How much is 1 USD in VND today?

The central exchange rate is listed by the State Bank at 24,036 VND/USD.

Today's black market USD exchange rate is at 24,055 - 24,425 VND (buy - sell).

Vietcombank USD exchange rate today is listed at: 24,055 VND - 24,425 VND (buy - sell).

Vietcombank Euro exchange rate is currently at 25,152 VND - 26,559 VND (buy - sell).

The current Japanese Yen exchange rate is 160.44 VND - 169.86 VND (buy - sell).

The current exchange rate of British Pound is 29,344 VND - 30,594 VND (buy - sell).

Today's Yuan exchange rate is at 3,273 VND - 3,413 VND (buy - sell).

USD price today

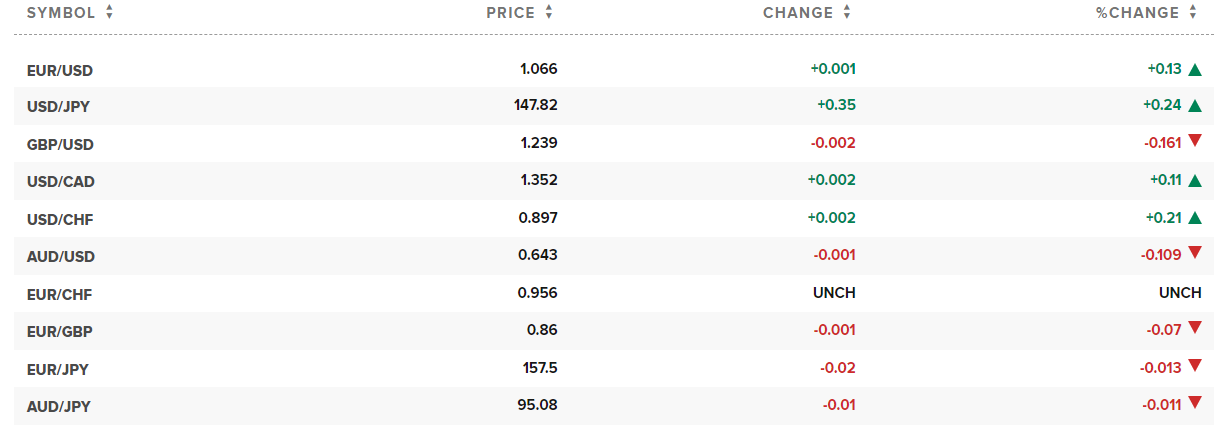

The US Dollar Index (DXY), which measures the greenback's movements against six major currencies (EUR, JPY, GBP, CAD, SEK, CHF), recorded 104.9 points.

The USD and Yen have been volatile over the past week. However, the exchange rate between the two currencies has remained around 147 JPY/USD. The market continues to monitor the Bank of Japan's every move to see what the agency will do when the Yen declines. Last year, the BOJ stepped in to rescue the Yen when the exchange rate reached the 145 point range.

Last week, the US released retail sales figures. The index rose 0.6% in August, higher than the expected 0.2% increase. The increase was driven by higher gasoline prices, while jobless claims rose to 220,000 (but below the forecast of 225,000).

Rising gasoline prices also weighed on the latest inflation data, as the producer price index rose 0.7% last month – above estimates of 0.4%.

According to statistics from the University of Michigan, the US consumer sentiment index last week fell to 67.7, below the 69.1 forecast from experts.

The EUR/USD pair fell after the European Central Bank (ECB) raised its key interest rate to a record high of 4%. This could be the final move in the EU's more than year-long fight against inflation as the eurozone economy continues to shrink.

The USD index fell slightly this week. However, experts assess that this state of the greenback is to prepare for the 9th consecutive increase - the biggest weekly increase since 2014.

“ECB President Christine Lagarde is hinting that this could be the last rate hike,” said Erik Bregar, a foreign exchange and precious metals expert at Silver Gold Bull. “The reason is that if you keep rates high for a period of time, it will work. And then I think every single US data point has been better than expected, jobless claims, retail sales, PPI headlines. Everything is bullish for the dollar.”

The Fed is expected to keep interest rates steady at the end of its policy meeting on September 19-20 (the probability is currently 97% according to the FedWatch Tool).

Source

Comment (0)