Most of the trading time of the May 29 session was still a tug-of-war. However, the scenario of today's session was reversed. Strong selling activity in the bluechip group caused the VN30-Index to drop 15.73 points, equivalent to 1.21%, and the VN-Index closed at the lowest point of the session at 1,272.64 points, down 9.09 points, equivalent to 0.71%.

HNX-Index adjusted 1.43 points, equivalent to 0.58%, while UPCoM-Index maintained a slight increase of 0.31 points, equivalent to 0.32%.

The market plunge at the end of the session surprised investors, but there were not many stocks hitting the floor, proving that this was simply a profit-taking activity when most investors achieved short-term profits, especially T+ swing traders. However, the selling pressure at the end of the session will not be able to react in time.

Previously, VN-Index had 2 sessions of increase, yesterday's session even increased by more than 14 points.

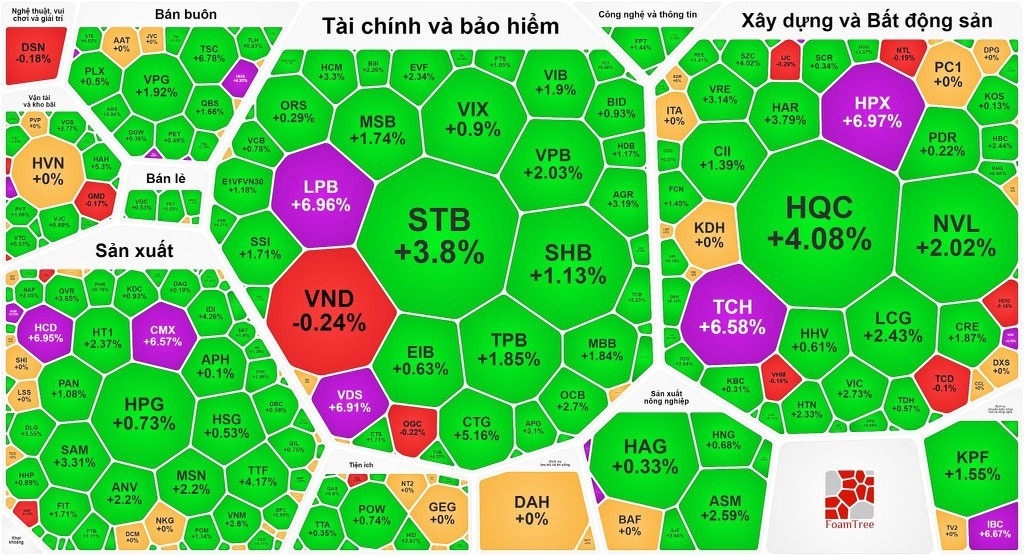

Today's market breadth is slightly tilted towards the decliners with 467 decliners and 18 floor hitters compared to 441 gainers and 41 ceiling hitters. On the HoSE alone, there were 260 decliners and 182 gainers.

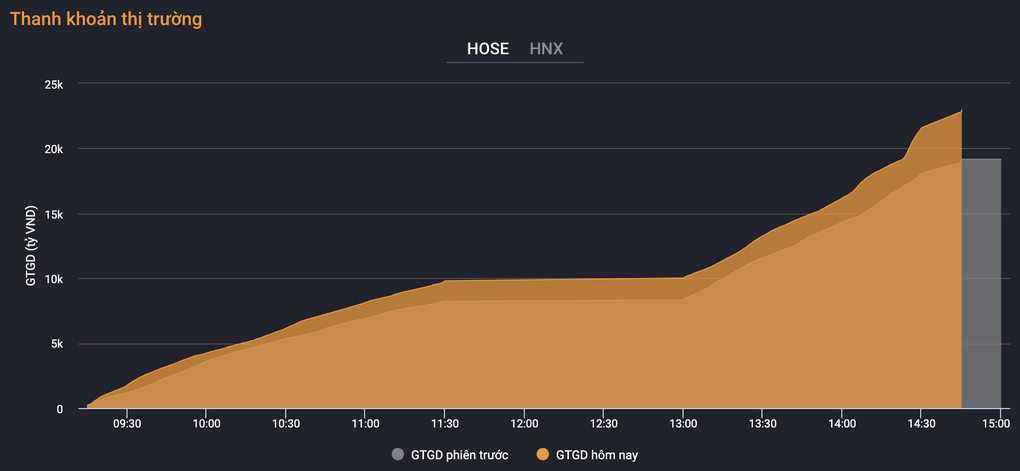

Market liquidity expanded, with 1.07 billion shares traded on the HoSE, equivalent to a trading value of VND25,430.34 billion; HNX had 94 million shares traded, equivalent to VND1,771.35 billion, and the figure on the UPCoM was 82.13 million shares, equivalent to VND1,280.17 billion.

