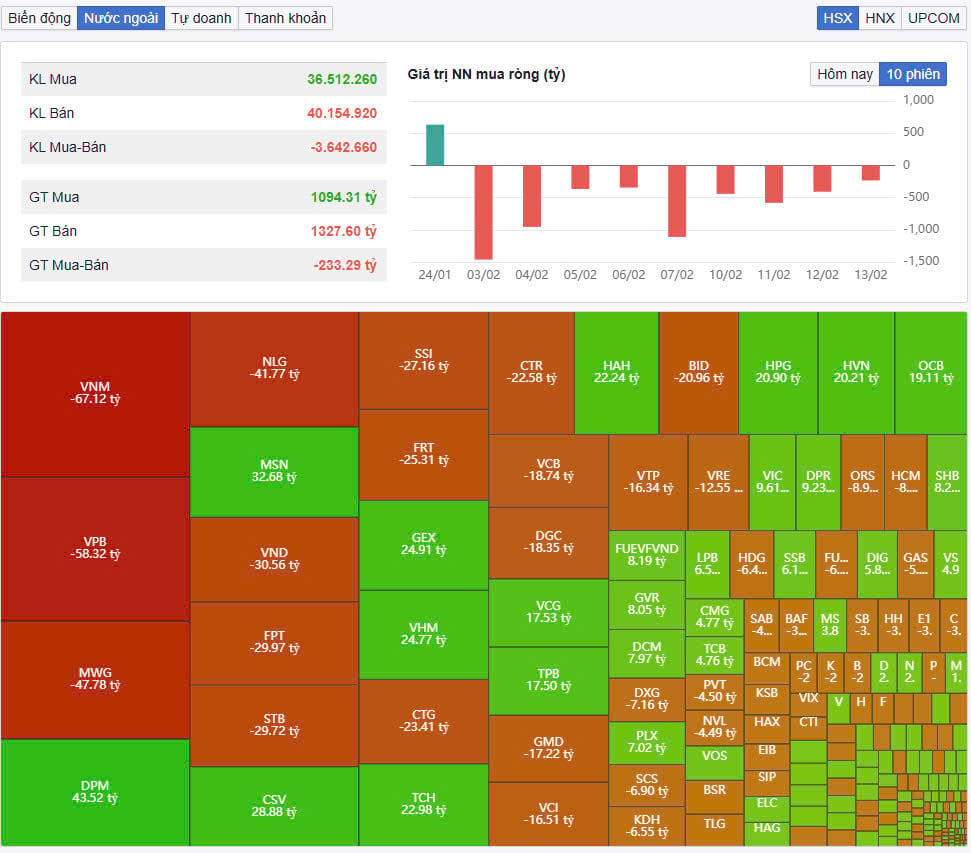

Foreign investors continued to net sell VND252 billion in the whole market, in which, this capital flow net sold the most Vinamilk (VNM) shares with more than VND67 billion. This is also one of the stocks that pulled the VN-Index down.

VN-Index regains 1,270 points despite continued net selling pressure from foreign investors

Foreign investors continued to net sell VND252 billion in the whole market, in which, this capital flow net sold the most Vinamilk (VNM) shares with more than VND67 billion. This is also one of the stocks that pulled the VN-Index down.

After a decline in points and liquidity, the market on February 13 did not have many notable fluctuations. The indices fluctuated around the reference level due to strong differentiation in stock sectors. Relatively strong pressure appeared after 10:00 and caused the VN-Index to gradually fall back to 1,260 points. However, thanks to good momentum from some stock sectors, the index quickly recovered. Market liquidity in the morning session was only average and equivalent to yesterday morning session.

After the lunch break, trading continued cautiously. The situation was somewhat more positive at the end of the session when cash flow focused quite strongly on mid- and small-cap stocks. However, large-cap stocks still recorded the dominant green color and helped the index close above 1,270 points.

At the end of the trading session, VN-Index increased by 3.44 points (0.27%) to 1,270.35 points. HNX-Index increased by 0.2 points (0.09%) to 229.52 points. UPCoM-Index increased by 0.94 points (0.97%) to 97.74 points. Today's market session had 377 stocks increasing, while 354 stocks decreased and 840 stocks remained unchanged/no trading. The whole market still had 33 stocks increasing to the ceiling while 6 stocks decreased to the floor.

|

| Top 10 stocks affecting VN-Index. |

Cash flow in today's session was strongly concentrated on mid- and small-cap stocks. In which, industry groups such as fertilizer, port - shipping, mining... had very positive fluctuations. In the mineral group, after a few shaky sessions, it returned to a strong uptrend. In which, codes such as MSR, BMC, HGM, KCB... all increased to the ceiling.

In the fertilizer and chemical group, DPM increased sharply by 4.7%, DCM increased by 3.9%, CSV increased by 5.9%... Fertilizer industry stocks broke out due to information that Urea prices increased sharply due to limited supply and high export demand.

In the seaport and shipping group, stocks such as TOS, MVN, TCL, SGP... also increased sharply after a short period of previous fluctuations and adjustments.

In the group of large-cap stocks, VHM unexpectedly increased sharply by 1.97% and was the stock with the most positive impact on the VN-Index, contributing 0.74 points. In addition, GVR also increased by more than 2.4% and contributed 0.67 points to the index. Codes such as CTG, TCB, VIC, MBB... also increased in price well and contributed to supporting the VN-Index.

On the other hand, FPT and MWG were the two "culprits" that caused the index to fluctuate. Of which, FPT decreased by 1.3% and MWG decreased by 2.8%. Recently, the Board of Directors of Mobile World Investment Corporation (code MWG) decided to issue 19,937,500 shares under the employee stock option program for key managers of the Company and its subsidiaries (ESOP), equivalent to a rate of 1.3642%. All ESOP shares will be restricted from transfer within 2 years from the date of issuance. The expected implementation time is in the first quarter of 2025. The preferential selling price is 10,000 VND/share.

In addition, stocks such as GAS, BSR, VNM... also closed in red and somewhat put pressure on the general market. In the mid- and small-cap group, NLG, NVL, DXG... also fluctuated negatively. NLG unexpectedly decreased by nearly 2%. NVL also decreased by 1.5%, DXG decreased by 1%.

|

| Foreign investors have not ended their net selling streak. |

The total transaction value on the HoSE today reached VND11,741 billion, up slightly by 4% compared to the previous session, of which negotiated transactions contributed nearly VND900 billion. The transaction value on the HNX and UPCoM reached VND721 billion and VND770 billion, respectively.

MWG ranked first in total market transactions with a value of over VND625 billion. FPT and DPM traded VND409 billion and VND335 billion respectively.

Foreign investors continued to net sell VND252 billion across the market, of which, this capital flow net sold the most VNM code with more than VND67 billion. VPB and MWG were net sold VND58 billion and VND48 billion. In the opposite direction, DPM was net bought the most with VND44 billion. MSN and CSV were net bought VND33 billion and VND29 billion, respectively.

Source: https://baodautu.vn/vn-index-lay-lai-moc-1270-diem-bat-chap-ap-luc-ban-rong-chua-dut-cua-khoi-ngoai-d246174.html

Comment (0)