According to the Ministry of Finance, in recent times, the insurance market in general and the insurance sales channel through banks in particular have grown rapidly. However, there have been cases where employees of some banks have introduced, invited, and forced customers to buy life insurance or investment-linked insurance when they come to deposit money or borrow credit.

Therefore, in 2022, the leaders of the Ministry of Finance directed relevant units to urgently organize inspections and checks on the sale of insurance through banks.

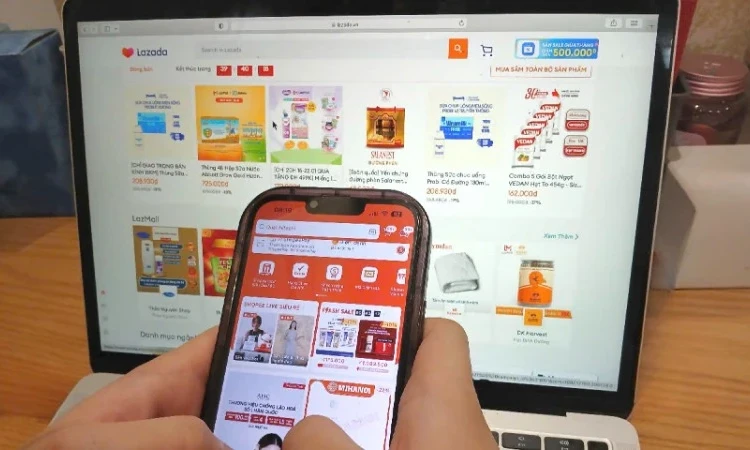

A series of violations in selling insurance through banks. (Photo: DD)

Implementing the direction of the Ministry of Finance, the Department of Insurance Management and Supervision has inspected this activity at 4 insurance companies. In particular, in the spirit of drastic and transparent direction, "wherever there is a mistake, there will be strict punishment" of the Minister of Finance, the inspection teams have carried out the inspection work seriously, objectively and honestly.

The inspection results show that there are many violations in selling insurance through the agency channel of banks, especially in the consulting stage of bank staff and brokers. There are 4 typical violations.

Firstly, not directly advising customers or not fully guiding them through the procedures and required documents according to the company's regulations.

Second, the quality of insurance product consultation is not guaranteed, leading to customers not understanding insurance products clearly.

Third, let others (other personal agents, bank employees) use the ipad, agent code to guide customers to enter information.

Fourth, not implementing the insurance premium schedule approved by the Ministry of Finance…

These are violations that will be considered by the Ministry of Finance for administrative sanctions in accordance with legal regulations, ensuring strictness and creating deterrence for businesses operating in the market. The sanction decisions, after being issued, will be made public to the press and public opinion to ensure objectivity and transparency.

At the same time, based on the inspection results, the Ministry of Finance requires insurance companies to implement measures such as strengthening management, supervision, and comprehensively rectifying the sale of insurance products through credit institutions and foreign bank branches.

Urgently develop a process to inspect and closely monitor the implementation of legal regulations in the insurance sector; proactively detect and handle shortcomings and violations in the implementation of insurance services at enterprises, minimizing the impact on customers' rights.

Ensure strict management of agents; prevent and promptly detect violations by insurance agents and individuals belonging to insurance agents.

There are measures to rectify the training, management and supervision of the quality of insurance agents. Accordingly, agents must fully meet the operating conditions and properly implement the contents and principles of insurance agency operations as prescribed by law.

Review insurance agency operating expenses, ensure expenses must serve insurance business activities, have full documents and evidence, and comply with legal regulations.

Strengthen supervision of risk management, ensure financial safety and capital safety criteria of enterprises in accordance with legal regulations.

In 2023, in addition to urgently completing the legal framework in the insurance sector, the Ministry of Finance will continue to conduct specialized inspections and examinations of insurance sales through credit institutions and foreign bank branches for 10 insurance companies. At the same time, closely coordinate with the Banking Inspection and Supervision Agency - State Bank of Vietnam in inspecting, examining and supervising the provision of insurance services through banks, and at the same time. In case of detecting violations, they will be strictly handled according to the provisions of law.

Source

![[Photo] Prime Minister Pham Minh Chinh receives Mr. Jefferey Perlman, CEO of Warburg Pincus Group (USA)](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/18/c37781eeb50342f09d8fe6841db2426c)

![[UPDATE] April 30th parade rehearsal on Le Duan street in front of Independence Palace](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/18/8f2604c6bc5648d4b918bd6867d08396)

Comment (0)