HoSE liquidity is higher than yesterday (Source: VNDS).

Profit-taking activities focused on VN30 stocks. This basket had 27 stocks decreasing in price and only 2 stocks increasing. Accordingly, the adjustments of VCB, HPG, BID, VIC, CTG, GVR, and VHM had a significant impact on the VN-Index.

While most bank stocks decreased in price, HDB decreased by 2.9%; STB decreased by 2.1%; VIB, CTG, OCB, SHB, MBB, ACB, MSB, BID, VCB decreased from 1% to nearly 2%, EIB and LPB increased by 4.8% and 3.8% respectively. Liquidity at these two codes was also positive with 33.1 million shares matched at EIB and 10.4 million shares at LPB.

Real estate stocks were differentiated and attracted attention when many codes increased well. CCL, SGR and DRH increased by the maximum amplitude; LDG increased by 6.5%; DXS increased by 6.2%; AGG increased by 5.9%; KHG increased by 5.4%; SCR increased by 4.8%... Some codes turned down after reaching an increasing status during the session such as QCG decreased by 3.8%; NVT decreased by 3%; HDC decreased by 3%; NVL decreased by 2.4% and HDG also decreased by 2.4%.

Some food and beverage stocks attracted the attention of investors. CMX hit the ceiling; VCF increased by 3.7%; BHN increased by 2.3%; HNG increased by 1.9%; ASM increased by 1.7%; ANV, AGM, IDI increased well.

In the financial services group, BCG shares hit the ceiling, VDS increased by 2.9%; FIT increased by 2.3%; ORS increased by 2.2%; AGR increased by 2%; VND increased by 1.7% but most of them adjusted: CTS, HCM, TVB, DCM, FTS, SSI, TCI, VIX all decreased in price.

Vietnam Airlines' HVN shares continued to accelerate, rising 5.2% to VND28,300 with over 6.4 million units matched. Meanwhile, VJC fell 1.6%; VNS fell 0.9%.

It is observed that the cash flow is shifting from large stocks to small stocks. While VN30-Index decreased by nearly 16 points, UPCoM-Index is still in an uptrend; VNMID-Index representing mid-cap stocks increased by 1.71 points, equivalent to 0.09%, and VNSML-Index increased by 9.18 points, equivalent to 0.6%.

On the HNX, Apec stocks fluctuated. Accordingly, API turned around and fell from the ceiling price of VND12,400 to the floor price of VND10,200. APS also fell from the ceiling price of VND9,600 to the floor price of VND8,000; IDJ approached the floor price, losing 8.7% to VND7,300 after increasing to the ceiling price of VND8,800.

Source: https://dantri.com.vn/kinh-doanh/chung-khoan-quay-xe-khet-let-gioi-dau-tu-tro-tay-khong-kip-20240529161353661.htm

![[Photo] Promoting friendship, solidarity and cooperation between the armies and people of the two countries](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/0c4d087864f14092aed77252590b6bae)

![[Photo] National Assembly Chairman Tran Thanh Man meets with outstanding workers in the oil and gas industry](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/1d0de4026b75434ab34279624db7ee4a)

![[Photo] General Secretary To Lam receives French Ambassador to Vietnam Olivier Brochet](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/49224f0f12e84b66a73b17eb251f7278)

![[Photo] Closing of the 4th Summit of the Partnership for Green Growth and the Global Goals](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/c0a0df9852c84e58be0a8b939189c85a)

![[Photo] Nhan Dan Newspaper announces the project "Love Vietnam so much"](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/362f882012d3432783fc92fab1b3e980)

![[Photo] Welcoming ceremony for Chinese Defense Minister and delegation for friendship exchange](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/fadd533046594e5cacbb28de4c4d5655)

![[Video] Viettel officially puts into operation the largest submarine optical cable line in Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/f19008c6010c4a538cc422cb791ca0a1)

Comment (0)