Room hit ceiling, money hard to come out

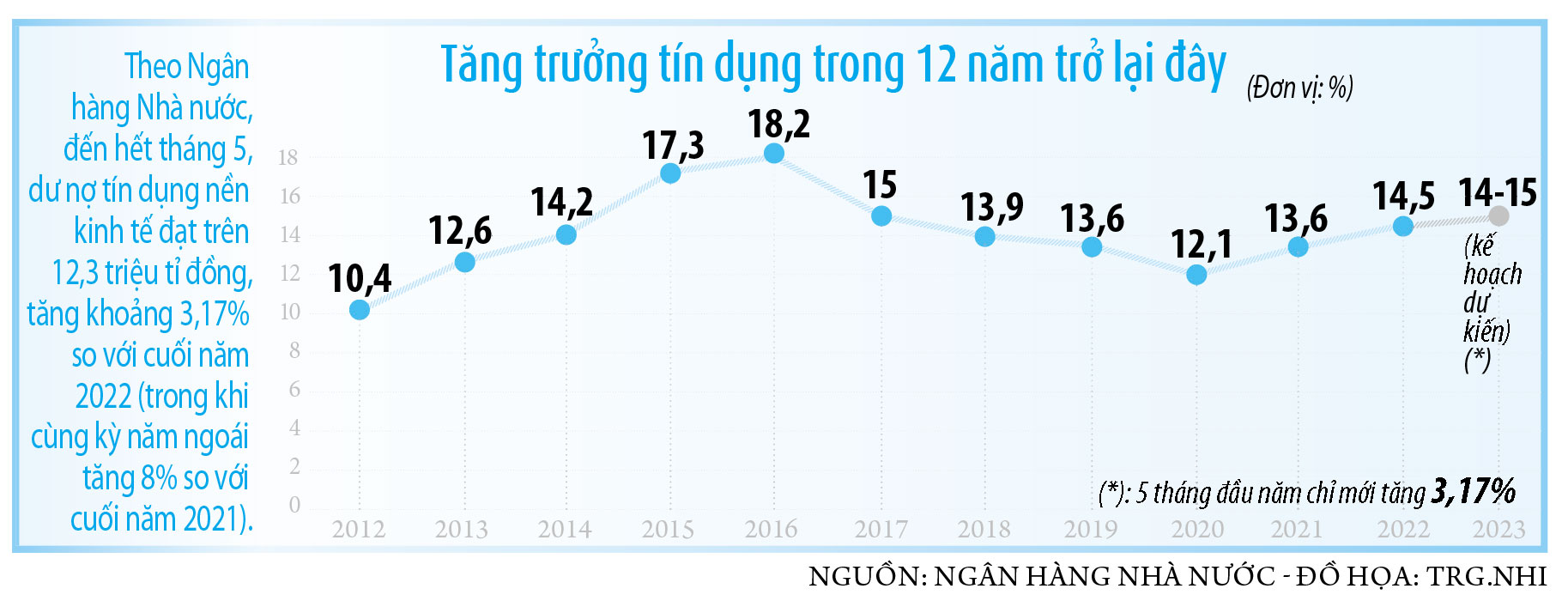

Recently, when customers ask to borrow money, some bank employees "urge" customers to quickly complete their applications because they are afraid of running out of credit room. Many businesses are not rejected outright, but their loan applications are "frozen" for a long time without knowing the reason. In fact, in just the first 3 months of the year, credit of some banks has increased rapidly, such as MSB increased by 13%, Techcombank increased by nearly 10.7%, HDBank increased by 9%; TPBank, Nam A Bank and VietABank increased by 7%... Compared with the credit room ratio allocated at the beginning of the year, it can be seen that most banks have almost reached the ceiling, meaning they have run out of credit quota to lend.

The State Bank needs to direct commercial banks to increase businesses' access to loans.

Not to mention, in just over the past month, many banks have spent tens of thousands of billions of VND to buy back bonds before maturity. For example, on May 29, Vietnam Joint Stock Commercial Bank for Investment and Development (BIDV) announced that it had bought back VND61 billion of 8-year bonds issued in May 2020. Previously, from the end of April to the beginning of May, this bank also continuously bought back many bonds before maturity with a total value of about VND2,500 billion.

Similarly, on May 18 and 19, Vietnam Maritime Commercial Joint Stock Bank (MSB) spent VND 2,700 billion to buy back two lots of bonds issued since May 2021; on May 12, Vietnam Technological and Commercial Joint Stock Bank (Techcombank) bought back all VND 1,000 billion of outstanding bonds with code TCB2225003 issued on May 12, 2022... This also "eats" into capital sources, making the amount of money available for lending unable to be abundant.

Professor, Dr. Tran Ngoc Tho, member of the National Monetary and Financial Policy Advisory Council

Dr. Nguyen Huu Huan, Head of the Finance Department of Ho Chi Minh City University of Economics, analyzed the reason why the State Bank of Vietnam (SBV) adjusted the operating interest rate three times but the interest rate level in the market could not decrease deeply because many banks reached the credit room ceiling.

