VN-Index rebounded immediately after yesterday's sharp decline (September 16), returning to the 1,260-point zone thanks to positive moves from foreign investors. However, liquidity has yet to show signs of improvement.

After 1 month since the explosive session on August 16, VN-Index suddenly rebounded by nearly 20 points (equivalent to 1.6%) on the Mid-Autumn Festival (September 17), helping VN-Index return to the 1,260-point threshold at 1,258.95 points.

This development appeared right after the previous sharp decline (September 16) of more than 12 points.

At the beginning of the morning session, selling pressure still dominated, however, positive signals started after the lunch break, liquidity increased, helping the index reverse and increase strongly, the market breadth tilted towards the buying side.

However, compared to the "explosive" session on August 16 with liquidity reaching more than VND 23,000 billion, cash flow on the floor today has not improved significantly, reaching VND 13,527.5 billion with 632 million shares "changed hands".

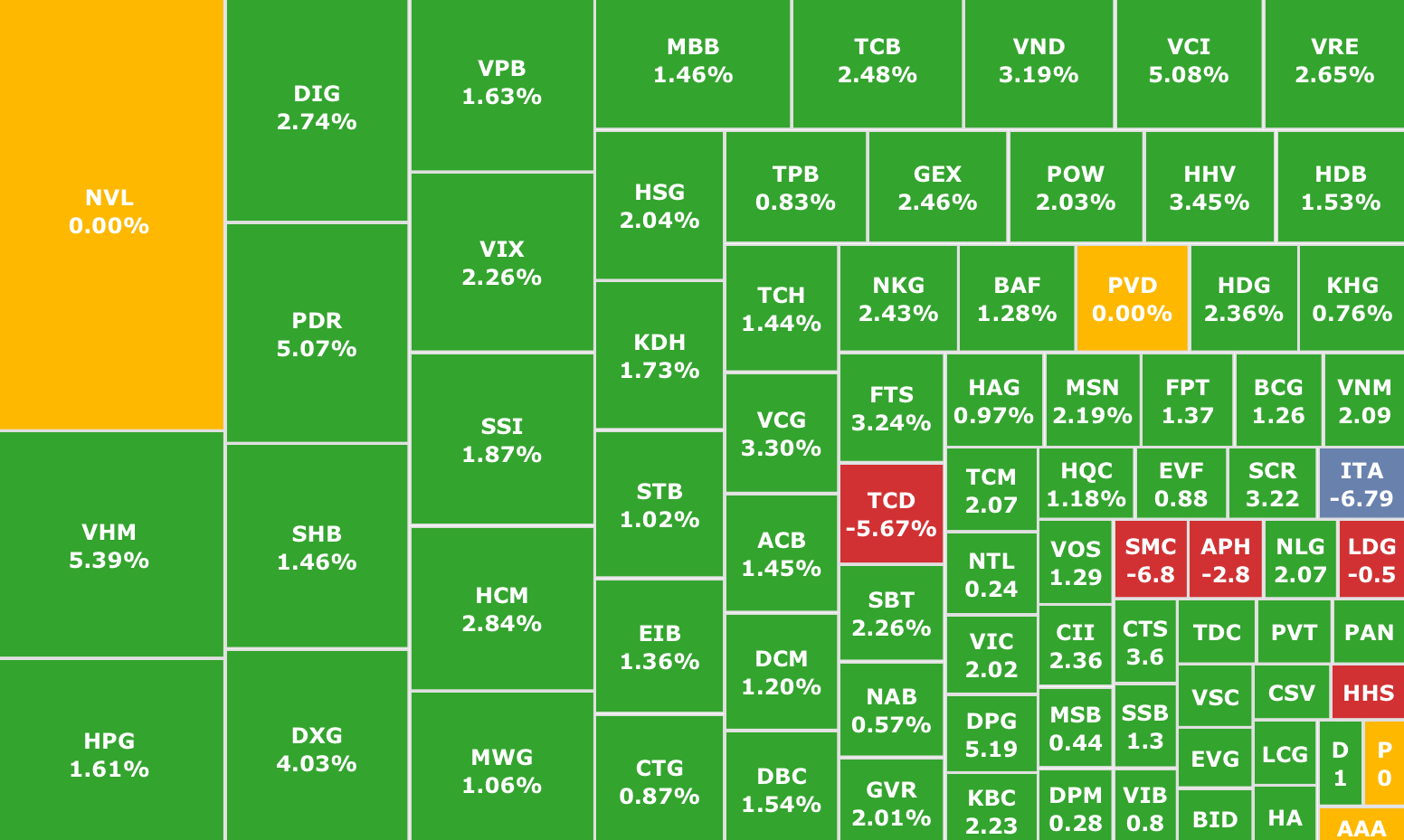

Green spread across the market with 312 stocks increasing (2 stocks "hit the ceiling"), 88 stocks decreasing (3 stocks "hit the floor"), 70 stocks remaining unchanged. Most industry groups increased positively, including: banking (+1.57%), securities (+2.46%), raw materials (+1.14%), etc.

"Green" spreads throughout the market

In particular, the real estate group surprised everyone when it rose after many consecutive sessions of hitting bottom recently, becoming the industry group leading the market's increase today.

The entire real estate industry increased by 2.4% with many stocks increasing strongly: VHM (Vinhomes, HOSE) increased by 5.39%, PDR (Phat Dat Real Estate, HOSE) increased by 5.07%, DXG (Dat Xanh, HOSE) increased by 4.03%,...

