On the morning of February 11, at the Government Headquarters, Prime Minister Pham Minh Chinh chaired the Government Standing Committee Conference to work with commercial banks to accelerate, break through, promote growth and control inflation.

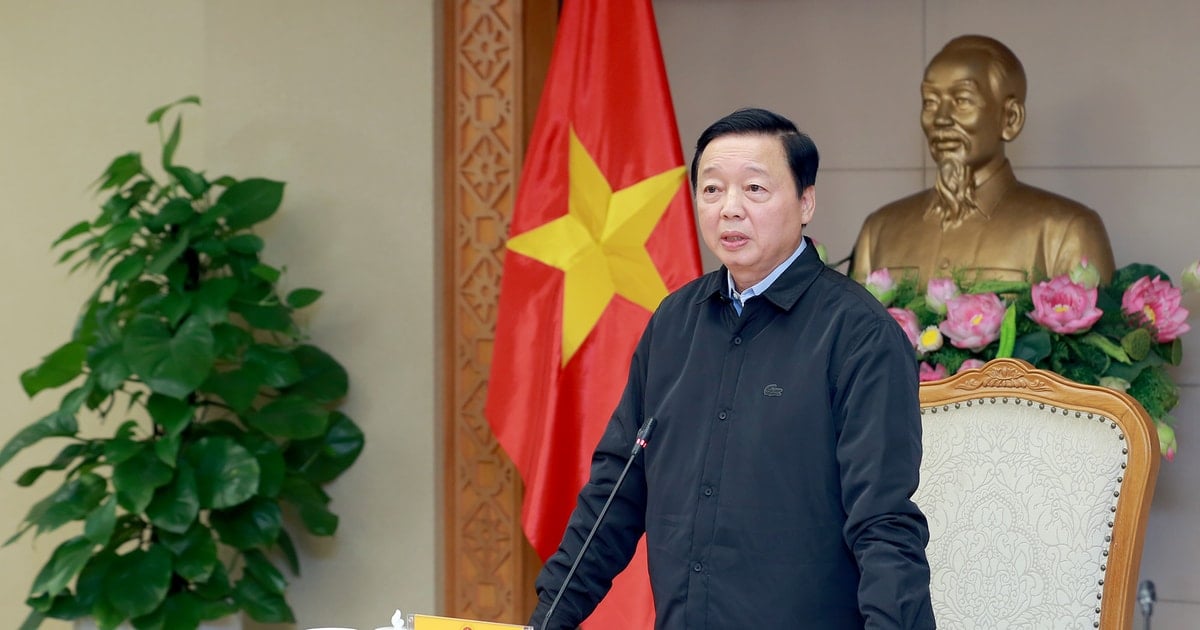

Attending the conference were: Permanent Deputy Prime Minister Nguyen Hoa Binh; Deputy Prime Ministers Tran Hong Ha, Le Thanh Long, Ho Duc Phoc; Ministers, Heads of ministerial-level agencies, Government agencies; leaders of 20 commercial banks and social policy banks.

At the conference, leaders of the State Bank of Vietnam (SBV) and delegates analyzed and evaluated the situation of monetary policy management, credit growth, exchange rates, and operations of commercial banks...

According to reports and opinions at the 2024 review conference, the SBV and the banking sector have successfully implemented the sector's tasks. Following the resolutions, conclusions and directions of the Central Committee, the Politburo, the Secretariat, the National Assembly and the Government, the SBV has closely monitored and grasped the situation, proactively advised competent authorities to issue and issue decisions within its authority to promptly respond to sudden, urgent issues and unusual fluctuations in banking activities.

At the same time, we will firmly pursue the goal of stabilizing the exchange rate in the context of many pressures and difficulties from unpredictable international economic and political developments, maintain the operating interest rates, create conditions for credit institutions to continue reducing lending rates, and effectively implement capital channels for the economy.

The banking sector has resolutely, effectively and substantially implemented solutions to support production and business, remove difficulties for customers, especially support to overcome the consequences of super typhoon No. 3, credit programs and policies under the direction of the Government (Social housing and worker housing loan program, Credit program for forestry and fishery sectors, Credit program to support linkage in production, processing and consumption of high-quality and low-emission rice products in the Mekong Delta...).

Along with that, focus on restructuring, ensuring safety and healthy development of the credit institution system, focusing on strictly controlling bad debt, completing the mandatory transfer of 4 weak banks.

The bank is also at the forefront of reforming and perfecting the legal framework for banking activities; promoting non-cash payments and promoting digital transformation in the banking industry; pioneering the implementation of Project 06 in banking activities...

