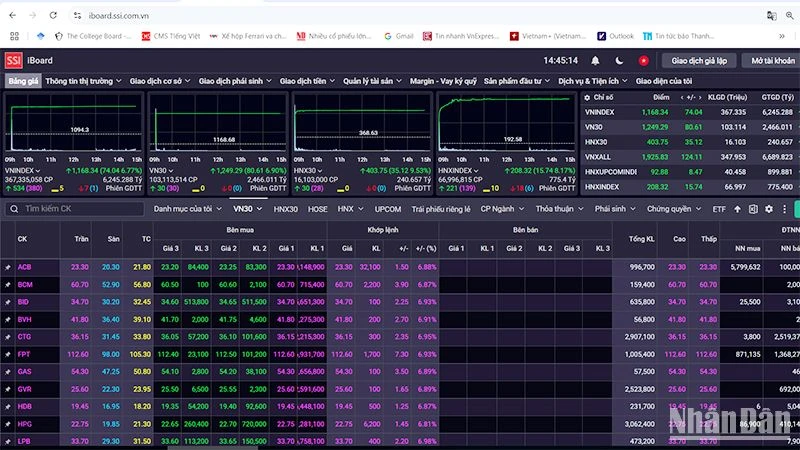

Green continued to cover the market with VN-Index increasing positively, thanks to the leadership of information technology, consumer services and securities groups.

These industry groups took turns leading the increase yesterday, contributing significantly to the index's increase, showing positive spread, creating a more solid foundation for the market's recovery. However, the risk is that the index may face significant pressure to shake again with high price supply around the near resistance levels.

The market in early August was full of turmoil when the VN-Index fluctuated strongly, with one session dropping by approximately 50 points. Looking back at July, it was also a series of not-so-positive days when the VN-Index fluctuated between 1,220 - 1,300 points, closing up only 0.5% compared to the previous month. The market's correction, in addition to being affected by the increasingly unstable political and international market context, was also a cyclical annual decline after the business results of enterprises were announced. However, after the correction, instead of worrying, investors should also see this as an opportunity.

Dr. Nguyen Duy Phuong, Investment Director of DGCapital, said that when corporate profits increase and stock prices become cheaper, many stocks will become more attractive. Although there are some general concerns from the international market, the domestic market is unlikely to fall too much further and will soon find its balance.

Opportunities are being given to both scenarios including a reversal or simply a period of accumulation, technical recovery before the downtrend returns. In the positive scenario, the support zone of 1,200 - 1,220 points is maintained and the resistance zone that needs to be conquered to regain a clearer positive signal will be around the threshold of 1,240 points (MA20). Along with that, the index needs to gather strong enough momentum from the support of large-cap groups and the response of active demand across a wide range of stocks in the entire market.

HSC Securities Company believes that the observation strategy should be maintained for new short-term buying positions. The positive changes in the last session of the week can be considered an opportunity for investors holding a high proportion of weak stocks to restructure their portfolios. Medium- and long-term positions are facing attractive opportunities, so pay attention to short-term deep corrections to accumulate, especially for potential stocks with a solid internal foundation.

Source: https://laodong.vn/kinh-doanh/don-cho-nhip-hoi-phuc-cua-chung-khoan-1379852.ldo

![[Photo] Opening of the 11th Conference of the 13th Party Central Committee](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/f9e717b67de343d7b687cb419c0829a2)

![[Photo] Unique folk games at Chuong Village Festival](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/cff805a06fdd443b9474c017f98075a4)

![[Photo] April Festival in Can Tho City](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/bf5ae82870e648fabfbcc93a25b481ea)

Comment (0)