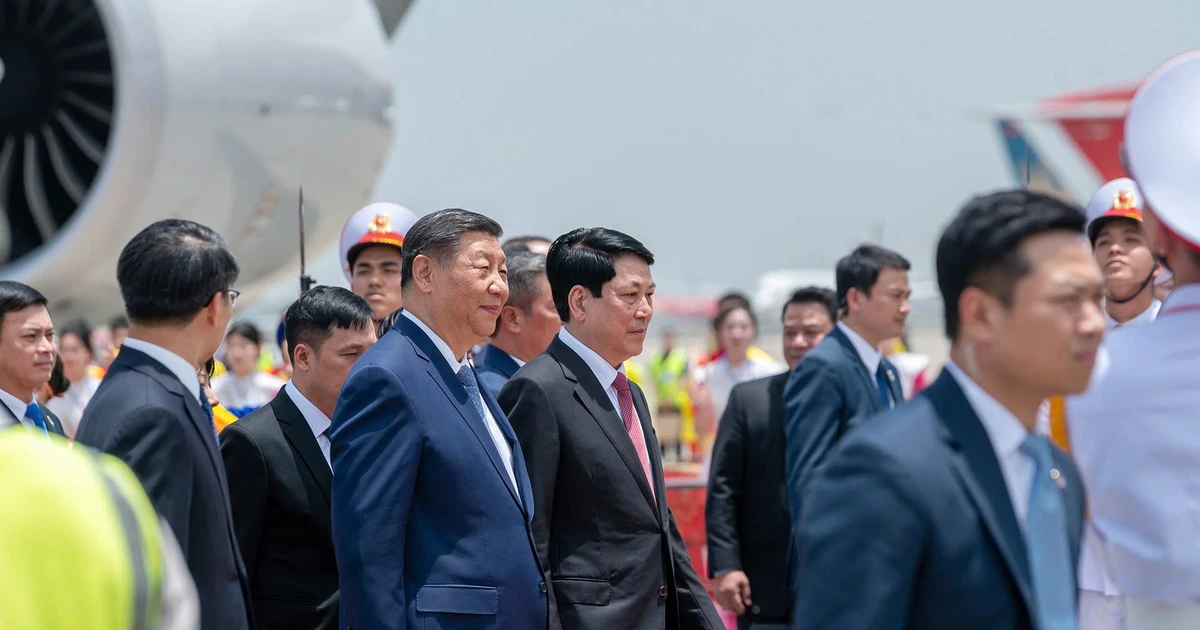

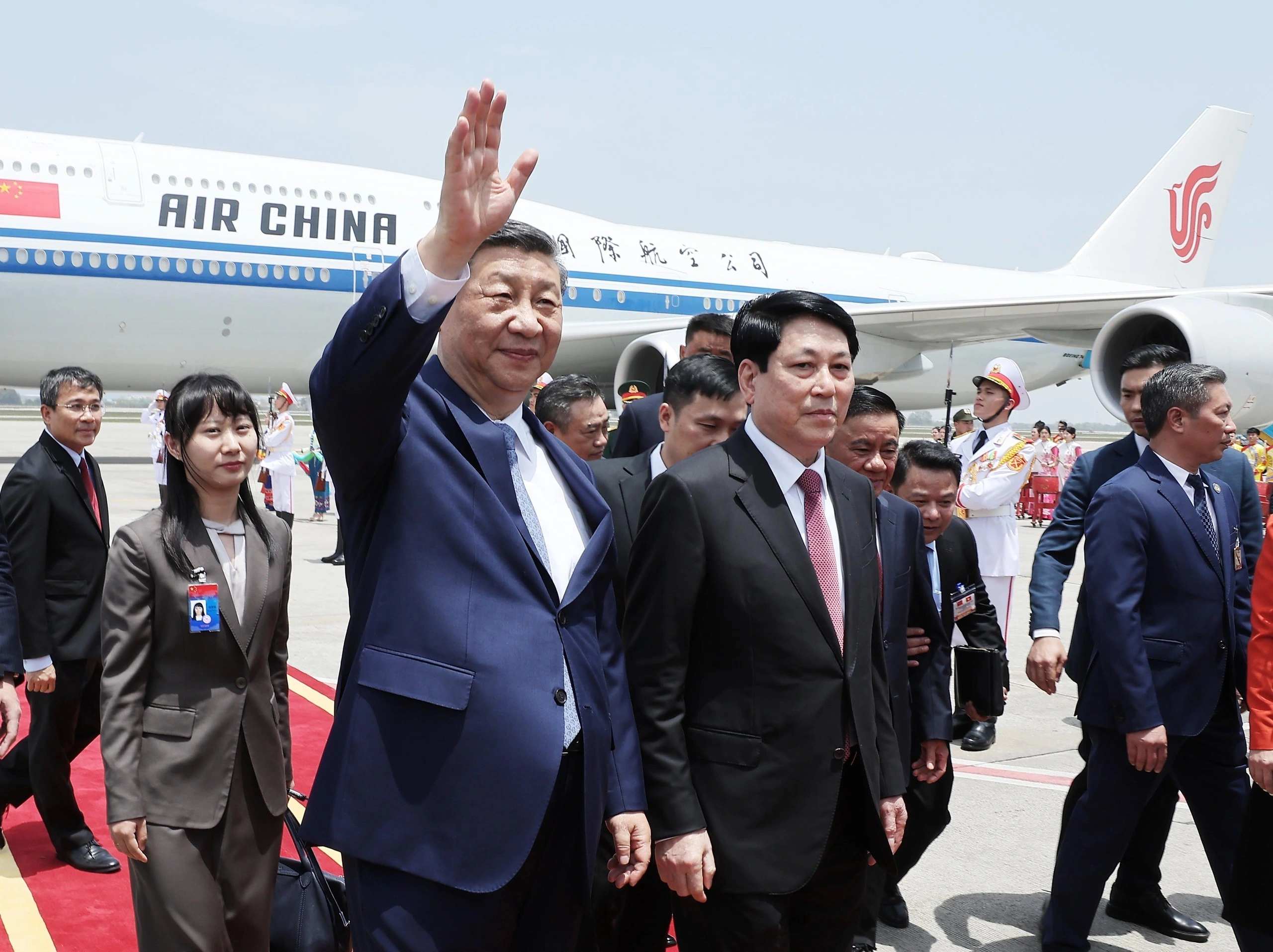

![[Photo] General Secretary and President of China Xi Jinping arrives in Hanoi, starting a State visit to Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/9e05688222c3405cb096618cb152bfd1)

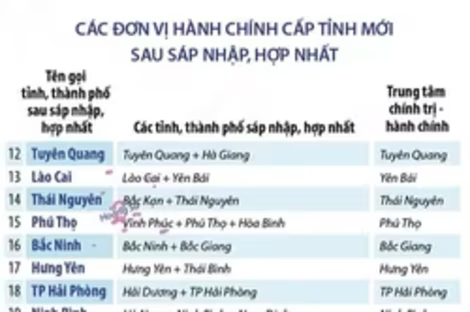

![[Photo] General Secretary To Lam chairs the third meeting to review the implementation of Resolution No. 18-NQ/TW](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/10f646e55e8e4f3b8c9ae2e35705481d)

Comment (0)