Delegates discussed and proposed key and breakthrough solutions for the banking industry to accelerate and make breakthroughs in 2025 and the coming time, contributing to promoting growth and controlling inflation, maintaining macroeconomic stability and ensuring major balances of the economy.

Ms. Nguyen Thi Phuong Thao, Permanent Vice President of HDBank, said that after meeting with President Donald Trump, HDBank and its partners are currently coordinating to implement contracts worth 48 billion USD with large US corporations and are negotiating to increase to 64 billion USD, creating 500,000 jobs.

Contributing to promoting the national digital transformation program, HDBank leaders said that they have established and supported the operation of an AI and Blockchain investment fund to build "Make-in-Vietnam" technology products; ready to provide funding for businesses, prioritizing the semiconductor and high-tech sectors.

She recommended that the Government and the State Bank promote the development of the capital market, reduce pressure on bank credit, support long-term growth; stabilize interest rates, support credit for priority programs; and flexibly manage exchange rates to promote exports. The Government has taken the lead, businesses must innovate, and banks must accompany, Ms. Thao emphasized.

Spending a lot of time participating in BOT projects, Mr. Do Minh Phu, Chairman of TP Bank, said that with the desire to contribute to the country having 3,000 km of expressway this year, the bank has participated in many projects such as Cam Lam - Vinh Hao expressway. Recently, TP Bank immediately signed a credit contract of 2,400 billion VND for the Huu Nghi - Chi Lang expressway BOT project and will disburse this week.

In 2024, TP Bank had a fairly high credit growth of 20.25%. Notably, TP Bank reduced lending interest rates by about VND 1,900 billion for about 92,000 customers on a total outstanding loan of VND 183,000 billion to support the economy and businesses.

Recommending the need to gradually reduce and eventually eliminate the management of credit growth targets for each credit institution, Mr. Do Minh Phu believes that the credit growth rate of 16% in 2025 as set by the State Bank is completely feasible.

Regarding the content of transport infrastructure projects, Minister of Transport Tran Hong Minh said that there are 11 BOT transport projects facing difficulties that need to be resolved, of which 7 projects have been basically resolved. To resolve these difficulties as well as implement new BOT projects, it is necessary to join hands, unanimity, and sharing among the relevant parties. In the coming time, the transport sector really needs the support of banks with a total investment for 5 types of transport needing about 6.27 million billion VND from now until 2035.

Promoting national sentiment and compatriotism in difficult times

In his concluding remarks, Prime Minister Pham Minh Chinh assigned the Government Office to coordinate with the State Bank and relevant ministries and agencies to study and absorb maximum opinions, promptly complete and submit for promulgation the Conference's products in the form of a Notice of Conclusion of the Government Standing Committee at the Conference.

The Prime Minister expressed his gratitude for the contributions of commercial banks in national construction and development, especially in ensuring social security, preventing and fighting the COVID-19 pandemic, overcoming the consequences of natural disasters, responding to the movement to eliminate temporary and dilapidated houses nationwide in 2025, implementing a number of credit packages related to agriculture, social housing, etc.

Reviewing some of the work done in 2024, the Prime Minister assessed the banking sector, in which commercial banks have made important contributions to maintaining macroeconomic stability, controlling inflation, promoting growth, ensuring major balances and controlling the country's deficit, government debt, public debt, and foreign debt within limits; sharing with people and businesses, reducing their profits to reduce lending interest rates; participating in the compulsory transfer of a number of banks; controlling bad debt better than in previous years; participating in BOT projects, major projects of the Government and businesses.

Expressing his wish that the banking industry will develop more healthily, actively and effectively, and that people will receive more attention, care and support; the Prime Minister pointed out a number of lessons learned.

First, share with people and businesses when they encounter difficulties, sacrificing part of your profits to do this.

Second, closely follow the world, regional and domestic situation to promptly make proposals and remove difficulties and obstacles regarding institutions and laws in laws, decrees and circulars.

Third , promote solidarity, unity and coordination between agencies in the political system and the banking system to solve major problems of the country, people's concerns, and difficulties and obstacles in the development process.

The Prime Minister said that in 2025, we must maintain macroeconomic stability, control inflation, promote growth, ensure major balances and control budget deficit, government debt, public debt, foreign debt within limits, well manage monetary policy, exchange rates, interest rates, especially the GDP growth target of at least 8% or more. With the credit growth target of over 16%, the Prime Minister requested that the banking sector in general and commercial banks in particular must take the lead in promoting growth, controlling inflation and stabilizing the macro economy.

