Ms. Le Thi Ha Thanh is about to inherit more than 20.7 million DIG Corp shares from the legacy in the joint assets with Mr. Nguyen Thien Tuan.

Ms. Le Thi Ha Thanh, wife of Mr. Nguyen Thien Tuan - the late Chairman of the Board of Directors of Construction Development Investment Corporation (DIC Corp, stock code: DIG), has just announced that she will receive more than 20,753 million shares between September 17 and October 16.

According to the document sent to the State Securities Commission and the Ho Chi Minh City Stock Exchange, this is a transaction to receive inheritance in the common assets of the couple after Mr. Tuan's death. Accordingly, Ms. Thanh's ownership ratio at DIG Corp will increase from 4,902 shares (equivalent to 0% of charter capital) to 20,758 million shares (equivalent to 3.4% of charter capital).

Previously, from February 7 to March 7, Ms. Thanh registered to sell 940,000 DIG shares. She sold all of the shares on the first day of the expected trading session.

Or from December 11, 2023 to January 9 this year, she registered to sell 200,000 DIG shares. However, at the end of the trading period, Ms. Thanh only successfully sold 35,300 shares, accounting for 17.7% of the registered shares for sale because the price did not meet expectations.

Currently, Mr. Nguyen Hung Cuong, Chairman of the Board of Directors and Ms. Nguyen Thi Thanh Huyen, Vice Chairman of the Board of Directors (daughter of Mr. Tuan and Ms. Thanh), own 10.16% of capital and 2.98% of charter capital, respectively.

After Mr. Tuan passed away on August 10, DIC Corp announced a change in senior personnel with many important positions. In particular, Mr. Nguyen Hung Cuong was appointed as Chairman of the Board of Directors and Chairman of the Strategy and Sustainable Development Committee, effective from September 10.

In addition, Mr. Nguyen Hung Cuong will also hold the position of Chairman and legal representative of DIC Urban and Industrial Park Development Investment Company Limited (DIC Urbiz), representing 100% of DIC Corp's equity capital.

At the same time, Ms. Nguyen Thi Thanh Huyen was assigned to hold the position of Vice Chairwoman of the Board of Directors, concurrently assuming the role of Chairwoman of the Personnel and Remuneration Committee and a member of the Audit Committee.

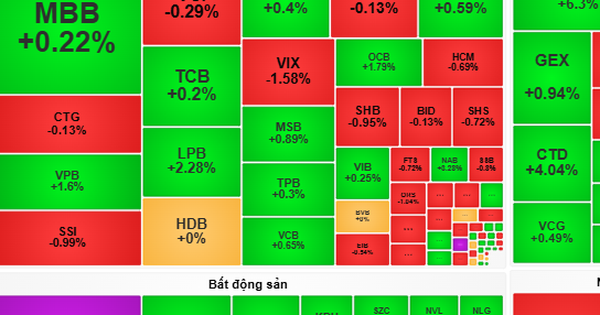

On the stock exchange, DIG decreased by 0.91% compared to the reference price, down to VND21,700, the lowest price in nearly a year. The matched volume reached more than 4.7 million shares (equivalent to VND103 billion), significantly lower than the average matched volume of the last 10 sessions (15.8 million shares). Market capitalization calculated at this price is approximately VND13,234 billion.

In the first 6 months of the year, DIC Corp recorded net revenue of VND635 billion, up 76.8% over the same period. Gross profit during this period was about VND109 billion, gross profit margin reached 17.2%.

The company reported pre-tax profit of VND21.5 billion and after-tax profit of VND3.9 billion, down 81.9% and 95.5% respectively compared to the first half of 2023.

This year, DIC Corp plans to have consolidated revenue of VND2,300 billion, up 72% over the same period. Pre-tax profit is expected to be VND1,010 billion and after-tax profit to be VND800 billion, of which pre-tax profit will increase by 508.9% compared to the actual figure in 2023.

By the end of the first half of 2024, the company completed 36.2% of its revenue plan. The pre-tax profit target was 2.1% complete, while the after-tax profit was less than 1% of the set plan.

Previously, DIC Corp said that this year's profit of the company is based on the business plan and accounting from the transfer of products in projects such as Dai Phuoc Eco-tourism Urban Area (Dong Nai), Lam Ha Center Point Residential Area (Ha Nam), DIC Nam Vinh Yen City New Urban Area Vinh Phuc, DIC Victory City Urban Area Hau Giang, Hiep Phuoc Residential Area Project, Vung Tau Gateway Apartment Project and CSJ Phase I Project with high feasibility.

By the end of the second quarter of 2024, DIC Corp's total assets increased by 9.7% compared to the beginning of the period, to VND 18,461 billion. Liabilities increased by VND 1,638 billion compared to the beginning of the year, reaching VND 10,572 billion, of which the majority was short-term debt. Owner's equity was more than VND 7,889 billion, and undistributed profit after tax was more than VND 404 billion.

Source: https://baodautu.vn/vo-ong-nguyen-thien-tuan-nhan-thua-ke-207-trieu-co-phieu-d224824.html

Comment (0)