Ministry of Finance proposes to reduce tax rates to reduce the burden on personal income taxpayers

Amending the Personal Income Tax Law: reducing tax rates and extending the rates of the progressive tax schedule

The Ministry of Finance has just requested the Ministry of Justice to appraise the Government's proposal to draft a replacement Law on Personal Income Tax .

An important content that the Ministry of Finance is orienting to amend and supplement is the progressive tax schedule for income from wages and salaries after 15 years of application.

In the impact assessment report, the Ministry of Finance said there was a view that the current tax schedule was unreasonable. Seven tax brackets were too many. The narrow spacing between brackets led to a jump in tax brackets when summing income in the year, increasing the amount of tax payable.

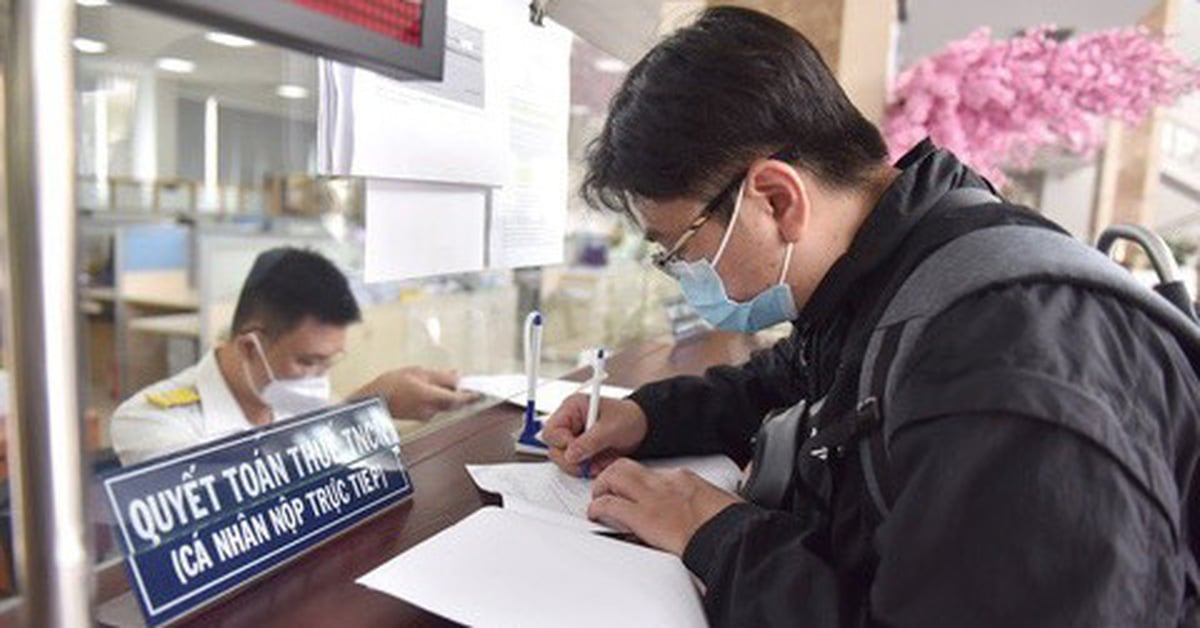

On the other hand, the number of tax settlements increases unnecessarily, while the additional tax payable is not much.

- Personal income tax is making people... 'suffocate'

- National Assembly Delegate: People must tighten their belts to pay personal income tax

According to the Ministry of Finance, the application of personal income tax collection according to progressive tax rates is commonly implemented in the world.

Recently, some countries have reduced the tax rates in their progressive tax schedules.

For example, Indonesia has five tax brackets with tax rates ranging from 5-35%. The Philippines also has five tax brackets.

Malaysia also reduced the number of tax brackets from 11 in 2021 to nine from 2024.

"Vietnam can reduce the number of tax brackets to below 7. At the same time, consider widening the income gap in tax brackets to ensure higher regulation for those with incomes at high tax brackets. Reducing the number of tax brackets will facilitate tax declaration and payment," the Ministry of Finance explained.

Tax rates should be reduced at the first three levels and taxable income should be increased.

Commenting on the progressive tax schedule, the Thai Nguyen Provincial Tax Department proposed reducing the tax rate for the first three tax brackets to reduce the burden on taxpayers. In reality, taxpayers in tax brackets 1, 2 and 3 have incomes just enough to cover their living expenses.

Thai Nguyen Provincial Tax Department proposed to halve the first-level tax rate to 2.5% instead of the current 5%, applied to taxable income of 0 - 5 million VND/month.

As for level 2, the tax rate is 5% instead of 10%, applied to taxable income from 5 - 10 million VND/month.

Level 3 has a tax rate of 5%, 10% applied to taxable income from 10 - 18 million VND/month.

The People's Committee of Ninh Thuan province proposed to reduce the difference between tax rates to avoid burdening people with average incomes.

Speaking to Tuoi Tre Online , Dr. Nguyen Ngoc Tu, a tax expert, said that the shortcomings of the progressive tax rate for income from wages and salaries were acknowledged by the Ministry of Finance in 2018, when it proposed amending this tax law. However, since then, this regulation has still existed, causing disadvantages and frustration for personal income taxpayers.

Because the gap between tax brackets is too narrow, taxable income of bracket 1 is from 0 - 5 million VND and has to pay tax at a rate of 5%. Bracket 2 is from 5 - 10 million VND with a tax rate of 10%; bracket 3 is from 10 - 18 million VND with a tax rate of 15%. So if income increases a little, it will "jump" (the additional tax must be paid at the bracket with a higher tax rate - PV), causing the amount of tax to be paid to be higher.

In addition, according to experts, the progressive tax rate was applied 15 years ago, in 2009, when the basic salary was 650,000 VND/month. Up to now, the basic salary has increased to 2,340,000 VND/month, which is 3.6 times higher. However, taxable income remains the same.

As proposed by Mr. Tu, the Ministry of Finance needs to study and calculate the increase in basic salary , consumer price index... to increase taxable income, ensuring fairness and legitimate interests of taxpayers.

"The tax rates in the progressive tax schedule can be reduced to 5 levels like many countries. The taxable income must be increased and the gap between the levels widened. As for the last level, the tax rate of 35% corresponds to the minimum taxable income of over 200 million VND, instead of the current level of over 80 million VND" - Mr. Tu suggested.

Source: https://tuoitre.vn/bo-tai-chinh-tinh-giam-bac-thue-de-bot-ganh-nang-cho-nguoi-nop-thue-thu-nhap-ca-nhan-20250209151928826.htm

Comment (0)