Only NVL (Novaland, HOSE) moved sideways after breaking the 18-month low due to strong selling in the morning session. This development was in the context of NVL receiving a warning decision because the company has not submitted its audited financial report for the first 6 months of 2024, before that, NVL also had its margin cut for this reason.

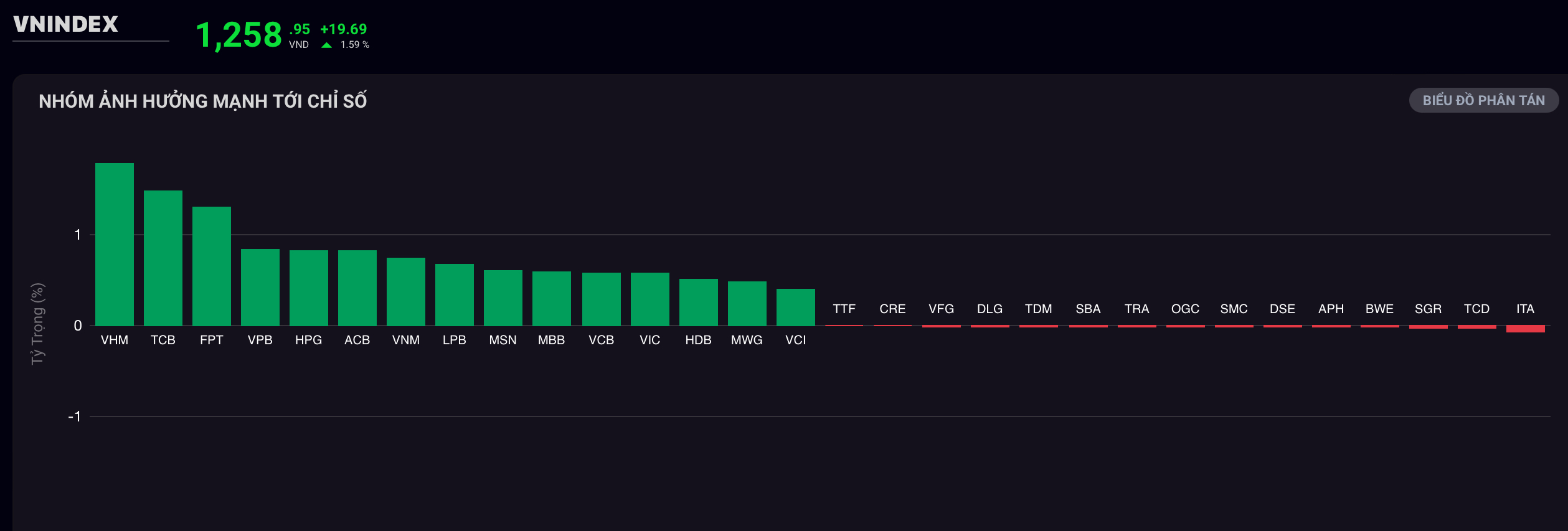

Group of stocks strongly affecting the index

Real estate and banking groups led the market to increase strongly (Source: SSI iBoard)

Next is the banking group with VCB (Vietcombank, HOSE) up 1.8%, BID (BIDV, HOSE) up 1.99%, TCB (Techcombank, HOSE) up 2.48% also contributing greatly to the overall growth.

Foreign investors also actively bought net again with a total value of VND525 billion throughout the session, maintaining 3 consecutive sessions of net buying. The most bought stocks included: VHM (Vinhomes, HOSE) reaching VND193 billion, FPT (FPT, HOSE) reaching VND189 billion, SSI (SSI Securities, HOSE) reaching VND46 billion). On the other hand, MWG (Mobile World, HOSE) was net sold VND144 billion.

In terms of behavior, this move by foreign investors is believed to be due to reduced selling pressure, while buying pressure is maintained "steadily".

Investors will be looking ahead to a number of notable events this week, including derivatives expiry, ETF structure and the Federal Reserve's FOMC meeting.

Recovery session or still in correction trend?

Commenting on today's session, Ms. Minh Chau, a consultant at Mirae Asset Securities, said that in the short term, the market shows a more positive state, especially when foreign capital flows continuously and large-cap stocks maintain growth momentum. However, investors still need to note that in the next few sessions, there will be many world macro events such as the Fed Meeting and the BOJ Meeting that can still put pressure on the Vietnamese market. "Shaking" in the 1,240 - 1,250 point range is possible.

In the medium and long term, she said, the index is still maintaining the main trend of moving sideways within a wide range of 1,200 - 1,290 points. The increase and decrease in the differentiation between stocks will still occur. Cash flow continues to focus on businesses with strong internal strength, future expectations, and meeting the story of recovery/growth in business results.

Investors are advised to prioritize the majority of their holdings in stocks with good financial foundations and growth expectations, currently at cheap valuations, and a small proportion in stock surfing.

Sectors that may be of interest: Retail with expectations of recovery/growth in business results; Banking with expectations of racing for credit growth at the end of the year and some banks have proactively set aside risk provisions; Energy (Hydropower) as the Lanina phenomenon is returning strongly in the second half of 2024.

Source: https://phunuvietnam.vn/vn-index-nhay-mua-tang-tro-lai-gan-20-diem-voi-thanh-khoan-thap-20240917184753753.htm

Comment (0)