"Only large-scale banks that have access to cheap capital from the State Bank, the State Treasury, and corporations can reduce interest rates. However, these banks have strict regulations that businesses find difficult to meet in order to borrow capital. This inadvertently pushes customers to switch to small banks, while the credit limit that the State Bank grants to small banks is only about 6-10%. If calculated on outstanding loans, some banks can only increase credit by a few thousand billion VND, which is nothing compared to the market's demand. Therefore, the interest rates of these banks are very difficult to reduce," Mr. Huan said, adding that there is also a strange phenomenon in the market where customers who come to this bank to ask for a loan are introduced to another bank with lower interest rates.

In fact, banks refuse to lend because of running out of room, which leads to these situations. According to Mr. Huan, banks are currently "stuck" with capital mobilized at high interest rates from 6-9 months ago, so they need time to delay reducing loan interest rates to avoid losses. Besides, operating interest rates have decreased, but if the credit room is full, capital mobilization (even cheap capital) will not be effective. "Therefore, it is time to consider opening credit room for banks, do not let a series of banks run out of room like in the fourth quarter of 2022", Mr. Huan emphasized.

Businesses still find it difficult to borrow capital from banks

Economist, Dr. Dinh The Hien, explained that capital is not entering the economy for many reasons. Firstly, many enterprises are currently facing business difficulties, and banks assess risks so they lend less than the enterprises' needs, or even do not want to lend. In addition, banks are currently re-evaluating collateral assets, reducing them by 20-30% compared to last year, so the lending limit of enterprises has decreased sharply. In particular, cash flow is stuck in land and real estate projects that cannot be rotated; stuck in bonds that cannot return to banks on time or banks themselves have to buy back bonds before maturity... From there, banks also do not have room to increase lending, and the lack of cash flow in the economy is understandable.

Don't speed up at the beginning of the year and suddenly tighten at the end of the year.

The issue of credit capital congestion causing economic stagnation is being dissected at the National Assembly. On May 31, contributing comments at the discussion on the implementation of the socio-economic development plan and state budget in the first months of 2023 under the program of the 5th Session of the 15th National Assembly, delegate To Ai Vang (National Assembly delegation of Soc Trang province) said that since the beginning of 2023, the State Bank has had 3 rounds of reducing operating interest rates, but currently businesses still have difficulty accessing loans.

"The mandatory ratio that each bank must ensure is the safety coefficient in the fields along with the required reserve, which has helped the State Bank control inflation. Just by using many mandatory reserve tools along with applying the safety coefficient regulations, banks can self-adjust without depending too much on the credit room ceiling. Therefore, the State Bank needs to have a flexible management method. That is, assigning the total room from the beginning of the year, avoiding the situation where the first half of the year accelerates, the room runs out at the end of the year or is suddenly tightened. In addition, the State Bank should consider having a flexible and diverse lending mechanism, especially unsecured loan packages based on the effective operating time and cash flow of enterprises. In addition, the State Bank needs to direct commercial banks to review all procedures and credit conditions, increasing the ability of enterprises to access loans," delegate Ai Vang analyzed.

Professor Tran Ngoc Tho, member of the National Monetary and Financial Policy Advisory Council, raised the issue: Everyone can see that in the 3 years of the Covid-19 pandemic, business activities have declined a lot, many places have closed, and business is difficult. However, the fact that banks still report profits means there is something wrong, mysterious, and unacceptable. According to Mr. Tho, banking activities are a field that not everyone understands, so any proposal to reduce interest rates or provide credit is refuted by banks with arguments such as businesses have no orders, no need to borrow... "So now, if we reduce loan interest rates sharply, we will know whether businesses and individuals will borrow or not," Mr. Tho said frankly.

Thinking that the State Bank needs to review the management of credit activities by granting limits to each bank in the year, Professor and Doctor Tran Ngoc Tho questioned that when the room is almost full, it means that interest rates will increase; and he suggested that the amount of loans that banks lend should be their business, as long as the banks must ensure the criteria set by the State Bank.

"The credit room is not the optimal solution yet, but whether Basel II (the risk management standard in banking) is more optimal or not requires more time to accurately assess. After all, the cause of all crises and failures of banks in the world has a common denominator, which is the supervisory capacity of the management agency. This also means that if the credit room is maintained, is the State Bank of Vietnam admitting that the management and supervision apparatus is not adequate, so it has to resort to the "golden ring" of force majeure?", Dr. Tho asked.

At the same time, Professor Tran Ngoc Tho said that real interest rates (lending interest rates minus inflation) cannot exceed economic growth rates. Vietnam's average lending interest rates are currently around 14%/year, minus inflation of around 4%/year, so real lending interest rates are around 10%. Meanwhile, the expected economic growth rate in 2023 is only 6% or less. That is, the entire economy's wealth creation in 2023 (and many years before) is not enough to pay off interest debts. If this situation does not improve, the economy will be exhausted in the next few years, maybe even this year.

Source link

Comment (0)