The Prime Minister pointed out 8 tasks and solutions that the banking industry and commercial banks need to focus on implementing.

Firstly , reduce costs, reorganize operations more effectively and especially sacrifice part of profits to reduce lending interest rates, support the economy, people, businesses, and create livelihoods for people.

Second, focus on credit, contributing to renewing the three growth drivers: investment, consumption, export and promoting new growth drivers. Accordingly, public investment leads private investment; there are consumer credit packages, credit for key industries to solve many jobs, shift the economic structure; preferential credit for industries, fields, priority subjects; credit for BOT projects, public-private partnerships; credit to remove difficulties for real estate projects...

Third , the State Bank and commercial banks must pioneer in digital transformation, application of science and technology, innovation; build databases, implement Project 06; implement Resolution 57 of the Politburo on breakthroughs in science and technology development, innovation, digital transformation; have measures to pilot the implementation and management of virtual banks.

Fourth , promote the reduction of administrative procedures, inconvenience, harassment, negative manifestations, fight corruption, waste in banking activities, reduce bad debt, create favorable conditions for people and businesses.

Fifth, implement smart governance, build smart banks, improve the capacity and fighting spirit of bankers for the common goal of building the country, contributing to sharing difficulties with people and businesses, while enhancing cooperation, sharing and learning international experiences.

Sixth , banks participate more actively and effectively in implementing three strategic breakthroughs in institutions, infrastructure, and human resources, contributing to the development of laws, focusing on mobilizing resources to develop strategic infrastructure, and training human resources for the country in the new era of development.

Seventh , the State Bank and commercial banks will research and continue to have preferential credit packages for both supply and demand to develop social housing, housing for young people aged 35 and under, housing for the disadvantaged; actively contribute to eliminating temporary and dilapidated houses nationwide.

Eighth, closely and effectively coordinate with state management agencies and agencies in the political system in the spirit of common development, healthy development of the banking system, solidarity, unity, and good performance of the political tasks of the agencies and the tasks of the banking system.

According to the Prime Minister, banks must make a profit in their business operations, but in addition to profit, they must bring common benefits to the country, because "when the water rises, the duckweed floats". In particular, the Prime Minister noted the need to remove difficulties and obstacles for backlogged and prolonged projects that cause waste for private enterprises and support small and medium-sized enterprises because these enterprises account for a very large proportion and create many jobs.

Hoping that banks operate in accordance with the law, contributing to the prevention and fight against corruption, negativity, and harassment, the Prime Minister stated that the recent violations related to bonds are partly the responsibility of banks. This requires reviewing and correcting business ethics, eliminating bad elements from the banking system, and not pushing customers into difficult situations or taking advantage of customers. The banking inspection agency also needs to operate more effectively.

Emphasizing high determination, great efforts, drastic actions, doing things properly, and finishing things, the Prime Minister requested to continue to operate monetary policy proactively, flexibly, promptly, and effectively, as a fulcrum for people, businesses, and the country's development.

The Prime Minister assigned Deputy Prime Minister Ho Duc Phoc to directly direct and Governor of the State Bank of Vietnam Nguyen Thi Hong to urgently prepare documents and submit them to the National Assembly in the upcoming May session to legalize Resolution No. 42/2017/QH14 of the National Assembly on piloting the handling of bad debts of credit institutions; at the same time, amend regulations related to increasing capital for state-owned commercial banks to ensure healthy competition with joint-stock commercial banks.

The Prime Minister assigned ministries and branches, according to their functions, tasks and powers, to handle the proposals and recommendations of the delegates with the spirit of clearly stating the person, clearly stating the work, clearly stating the time, clearly stating the responsibility, clearly stating the results; not saying no, not saying difficult, not saying yes but not doing; having done and implemented, there must be products that can be weighed and measured.

Praising the banking sector for supporting people and businesses to recover after storm No. 3 (Yagi), the Prime Minister directed research agencies to coordinate with banks on debt extension, debt forgiveness, and debt restructuring appropriately. According to the Prime Minister, banking activities must be very flexible, based on specific situations. If the situation is special, there must be special responses, promoting culture, business ethics, mutual trust, national sentiment, and compatriotism in difficult times to overcome together in the spirit of harmonious interests, shared risks, and sometimes sacrifices, contributing to gratitude to previous generations who fought and sacrificed for the country and the people.

Source: https://baotainguyenmoitruong.vn/thu-tuong-cac-ngan-hang-can-hy-sinh-mot-phan-loi-nhuan-de-giam-lai-suat-cho-vay-ho-tro-nen-kinh-te-nguoi-dan-doanh-nghiep-386530.html

Comment (0)