The US dollar enters 2024 with many disadvantages. One of them is the expectation that the US Federal Reserve (Fed) will soon cut interest rates, thereby reducing the value of the USD.

However, in the first week of 2024, the opposite happened. The USD broke out globally. In particular, the USD/VND exchange rate increased sharply, almost double the world market.

USD/VND exchange rate increased by 0.66%

Closing the last trading session of the first week of 2024, the USD/VND exchange rate at Vietnam Joint Stock Commercial Bank for Industry and Trade (VietinBank) closed the week at: 24,160 VND/USD - 24,580 VND/USD, an increase of 155 VND/USD, equivalent to 0.66% compared to the end of 2023.

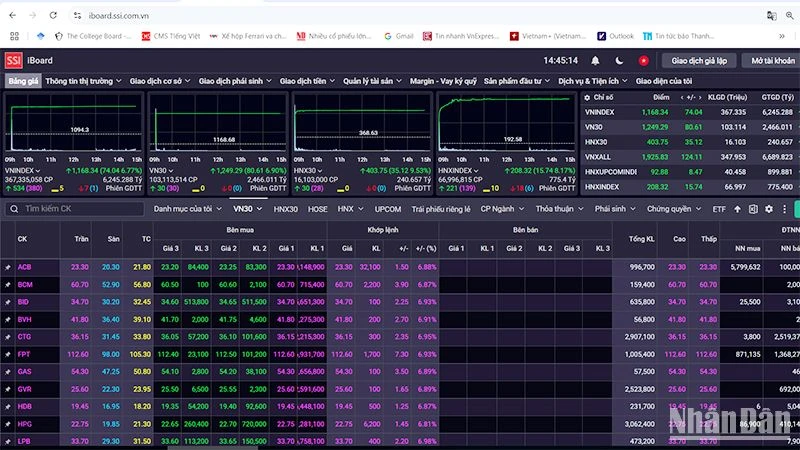

In the first trading week of the new year 2024, the USD was hot globally. In which, the USD/VND exchange rate increased sharply, almost double the world market. Illustrative photo

The USD/VND exchange rate at the Joint Stock Commercial Bank for Foreign Trade of Vietnam (Vietcombank) is traded at: 24,190 VND/USD - 24,530 VND/USD, up 110 VND/USD, equivalent to 0.46% in both buying and selling directions.

After 1 week of trading, the Joint Stock Commercial Bank for Investment and Development of Vietnam (BIDV) adjusted the USD/VND exchange rate up by 95 VND/USD in both buying and selling directions to 24,205 VND/USD - 24,505 VND/USD.

USD/VND exchange rate of Vietnam Bank for Agriculture and Rural Development (Agribank) closed the first week of the new year at: 24,190 VND/USD - 24,510 VND/USD, up 90 VND/USD.

Vietnam Technological and Commercial Joint Stock Bank (Techcombank) adjusted the USD/VND exchange rate up 110 VND/USD for buying and up 97 VND/USD for selling to 24,220 VND/USD - 24,527 VND/USD.

Orient Commercial Joint Stock Bank (OCB) listed the USD exchange rate at: 24,234 VND/USD - 24,490 VND/USD, up 103 VND/USD for buying, up 99 VND/USD for selling.

It can be seen that in the first week of the new year 2024, the USD has clearly heated up. The USD/VND exchange rate increased from 0.46% to 0.66% depending on the bank. This speed is much higher than the upward trend of the USD in the world market.

USD up 0.25% worldwide

The dollar rose on Friday, heading for its biggest weekly gain since May as traders eased expectations of a U.S. interest rate cut early this year.

The strong start to the year for the US currency cast a shadow over the euro even as rising inflation in the euro zone appeared to ease market pressure on the European Central Bank (ECB) to cut interest rates.

The dollar's recovery will be tested by the non-farm payrolls report due later on Friday.

Fed officials in December predicted 75 basis points of rate cuts by 2024. Money markets are expecting double that amount, with such expectations sending stocks and bonds soaring at the end of the year.

But since the start of the year, markets have scaled back their expectations. The CME FedWatch tool shows traders are now pricing in a cut of less than 140 basis points this year, with the probability of a cut in March at 62%, down from 86% a week ago.

The dollar was last up 0.25% against a basket of currencies at 102.69, after hitting a fresh three-week high. The index rose 1.3% for the week, its biggest gain since the week ended May 15.

The euro fell 0.24% to $1.0919 and was on track to drop 1.09% for the week, its biggest weekly decline since early December and ending a three-week winning streak.

Inflation across the 20-nation bloc rose to 2.9% in December from 2.4% in November, just below expectations of 3.0%.

Source

![[Photo] April Festival in Can Tho City](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/bf5ae82870e648fabfbcc93a25b481ea)

![[Photo] Unique folk games at Chuong Village Festival](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/cff805a06fdd443b9474c017f98075a4)

![[Photo] Opening of the 11th Conference of the 13th Party Central Committee](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/f9e717b67de343d7b687cb419c0829a2)

Comment (0)